AlAbAmA DepArtment of Revenue 2022

What is the Alabama Department of Revenue?

The Alabama Department of Revenue (ADOR) is the state agency responsible for administering tax laws and collecting taxes in Alabama. This includes various taxes such as income, sales, and property taxes. The department ensures compliance with state tax regulations and provides services to taxpayers, including guidance on tax forms like the 2015 Form 40 Alabama. Understanding the role of ADOR is essential for individuals and businesses to navigate their tax responsibilities effectively.

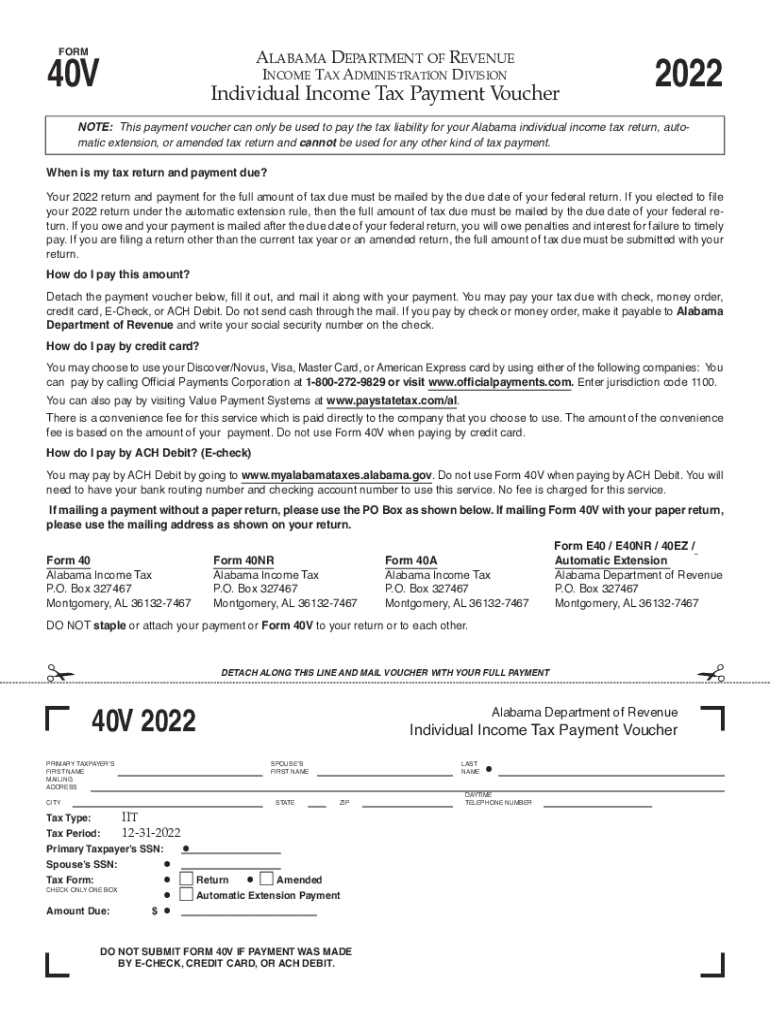

Steps to Complete the Alabama Department of Revenue Form 40

Completing the Alabama Form 40 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any relevant deductions. Next, carefully fill out the form, ensuring that all personal information, income details, and deductions are accurately reported. It's important to double-check all entries for errors before submission. Once completed, the form can be submitted either electronically or via mail, depending on your preference and the specific guidelines provided by the Alabama Department of Revenue.

Filing Deadlines / Important Dates

For the 2015 tax year, the deadline to file the Alabama Form 40 is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of these deadlines to avoid penalties. Additionally, if you are requesting an extension, it is crucial to file the appropriate forms by the original deadline to ensure compliance.

Required Documents

When preparing to file the Alabama Form 40, several documents are required to ensure a complete and accurate submission. These include:

- W-2 forms from employers

- 1099 forms for any additional income

- Documentation for deductions, such as mortgage interest statements and medical expenses

- Any relevant tax credits that may apply

Having these documents ready will facilitate a smoother filing process and help prevent delays or issues with your tax return.

Form Submission Methods (Online / Mail / In-Person)

The Alabama Form 40 can be submitted through various methods to accommodate taxpayer preferences. Electronic filing is available and is often the quickest way to submit your return, allowing for faster processing times. Alternatively, taxpayers may choose to mail their completed forms to the appropriate address provided by the Alabama Department of Revenue. In-person submissions are also an option at designated ADOR offices, where assistance may be available for those needing help with the filing process.

Penalties for Non-Compliance

Failing to file the Alabama Form 40 by the deadline can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action from the state. It is important to be aware of these consequences and to file on time, even if you are unable to pay the full amount owed. Taxpayers can often set up payment plans with the Alabama Department of Revenue to address outstanding balances.

Quick guide on how to complete alabama department of revenue

Effortlessly Prepare AlAbAmA DepArtment Of Revenue on Any Device

Managing documents online has become increasingly favored by organizations and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Handle AlAbAmA DepArtment Of Revenue on any device using airSlate SignNow apps for Android or iOS and simplify any document-based task today.

The Easiest Way to Alter and eSign AlAbAmA DepArtment Of Revenue Effortlessly

- Locate AlAbAmA DepArtment Of Revenue and select Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight crucial sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Modify and eSign AlAbAmA DepArtment Of Revenue and guarantee effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alabama department of revenue

Create this form in 5 minutes!

How to create an eSignature for the alabama department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2015 Form 40 Alabama, and why is it important?

The 2015 Form 40 Alabama is the state income tax return form required by residents of Alabama to report their annual earnings and calculate taxes owed. Completing this form accurately is crucial for compliance with Alabama tax laws and helps avoid potential penalties.

-

How can airSlate SignNow help with the 2015 Form 40 Alabama?

airSlate SignNow allows users to easily eSign and send the 2015 Form 40 Alabama electronically, streamlining the submission process. This ensures your documents are securely signed, organized, and sent quickly to the appropriate tax authorities.

-

What are the pricing options for airSlate SignNow when using the 2015 Form 40 Alabama?

airSlate SignNow offers various pricing plans suitable for individuals and businesses looking to manage the 2015 Form 40 Alabama. With competitive pricing options, users can choose a plan that best fits their eSigning needs while benefiting from a seamless experience.

-

Are there any features specifically beneficial for completing the 2015 Form 40 Alabama?

Yes, airSlate SignNow includes features such as document templates and secure storage that are particularly helpful for completing the 2015 Form 40 Alabama. Users can create and save templates to simplify future submissions, ensuring compliance with state requirements.

-

Can I integrate airSlate SignNow with other software to manage the 2015 Form 40 Alabama?

Absolutely! airSlate SignNow supports integrations with popular accounting and productivity software, making it easier to manage the 2015 Form 40 Alabama alongside other important documentation. This connection enhances workflow efficiency and keeps records organized.

-

Is airSlate SignNow secure for signing sensitive documents like the 2015 Form 40 Alabama?

Yes, security is a top priority at airSlate SignNow. The platform provides advanced encryption and secure login processes to ensure that your 2015 Form 40 Alabama and other sensitive documents remain confidential and protected from unauthorized access.

-

How does airSlate SignNow enhance the overall eSignature process for the 2015 Form 40 Alabama?

airSlate SignNow enhances the eSignature process for the 2015 Form 40 Alabama by providing a user-friendly interface and efficient document management features. Users can easily track document status and receive notifications, ensuring timely completion and submissions.

Get more for AlAbAmA DepArtment Of Revenue

Find out other AlAbAmA DepArtment Of Revenue

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed