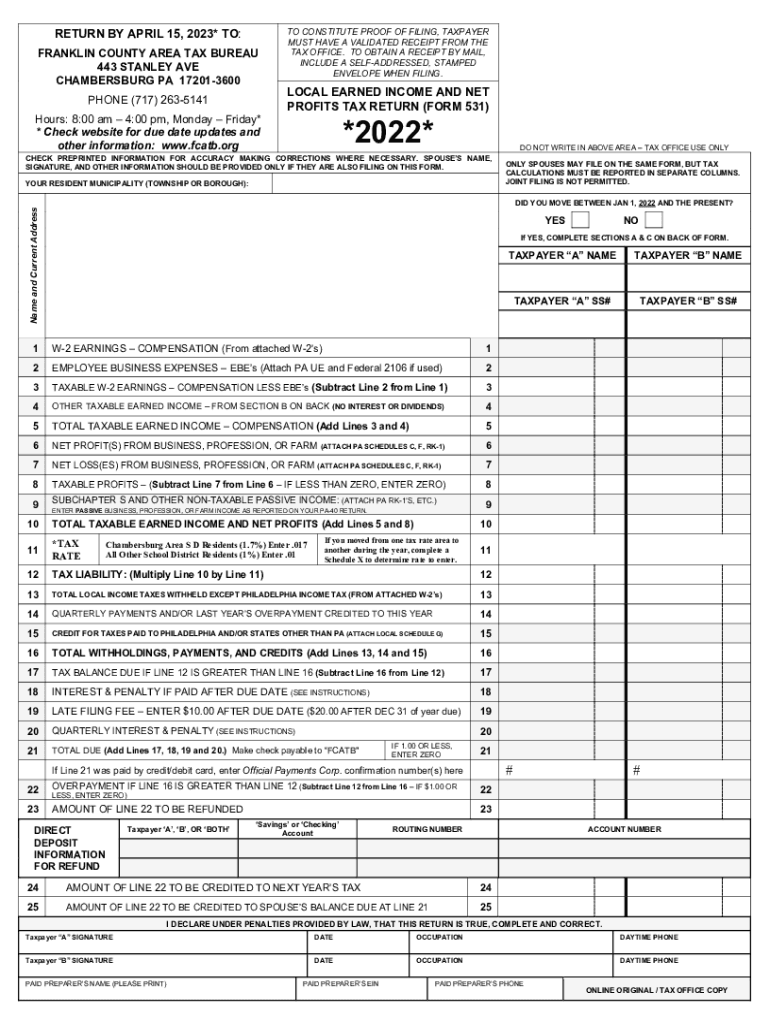

Tax Claim Franklin County, PA 2022

What is the Tax Claim Franklin County, PA

The Tax Claim in Franklin County, Pennsylvania, refers to the process by which the county collects delinquent property taxes. This system is designed to ensure that property owners fulfill their tax obligations. If property taxes remain unpaid, the county may initiate a tax claim process that can lead to the sale of the property to recover the owed taxes. Understanding this process is essential for property owners to avoid potential loss of their property.

How to use the Tax Claim Franklin County, PA

Using the Tax Claim process in Franklin County involves several steps. First, property owners should verify their tax status by checking for any outstanding taxes. This can typically be done through the county's tax office or website. If taxes are owed, the next step is to address the delinquency by either paying the owed amount or entering into a payment plan if available. It is crucial to stay informed about deadlines and requirements to prevent further penalties or property loss.

Steps to complete the Tax Claim Franklin County, PA

Completing the Tax Claim process in Franklin County involves the following steps:

- Check your property tax status through the Franklin County tax office.

- Gather necessary documentation, including previous tax statements and payment records.

- Contact the tax office to discuss payment options or to inquire about the tax claim process.

- If applicable, submit any required forms or applications for payment plans.

- Make timely payments to avoid additional penalties or legal actions.

Legal use of the Tax Claim Franklin County, PA

The legal framework governing the Tax Claim process in Franklin County is outlined by Pennsylvania state law. This ensures that property owners are given appropriate notice of delinquent taxes and the potential consequences of non-payment. The county must follow specific procedures, including notifying property owners of their tax status and providing opportunities for payment before initiating any legal actions, such as property sales.

Required Documents

To effectively navigate the Tax Claim process in Franklin County, certain documents may be required. These include:

- Current property tax statements.

- Proof of previous payments.

- Identification documents for verification purposes.

- Any correspondence received from the tax office regarding delinquency.

Filing Deadlines / Important Dates

Staying informed about filing deadlines and important dates is critical in the Tax Claim process. Franklin County typically sets specific dates for tax payments, appeals, and other related actions. Property owners should regularly check the county's official communications or website to ensure they meet all necessary deadlines to avoid penalties or further legal actions.

Quick guide on how to complete tax claim franklin county pa

Effortlessly Prepare Tax Claim Franklin County, PA on Any Device

The management of online documents has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it on the internet. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Handle Tax Claim Franklin County, PA on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign Tax Claim Franklin County, PA with Ease

- Obtain Tax Claim Franklin County, PA and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal value as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Tax Claim Franklin County, PA to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax claim franklin county pa

Create this form in 5 minutes!

How to create an eSignature for the tax claim franklin county pa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is fcatb, and how does it relate to airSlate SignNow?

fcatb refers to the features and benefits of using airSlate SignNow for electronic signatures. It offers a streamlined way to send, sign, and manage documents electronically, making the process efficient and secure for businesses. Utilizing fcatb can help organizations reduce turnaround times and improve workflow.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. The fcatb options include monthly and yearly subscriptions, allowing companies to choose a plan based on their document signing volume and budget. Each tier provides essential features, ensuring you can find the right fit for your organization's needs.

-

What features make airSlate SignNow stand out?

airSlate SignNow includes a range of features that enhance user experience, such as customizable templates, real-time tracking, and secure storage. The fcatb capabilities also enable seamless integrations with popular tools like Google Drive and Salesforce. This ensures that businesses can easily incorporate electronic signing into their existing workflows.

-

How can airSlate SignNow benefit my business?

By implementing airSlate SignNow, businesses can signNowly improve their document signing process, leading to faster agreements and reduced administrative burdens. The fcatb advantages include higher efficiency, lower costs associated with paper usage, and enhanced security features. This ultimately helps organizations focus on their core operations.

-

Is airSlate SignNow secure for e-signatures?

Yes, airSlate SignNow prioritizes security and compliance with industry standards for electronic signatures. The fcatb security features include data encryption and audit trails that provide a comprehensive overview of document interactions. This ensures that your sensitive information remains protected throughout the signing process.

-

What integrations does airSlate SignNow support?

airSlate SignNow supports numerous integrations with various platforms like Google Workspace, Microsoft Office, and CRM systems. The fcatb integration options allow businesses to connect their existing tools, streamlining workflows and improving productivity. This helps users manage documents more effectively within their preferred software environment.

-

Can I try airSlate SignNow before committing?

Absolutely! airSlate SignNow offers a free trial so prospective customers can explore its features and functionalities without any commitment. During the trial, users can experience the fcatb benefits firsthand and determine how well it meets their document signing needs. This is an excellent opportunity to evaluate the product before making a decision.

Get more for Tax Claim Franklin County, PA

- Arbitration brief sample form

- Perimeter word problems worksheets pdf form

- Weekly fire pump test form

- Standard form 153

- Residential building permit application deckporch addition form

- Pcs code otc form

- Supplemental judgment modifying custody parenting time and child support 11 oregon form

- Harris county l2 form

Find out other Tax Claim Franklin County, PA

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template