Rct 106 2015

What is the Rct 106

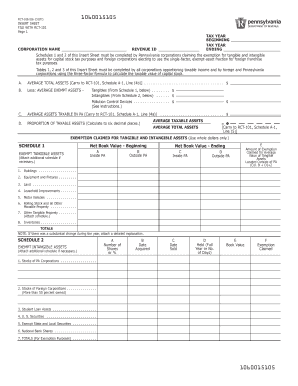

The Rct 106 is a specific form used in the United States for various tax-related purposes. It is essential for individuals and businesses to understand its purpose and requirements to ensure compliance with tax regulations. This form often pertains to the reporting of certain financial activities, making it crucial for accurate tax filings.

How to use the Rct 106

Using the Rct 106 involves several steps to ensure that all information is accurately reported. First, gather all necessary financial documents that pertain to the reporting period. Next, carefully fill out the form, ensuring that all required fields are completed. It is important to double-check the entries for accuracy before submission. Finally, submit the form according to the specified guidelines, either electronically or by mail.

Steps to complete the Rct 106

Completing the Rct 106 requires a systematic approach:

- Gather all relevant financial documents, including income statements and expense reports.

- Download the Rct 106 form from the appropriate source.

- Fill in your personal or business information as required.

- Report all applicable income and deductions accurately.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline.

Legal use of the Rct 106

The legal use of the Rct 106 is governed by specific tax laws and regulations. It is important to ensure that the form is filled out accurately to avoid legal repercussions. The information provided must be truthful and complete, as inaccuracies can lead to penalties or audits. Understanding the legal implications of the Rct 106 helps individuals and businesses stay compliant with tax obligations.

Key elements of the Rct 106

Key elements of the Rct 106 include:

- Identification of the taxpayer or business entity.

- Detailed reporting of income sources.

- Documentation of deductions and credits.

- Signature and date to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Rct 106 are crucial for compliance. Typically, the form must be submitted by a specific date each year, often aligning with the tax filing season. It is essential to keep track of these deadlines to avoid late fees or penalties. Marking these dates on a calendar can help ensure timely submission.

Required Documents

When completing the Rct 106, several documents are typically required, including:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous year’s tax returns for reference.

- Any additional documentation requested by tax authorities.

Quick guide on how to complete rct 106

Prepare Rct 106 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Rct 106 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Rct 106 with ease

- Locate Rct 106 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow efficiently addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Rct 106 and ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rct 106

Create this form in 5 minutes!

How to create an eSignature for the rct 106

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is rct106 in airSlate SignNow?

The rct106 refers to a specific compliance and regulatory feature within airSlate SignNow that ensures your document management processes meet industry standards. By utilizing rct106, businesses can ensure their electronic signatures are legally binding and secure, helping streamline contractual obligations.

-

How much does the airSlate SignNow service with rct106 features cost?

Pricing for airSlate SignNow, including rct106 features, varies based on the chosen plan. Businesses can choose from different subscription tiers, allowing for flexibility according to your needs, and you can often find promotional offers that enhance cost-effectiveness.

-

What are the key features associated with rct106 in airSlate SignNow?

Key features of rct106 in airSlate SignNow include advanced encryption, customizable templates, and robust compliance tracking. These features allow businesses to simplify their document workflows while maintaining high security and adherence to legal requirements.

-

How can rct106 benefits improve my business operations?

Incorporating rct106 with airSlate SignNow can signNowly enhance your business operations by reducing turnaround time for document signing and improving tracking of contract statuses. This efficiency not only fosters better relationships with clients but also increases overall productivity.

-

What integrations are available with rct106 in airSlate SignNow?

airSlate SignNow, along with the rct106 features, integrates seamlessly with popular CRMs, cloud storage solutions, and project management tools. These integrations facilitate a smooth workflow, allowing users to manage documents and signatures from within their preferred platforms.

-

Is rct106 compliant with industry regulations?

Yes, rct106 in airSlate SignNow is designed to comply with various industry regulations, including GDPR and eIDAS. This compliance ensures that your document transactions are secure and legally valid, which is essential for businesses operating across different jurisdictions.

-

Can I customize my document workflows using rct106 in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize their document workflows while utilizing rct106 features. This customization enables businesses to tailor the signing process to meet specific needs, enhancing efficiency and user experience.

Get more for Rct 106

- This application is for acceptance into the kelberman overnight camp form

- Yukon housing corporation developer build loan form

- Small claims court of yukon notice of trial form

- Business corporations act subsection 21310 form 22

- Auabout uspublicationsip legislation and is protected by the privacy act 1988 www form

- Financial aid office 2017 2018 statement of non filing form

- Attachment es authorization form for release of health information created

- Vermont rabies control form

Find out other Rct 106

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template