Irs Form N 848pdffillercom 2012

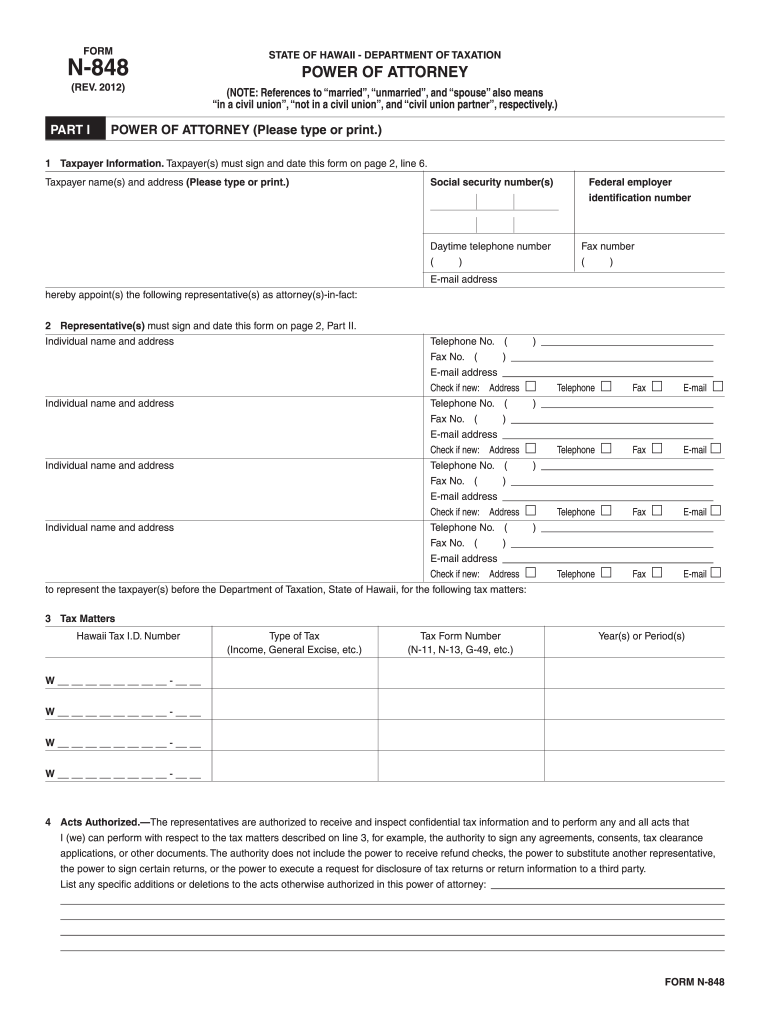

What is the Irs Form N 848pdffillercom

The Irs Form N 848pdffillercom is a specific tax form used by individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). This form is designed to streamline the process of filing taxes and ensuring compliance with federal regulations. It typically includes various fields for entering personal details, income, deductions, and other relevant financial data. Understanding the purpose of this form is essential for accurate tax reporting and avoiding potential penalties.

How to use the Irs Form N 848pdffillercom

Using the Irs Form N 848pdffillercom involves several key steps. First, ensure you have the correct version of the form, as outdated versions may not be accepted by the IRS. Next, carefully fill out each section of the form, providing accurate information as required. After completing the form, review it for any errors or omissions. Finally, submit the form according to the IRS guidelines, either electronically or via mail. Utilizing a digital platform can simplify this process, allowing for easy editing and eSigning.

Steps to complete the Irs Form N 848pdffillercom

Completing the Irs Form N 848pdffillercom involves a systematic approach:

- Gather all necessary documentation, including income statements, previous tax returns, and any relevant financial records.

- Access the form through a reliable source, ensuring it is the most current version.

- Begin filling out the form by entering your personal information in the designated fields.

- Provide accurate financial details, including income, deductions, and credits.

- Review the completed form thoroughly for accuracy and completeness.

- Sign the form electronically or manually, depending on your submission method.

- Submit the form to the IRS by the specified deadline.

Legal use of the Irs Form N 848pdffillercom

The Irs Form N 848pdffillercom is legally binding when completed and submitted correctly. It must adhere to IRS guidelines to ensure compliance with federal tax laws. The form can be signed electronically, which the IRS recognizes as valid. It is important to keep a copy of the submitted form for your records, as it may be required for future reference or audits. Understanding the legal implications of this form helps ensure that taxpayers fulfill their obligations while minimizing the risk of errors or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Form N 848pdffillercom vary depending on the taxpayer's situation. Typically, individual tax returns are due on April fifteenth of each year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Additionally, taxpayers may request an extension, but this does not extend the time to pay any taxes owed. Staying informed about these important dates is crucial for timely compliance and avoiding late fees.

Form Submission Methods (Online / Mail / In-Person)

The Irs Form N 848pdffillercom can be submitted through various methods, providing flexibility for taxpayers. The most efficient way is to file electronically using IRS-approved software, which often includes features for eSigning. Alternatively, taxpayers can print the completed form and mail it to the appropriate IRS address. In-person submission is less common but may be available at certain IRS offices. Each method has its own advantages, and choosing the right one depends on individual preferences and circumstances.

Quick guide on how to complete irs form n 848pdffillercom 2012

Your assistance guide on preparing your Irs Form N 848pdffillercom

If you’re interested in learning how to generate and dispatch your Irs Form N 848pdffillercom, here are some brief guidelines to simplify tax processing.

To begin, you just need to set up your airSlate SignNow account to revolutionize your online document management. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, draft, and finalize your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures, and revisit to adjust information as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your Irs Form N 848pdffillercom in a few minutes:

- Establish your account and start working on PDFs in just a few minutes.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Click Get form to access your Irs Form N 848pdffillercom in our editor.

- Complete the necessary fillable fields with your information (textual entries, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Please be aware that submitting in paper format can lead to more mistakes and delay refunds. Of course, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct irs form n 848pdffillercom 2012

FAQs

-

Which IRS forms do US expats need to fill out?

That would depend on their personal situation, but should they actually have a full financial life in another country including investments, pensions, mortgages, insurance policies, a small business, multiple bank accounts…The reporting alone can be bankrupting, and that is before you get on to actual taxes that are punitive toward foreign finances owned by a US citizen and god help you if you make mistake because penalties appear designed to bankrupt you.US citizens globally are renouncing citizenship for good reason.This is extracted from a letter sent by the James Bopp law firm to Chairman Mark Meadows of the subcommittee of government operations regarding the difficulty faced by US citizens who try to live else where.“ FATCA is forcing Americans abroad into a set of circumstances where they must renounce their U.S. citizenship to survive.For example, suppose you have a married couple living in Washington DC. One works as a lobbyist for an NGO and has a defined benefits pensions. The other is self employed in a lobby firm, working under an LLC. According to the IRS filing requirements, it would take about 15 hours and $280 to complete their yearly filings. Should they under report income, any penalties would be a percentage of their unreported tax burden. The worst case is a 20% civil fraud penalty.Compare the same couple with one different fact. They moved to Australia because the NGO reassigned the wife to Sydney. The husband, likewise, moves his business overseas. They open a bank account, contribute to the mandatory Australian retirement fund, purchase a house with a mortgage and get a life insurance policy on both of them.These are now their new filing requirements:• Form 8938• Form 3520-A• Form 3520• Form 5471 (to be filed by the husbands new Australian corporation where he is self employed)• Form 720 Excise Tax.• FinCEN Form 114The burden that was 15 hours now goes up to• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury.”

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Do un-contracted workers have to fill out IRS W4 form?

I have no idea what an “un-contracted worker” is. I am not familiar with that term.Employees working in the U.S. complete a Form W-4.Independent contractors in the U.S. do not. Instead, they usually complete a Form W-9.If unclear on the difference between an employee or an independent contractor, see Independent Contractor Self Employed or Employee

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

What is the IRS form W-10 and how is it correctly filled out?

While you may have never heard of IRS Form W-10, you will if you’re currently paying or planning to pay someone to care for a child, dependent, or spouse? If you are, then you may qualify to claim what’s called the Child and Dependent Care credit on your federal income tax return. To claim this credit, your care provider must fill out a W-10. You may also need to fill out the form if you receive benefits from an employer sponsored dependent care plan.It’s certainly worth it to see if you qualify (and for this we recommend that you consult with a tax professional). The child and dependent care credit can be up to 35 percent of qualifying expenses, depending on adjusted gross income. For 2011, filers may use up to $3,000 of expenses paid in a year for one qualifying individual or $6,000 for two or more qualifying individuals. (When it comes time to figure your qualifying expenses, remember that they must be reduced by the amount of any dependent care benefits provided by your employer, if those benefits were deducted or excluded from your income.)Do You Qualify for the Credit?To see if you need to have your care provider fill out a W-10, first determine if you qualify for the credit for child and dependent care expenses. To qualify, the care must have been provided for one or more qualifying persons, generally a dependent child age 12 or younger when the care was provided. Certain other individuals, spouses and those who are incapable of self-care, may also be considered qualifying persons. (Note: each qualifying individual must be listed on your tax return.)Remember also that the amount you can claim as a credit is reduced as your income rises. According to the Tax Policy Center, “Families with income below $15,000 qualify for the 35 percent credit. That rate falls by 1 percentage point for each additional $2,000 of income (or part thereof) until it signNowes 20 percent for families with income of $43,000 or more.”Next, consider why the care was provided. To qualify, the person (or couple, if married and filing jointly) claiming the credit must have sought care so they could work or search for employment. Further, the individual or couple filing must be considered earned income earners. Wages, salaries, tips, other taxable employee compensation, and net earnings from self-employment all qualify individuals as having earned income. For married filers, one spouse may be considered as having earned income if they were a full-time student, or if they were unable to care for themselves.Who did you pay for care? Qualifying funds spent for care cannot be paid to a filer’s spouse, a dependent of the filer, or to the filer’s child, unless that child will signNow age 19 or older by the end of the year. (The rule for payments to the filer’s child does not change, even if the child is not the filer’s dependent.) Filers must identify care providers on their tax return.There are just a few more qualifying details. To qualify, filing status must be single, married filing jointly, head of household or qualifying widow(er) with a dependent child. The qualifying person must have lived with the person filing for over one half of the year. There are exceptions, for the birth or death of a qualifying person, and for children of divorced or separated parents.IRS Form W-10So, if you meet those criteria, then its time to make sure your care provider fills out a W-10. The form is simple to fill out, requiring only the provider’s name, address, signature and taxpayer identification number (usually their social security number). The form is only for your records; details about the provider will come when you fill out form 2441 for Child and Dependent Care Expenses.Source: The Child and Dependent Care Credit and IRS W-10 Form

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

Create this form in 5 minutes!

How to create an eSignature for the irs form n 848pdffillercom 2012

How to create an electronic signature for the Irs Form N 848pdffillercom 2012 online

How to make an electronic signature for the Irs Form N 848pdffillercom 2012 in Google Chrome

How to make an electronic signature for signing the Irs Form N 848pdffillercom 2012 in Gmail

How to create an electronic signature for the Irs Form N 848pdffillercom 2012 from your mobile device

How to generate an electronic signature for the Irs Form N 848pdffillercom 2012 on iOS devices

How to generate an eSignature for the Irs Form N 848pdffillercom 2012 on Android OS

People also ask

-

What is IRS Form N 848signNowcom and how can it benefit my business?

IRS Form N 848signNowcom is a form used for various tax purposes, and utilizing airSlate SignNow allows you to fill it out efficiently. Our platform simplifies the signing and submission process, ensuring compliance and reducing the risk of errors. With our user-friendly interface, you can easily manage your documents and enhance your business's productivity.

-

How much does airSlate SignNow cost for using IRS Form N 848signNowcom?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for managing IRS Form N 848signNowcom and other document workflows. We offer various subscription plans to suit different business needs, ensuring you only pay for what you use. Additionally, our platform provides a free trial so you can evaluate its features before committing.

-

Can I integrate airSlate SignNow with other applications when using IRS Form N 848signNowcom?

Yes, airSlate SignNow offers seamless integrations with numerous applications, allowing you to streamline your workflow when dealing with IRS Form N 848signNowcom. Whether you use CRM software, cloud storage, or email services, our integrations help enhance your productivity and keep your documents organized. Check our integrations page to see all compatible applications.

-

What features does airSlate SignNow offer for IRS Form N 848signNowcom?

airSlate SignNow provides a range of features to enhance your experience with IRS Form N 848signNowcom, including eSignature capabilities, document templates, and real-time collaboration tools. Our platform ensures that you can easily fill, sign, and send your forms securely. Plus, you can track the status of your documents, ensuring timely submissions.

-

Is airSlate SignNow secure for handling IRS Form N 848signNowcom?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including IRS Form N 848signNowcom. Our platform uses encryption, secure data storage, and compliance with industry regulations to safeguard your sensitive information. You can feel confident in the security of your documents while using our service.

-

How can I get started with airSlate SignNow for IRS Form N 848signNowcom?

Getting started with airSlate SignNow for IRS Form N 848signNowcom is easy! Simply sign up for a free trial on our website, and you can begin creating and managing your documents immediately. Our intuitive interface guides you through the process, making it simple to fill and eSign your forms.

-

What support options are available for users of IRS Form N 848signNowcom on airSlate SignNow?

airSlate SignNow offers comprehensive support options for users dealing with IRS Form N 848signNowcom. You can access our extensive knowledge base, video tutorials, and customer support through chat or email. Our dedicated team is ready to assist you with any questions or issues you may encounter.

Get more for Irs Form N 848pdffillercom

Find out other Irs Form N 848pdffillercom

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer