Your Return and Payment for the Full Amount of Tax Due Must Be Mailed by the Due Date of Your Federal Return 2023-2026

Filing Deadlines and Important Dates

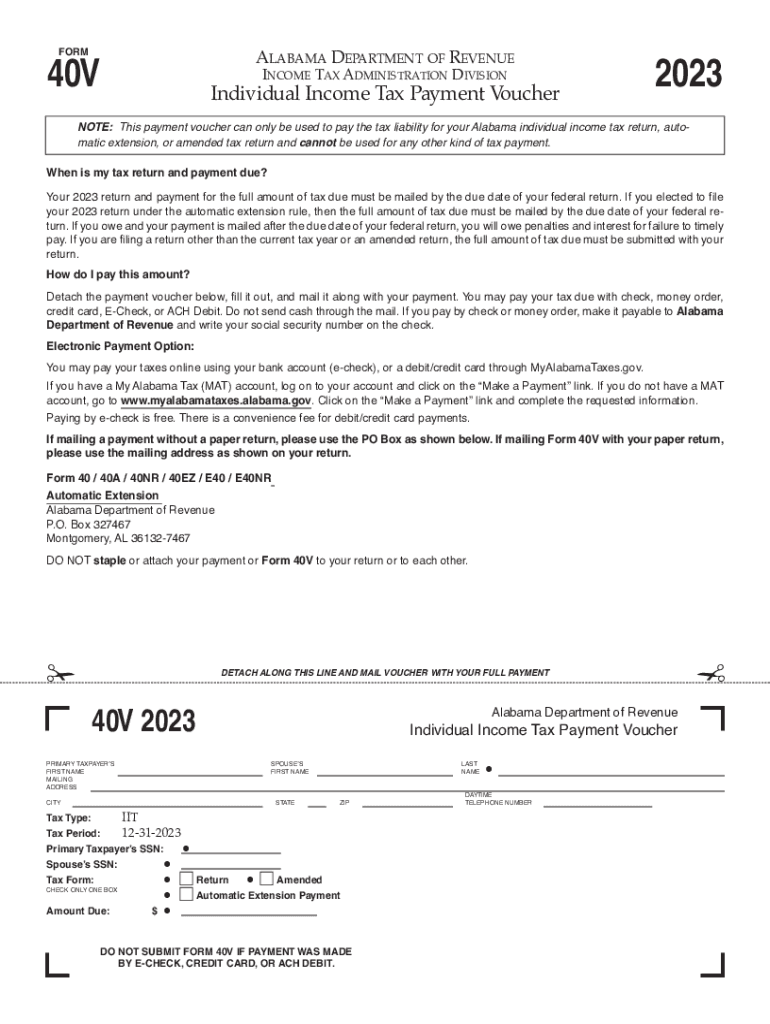

When filing the Alabama Form 40, it is crucial to be aware of specific deadlines to avoid penalties. The due date for submitting your Alabama income tax return typically aligns with the federal tax return deadline. For most taxpayers, this means the return is due on April 15 of each year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers who require additional time can file for an extension, but they must ensure that any taxes owed are paid by the original due date to avoid interest and penalties.

Required Documents for Alabama Form 40

To complete the Alabama Form 40, you will need several key documents. These typically include:

- Your federal tax return, as it provides essential information for your state return.

- W-2 forms from all employers, which detail your income and taxes withheld.

- 1099 forms for any additional income, such as freelance work or interest earned.

- Documentation for any deductions or credits you plan to claim, such as receipts for medical expenses or educational costs.

Having these documents ready will streamline the process of filling out the form and ensure accuracy in your reported income and deductions.

Steps to Complete Alabama Form 40

Completing the Alabama Form 40 involves several straightforward steps:

- Gather all necessary documents, including your federal tax return and income statements.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report your total income as calculated on your federal return.

- Calculate your deductions and credits, ensuring you have the appropriate documentation to support your claims.

- Determine your tax liability based on the Alabama tax tables provided with the form.

- Review your completed form for accuracy before submission.

Following these steps will help ensure that your Alabama Form 40 is completed correctly and submitted on time.

Form Submission Methods

There are several methods available for submitting the Alabama Form 40. Taxpayers can choose to:

- File electronically through approved e-filing software, which often provides a more efficient and error-free process.

- Mail a paper copy of the completed form to the Alabama Department of Revenue. Ensure that you send it to the correct address based on whether you are expecting a refund or owe taxes.

- In some cases, you may be able to deliver the form in person at designated local offices.

Each method has its own advantages, so consider your preferences and needs when deciding how to submit your return.

Penalties for Non-Compliance

Failing to comply with the filing requirements for Alabama Form 40 can result in significant penalties. If you do not file your return by the due date, you may incur a late filing penalty, which is typically a percentage of the taxes owed. Additionally, if you do not pay the taxes due by the deadline, you may face interest charges on the unpaid amount. It is important to file your return even if you cannot pay the full amount owed, as this can help mitigate some penalties.

Digital vs. Paper Version

When considering the Alabama Form 40, taxpayers have the option to file digitally or submit a paper version. The digital version often allows for quicker processing times and can reduce the likelihood of errors. Many taxpayers find that e-filing provides a more user-friendly experience, with prompts and checks in place to guide them through the process. Conversely, some individuals may prefer the traditional paper method for its familiarity. Regardless of the choice, ensure that you keep a copy of your submitted form for your records.

Quick guide on how to complete your return and payment for the full amount of tax due must be mailed by the due date of your federal return

Effortlessly Prepare Your Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Your Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Alter and Electronically Sign Your Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return Seamlessly

- Find Your Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark relevant sections of the documents or redact sensitive information with tools offered by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Your Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return and guarantee effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct your return and payment for the full amount of tax due must be mailed by the due date of your federal return

Create this form in 5 minutes!

How to create an eSignature for the your return and payment for the full amount of tax due must be mailed by the due date of your federal return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alabama Form 40 and why is it important?

The Alabama Form 40 is a crucial document for residents of Alabama filing their state income tax returns. It enables taxpayers to report their income, calculate tax liability, and claim any applicable deductions or credits. Understanding how to properly fill out the Alabama Form 40 is essential for compliance and to maximize potential refunds.

-

How does airSlate SignNow assist with eSigning the Alabama Form 40?

airSlate SignNow offers a streamlined process for eSigning the Alabama Form 40, making it easy to review and sign your tax documents electronically. With intuitive features, users can securely complete and send their Alabama Form 40 without the hassle of printing and scanning. This ensures faster processing and submission of your tax return.

-

Is there a cost associated with using airSlate SignNow for the Alabama Form 40?

Yes, while airSlate SignNow provides several pricing plans, the cost is quite competitive compared to traditional methods of document signing. This affordability allows individuals and businesses to use the service for their Alabama Form 40 and other documents without breaking the bank. The value offered in terms of convenience and efficiency often outweighs the small investment.

-

What features does airSlate SignNow offer for Alabama Form 40 users?

AirSlate SignNow includes features like cloud storage, customizable templates, and mobile accessibility that enhance the experience of completing the Alabama Form 40. Users can track document status, send reminders, and collaborate with others securely. These features not only streamline the signing process but also improve overall document management.

-

Can I integrate airSlate SignNow with other tools for my Alabama Form 40 processing?

Absolutely! airSlate SignNow seamlessly integrates with various software applications such as CRMs and project management tools, allowing users to optimize their workflow when handling the Alabama Form 40. This integration helps in maintaining organized records and ensures that all necessary documentation is accessible in one place.

-

What are the benefits of using airSlate SignNow for tax preparation of the Alabama Form 40?

Using airSlate SignNow for the Alabama Form 40 provides signNow benefits, including time savings and increased accuracy. The platform simplifies the entire process by auto-filling information and reducing errors that can occur with manual entry. Additionally, the ability to sign documents remotely makes it easier to gather all necessary signatures promptly.

-

How secure is airSlate SignNow when handling my Alabama Form 40?

Security is a top priority for airSlate SignNow, especially when managing sensitive documents like the Alabama Form 40. The platform employs encryption and secure access protocols to protect your information. Users can rest assured that their data is safeguarded throughout the signing and storage process.

Get more for Your Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return

- Scholarship award check enclosed form

- Contract form 56 internet service provider agreement pct

- Fundraising letter to business from high school seeking sponsorship of senior form

- Letter from artist thanking patrons form

- Registration rights agreement the sco group inc baystar form

- Distribution agreement template get free sample form

- Executive director agreement stanford university form

- Request for donated items form

Find out other Your Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement