PDF 40V TY Print Version Qxp Alabama Department of Revenue 2020

Understanding the Alabama Form 40

The Alabama Form 40 is a state income tax return used by residents to report their income and calculate their tax liability. This form is essential for individuals who earn income within Alabama and need to comply with state tax regulations. The form includes various sections for reporting wages, interest, dividends, and other sources of income, as well as deductions and credits that may apply.

Steps to Complete the Alabama Form 40

Filling out the Alabama Form 40 involves several key steps to ensure accuracy and compliance:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Begin by entering your personal information, such as your name, address, and Social Security number.

- Report your total income from all sources on the appropriate lines of the form.

- Deduct any applicable deductions, such as standard deductions or itemized deductions.

- Calculate your tax liability using the tax tables provided by the Alabama Department of Revenue.

- Complete any additional schedules if required, depending on your specific tax situation.

- Review the form for accuracy before signing and dating it.

Filing Deadlines for the Alabama Form 40

It is important to be aware of the filing deadlines associated with the Alabama Form 40. Generally, the form must be submitted by April 15th of the year following the tax year being reported. If the deadline falls on a weekend or holiday, it is typically extended to the next business day. Taxpayers should also consider any extensions that may be available if additional time is needed to complete the form.

Form Submission Methods for the Alabama Form 40

Taxpayers have several options for submitting the Alabama Form 40:

- Online Filing: Many taxpayers choose to file electronically using approved e-filing software, which can streamline the process and reduce errors.

- Mail: The form can be printed and mailed to the appropriate address provided by the Alabama Department of Revenue. Ensure that the form is postmarked by the filing deadline.

- In-Person: Taxpayers may also submit their forms in person at designated Alabama Department of Revenue offices.

Legal Use of the Alabama Form 40

The Alabama Form 40 is legally binding once it is signed and submitted to the state tax authority. It is essential to provide accurate and truthful information, as any discrepancies may lead to audits or penalties. The form must comply with state tax laws, and taxpayers should retain copies of their submitted forms and supporting documents for their records.

Key Elements of the Alabama Form 40

Several key elements are crucial when completing the Alabama Form 40:

- Personal Information: Accurate personal details are necessary for identification and processing.

- Income Reporting: All sources of income must be reported to ensure a correct tax calculation.

- Deductions and Credits: Understanding available deductions and credits can significantly affect tax liability.

- Signature: A valid signature is required to certify the accuracy of the information provided.

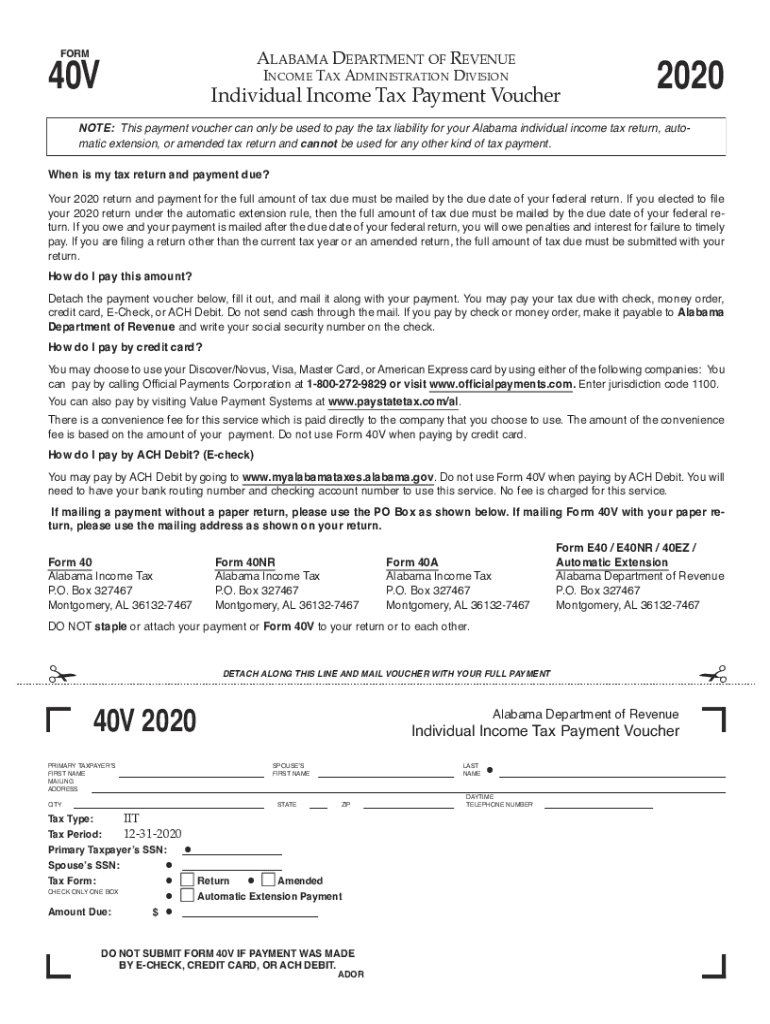

Quick guide on how to complete pdf 40v ty 2020 print versionqxp alabama department of revenue

Complete PDF 40V TY Print Version qxp Alabama Department Of Revenue effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage PDF 40V TY Print Version qxp Alabama Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign PDF 40V TY Print Version qxp Alabama Department Of Revenue effortlessly

- Obtain PDF 40V TY Print Version qxp Alabama Department Of Revenue and click Get Form to get started.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign PDF 40V TY Print Version qxp Alabama Department Of Revenue and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf 40v ty 2020 print versionqxp alabama department of revenue

Create this form in 5 minutes!

How to create an eSignature for the pdf 40v ty 2020 print versionqxp alabama department of revenue

How to make an e-signature for a PDF document in the online mode

How to make an e-signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

The best way to make an e-signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the Alabama Form 40?

The Alabama Form 40 is the state's individual income tax return form, used by residents to report their income and calculate taxes owed. Completing the Alabama Form 40 accurately is essential for compliance and ensures that you claim all eligible deductions.

-

How can airSlate SignNow help with the Alabama Form 40?

airSlate SignNow simplifies the process of signing and submitting your Alabama Form 40. With our platform, users can efficiently prepare, eSign, and manage their tax documents securely, making tax season smoother and less stressful.

-

Is airSlate SignNow cost-effective for filing the Alabama Form 40?

Yes, airSlate SignNow offers a cost-effective solution for managing your Alabama Form 40 filings. With various pricing plans, our service provides excellent value by streamlining the eSignature process and reducing paperwork costs.

-

What features does airSlate SignNow offer for the Alabama Form 40?

airSlate SignNow provides features such as eSigning, document templates, and secure storage, which are essential for filing your Alabama Form 40. These tools help ensure that your forms are completed accurately and promptly.

-

Can I use airSlate SignNow on different devices for the Alabama Form 40?

Absolutely! airSlate SignNow is a versatile platform that can be accessed on various devices, including computers, tablets, and smartphones. This flexibility allows you to complete your Alabama Form 40 paperwork anytime and from anywhere.

-

Does airSlate SignNow integrate with other tax software for the Alabama Form 40?

Yes, airSlate SignNow integrates with popular tax software, making it easier to manage your Alabama Form 40 alongside your financial documents. This integration enhances your workflow, allowing for seamless data transfer and eSigning.

-

What are the benefits of using airSlate SignNow for the Alabama Form 40?

Using airSlate SignNow for your Alabama Form 40 offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved security. These advantages ensure that your tax processes are streamlined and protect sensitive information.

Get more for PDF 40V TY Print Version qxp Alabama Department Of Revenue

- Ak landlord notice form

- Letter from tenant to landlord about illegal entry by landlord alaska form

- Letter from landlord to tenant about time of intent to enter premises alaska form

- Letter from tenant to landlord containing notice to cease unjustified nonacceptance of rent alaska form

- Letter from tenant to landlord about sexual harassment alaska form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children alaska form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance alaska form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords form

Find out other PDF 40V TY Print Version qxp Alabama Department Of Revenue

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement