Form N 848, Rev , Power of Attorney Forms 2022-2026

What is the Form N-848, Power of Attorney?

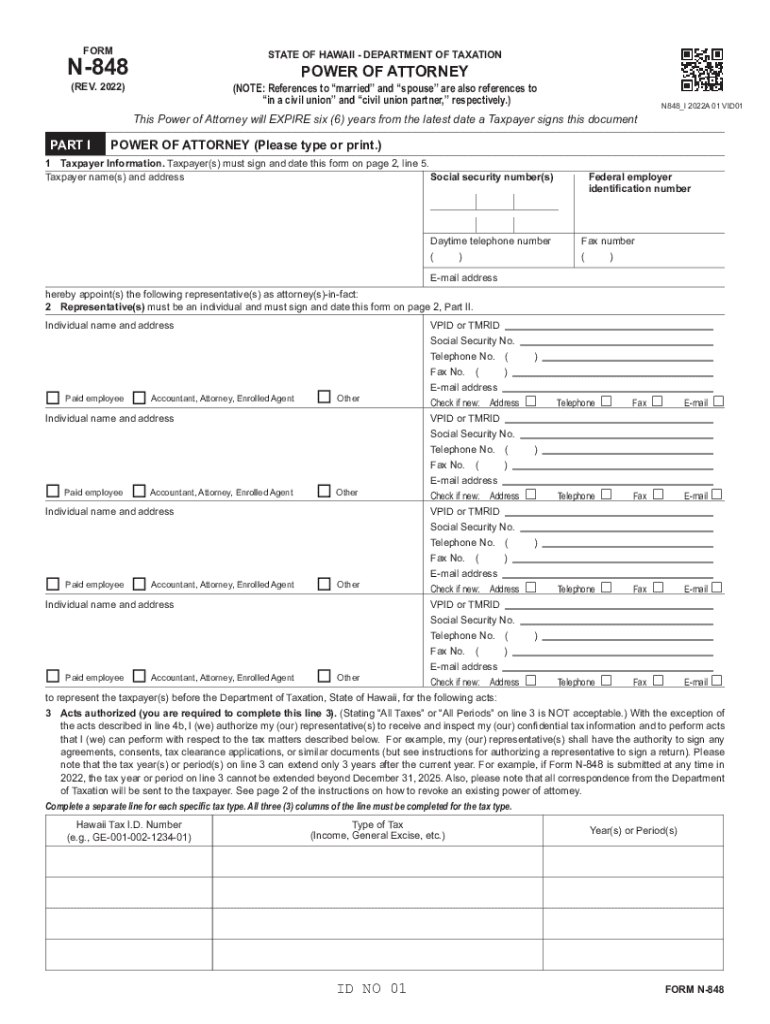

The Form N-848, also known as the Hawaii Power of Attorney, is a legal document that allows an individual to designate another person to act on their behalf in various matters. This form is particularly important for managing financial, legal, and healthcare decisions when the individual is unable to do so themselves. The power granted can be broad or limited, depending on the specific needs of the principal (the person granting the power). This form is essential for ensuring that the designated agent can make decisions in accordance with the principal's wishes.

How to Use the Form N-848

Using the Form N-848 involves several steps to ensure that it is completed correctly and legally binding. First, the principal must fill out the form with accurate information, including their name, address, and the name of the agent. It is crucial to specify the powers being granted, whether they are general or limited. Once completed, the form must be signed in the presence of a notary public to validate the document. This notarization adds an extra layer of security and ensures that the form meets legal requirements.

Steps to Complete the Form N-848

Completing the Form N-848 requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the Form N-848, which can be found online or through legal offices.

- Fill in the principal's information, including full name and address.

- Designate the agent by providing their name and contact details.

- Clearly outline the powers being granted, indicating if they are general or specific.

- Sign the document in front of a notary public to ensure its legality.

- Provide copies to the agent and keep a copy for personal records.

Legal Use of the Form N-848

The Form N-848 is legally recognized in Hawaii, provided that it is executed in accordance with state laws. This includes having the document notarized and ensuring that the principal is of sound mind when signing. The powers granted through this form can be utilized in various situations, such as managing bank accounts, making healthcare decisions, or handling real estate transactions. It is important for both the principal and the agent to understand the extent of the powers granted and to act in the best interest of the principal.

State-Specific Rules for the Form N-848

Hawaii has specific regulations governing the use of the Form N-848. These include requirements for notarization and the necessity for the principal to be mentally competent at the time of signing. Additionally, the form must be clear in its language regarding the powers being granted. It is advisable to consult with a legal professional to ensure compliance with all state laws and to address any specific concerns related to the powers of attorney in Hawaii.

Examples of Using the Form N-848

The Form N-848 can be used in various scenarios. For instance, a parent may designate a trusted family member to make healthcare decisions for their child in case of an emergency. Another example is an individual who is traveling abroad and needs someone to manage their financial affairs while they are away. These examples illustrate the versatility of the Form N-848 in providing peace of mind and ensuring that important decisions can be made when necessary.

Quick guide on how to complete form n 848 rev 2018 power of attorney forms 2018

Complete Form N 848, Rev , Power Of Attorney Forms effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form N 848, Rev , Power Of Attorney Forms on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-driven procedure today.

How to modify and electronically sign Form N 848, Rev , Power Of Attorney Forms with ease

- Locate Form N 848, Rev , Power Of Attorney Forms and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize essential parts of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choosing. Adjust and electronically sign Form N 848, Rev , Power Of Attorney Forms and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 848 rev 2018 power of attorney forms 2018

Create this form in 5 minutes!

How to create an eSignature for the form n 848 rev 2018 power of attorney forms 2018

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Hawaii power of attorney printable?

A Hawaii power of attorney printable is a legal document that allows you to designate someone to make decisions on your behalf in Hawaii. This document can be easily downloaded and filled out, providing a convenient solution for those who need to grant someone authority without visiting a lawyer.

-

How do I obtain a Hawaii power of attorney printable?

You can easily obtain a Hawaii power of attorney printable by visiting our airSlate SignNow website. We offer a user-friendly platform where you can access the document, customize it according to your needs, and print it out for use.

-

Is there a cost associated with the Hawaii power of attorney printable?

Our Hawaii power of attorney printable is available at a competitive price, making it a cost-effective solution for individuals and businesses alike. Once you purchase the document, you will have full access to our editing features at no additional cost.

-

Can I customize the Hawaii power of attorney printable?

Yes, our Hawaii power of attorney printable is fully customizable. Users can modify the document to fit their specific needs, ensuring that the chosen agent has the appropriate powers and responsibilities as required by law.

-

What are the benefits of using the Hawaii power of attorney printable from airSlate SignNow?

Using our Hawaii power of attorney printable offers several benefits, including convenience, ease of use, and legality. It allows you to quickly prepare a legally binding document without the hassle of complicated legal procedures or high attorney fees.

-

How does airSlate SignNow ensure the legality of the Hawaii power of attorney printable?

Our Hawaii power of attorney printable is designed to meet state-specific legal requirements. We provide templates that are compliant with Hawaii laws, ensuring that your document is valid and enforceable when executed correctly.

-

Can I eSign the Hawaii power of attorney printable?

Absolutely! Our platform allows you to digitally sign the Hawaii power of attorney printable using our secure eSignature feature. This not only saves time but also enhances the document's security and authenticity.

Get more for Form N 848, Rev , Power Of Attorney Forms

Find out other Form N 848, Rev , Power Of Attorney Forms

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now