Fillable IL 4506 Request for Copy of Tax Return Illinois Fill Io 2022-2026

Understanding the IL 8453 Form

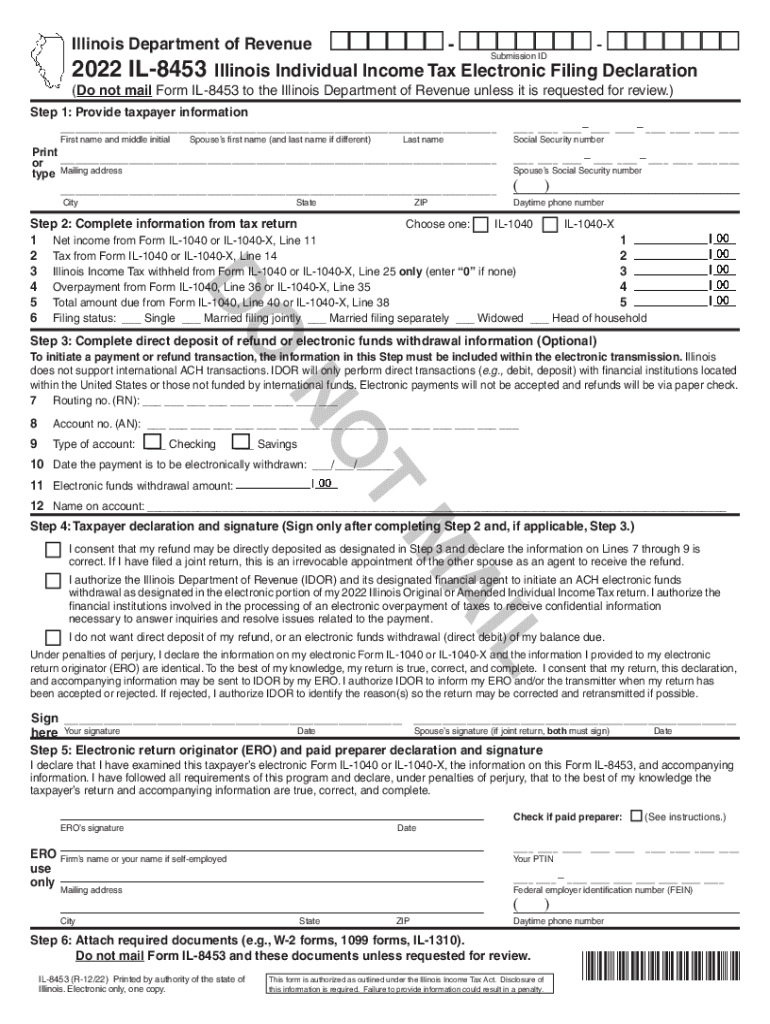

The IL 8453 form, also known as the Illinois e-Filing Declaration, is a crucial document for taxpayers in Illinois who file their tax returns electronically. This form serves as a declaration that the information provided in the electronic filing is accurate and complete. It is essential for ensuring compliance with state tax regulations and serves as a safeguard against potential audits. The IL 8453 form must be signed electronically, and it is important to use a reliable eSignature platform to ensure its legal validity.

Steps to Complete the IL 8453 Form

Completing the IL 8453 form involves several key steps to ensure accuracy and compliance. Here is a straightforward process to follow:

- Gather all necessary tax documents, including W-2s, 1099s, and other relevant income statements.

- Access the IL 8453 form through a trusted e-filing platform that supports electronic submission.

- Fill in your personal information, including your name, address, and Social Security number.

- Review the information for accuracy before proceeding to the signature section.

- Use a secure eSignature tool to sign the form electronically, ensuring compliance with eSignature laws.

- Submit the completed form along with your electronic tax return.

Legal Validity of the IL 8453 Form

To ensure the legal validity of the IL 8453 form, it is important to adhere to specific requirements set forth by Illinois tax authorities. The form must be signed using a compliant electronic signature that meets the standards of the ESIGN Act and UETA. Additionally, using a reputable eSignature service provides an audit trail and a certificate of completion, which can be crucial in case of disputes or audits. Properly executed, the IL 8453 form is legally binding and recognized by the state.

Form Submission Methods

The IL 8453 form can be submitted electronically as part of your e-filed tax return. It is essential to ensure that the e-filing platform you choose allows for the seamless integration of the IL 8453 form with your tax return. Alternatively, if you are filing by mail, you may need to print and send the form along with your paper tax return. However, electronic submission is encouraged for faster processing and confirmation.

Required Documents for Filing

When preparing to file the IL 8453 form, it is important to have the following documents on hand:

- W-2 forms from all employers for the tax year.

- 1099 forms for any additional income received.

- Records of any deductions or credits you plan to claim.

- Previous year’s tax return for reference.

Having these documents ready will streamline the completion of the IL 8453 form and ensure that all information is accurate.

Common Scenarios for Using the IL 8453 Form

The IL 8453 form is commonly used by various taxpayer scenarios, including individuals, families, and small business owners. For example:

- Self-employed individuals must complete the IL 8453 form as part of their electronic filing process to report income and expenses accurately.

- Families filing jointly may need to use the IL 8453 form to declare their combined income and deductions effectively.

- Students filing for tax credits or education-related deductions also utilize the IL 8453 to ensure their filings are complete and compliant.

Understanding these scenarios can help taxpayers recognize the importance of the IL 8453 form in their specific situations.

Quick guide on how to complete fillable il 4506 request for copy of tax return illinois fill io

Complete Fillable IL 4506 Request For Copy Of Tax Return Illinois Fill Io effortlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Fillable IL 4506 Request For Copy Of Tax Return Illinois Fill Io on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest method to modify and eSign Fillable IL 4506 Request For Copy Of Tax Return Illinois Fill Io with ease

- Obtain Fillable IL 4506 Request For Copy Of Tax Return Illinois Fill Io and click Get Form to begin.

- Use the tools available to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Fillable IL 4506 Request For Copy Of Tax Return Illinois Fill Io and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable il 4506 request for copy of tax return illinois fill io

Create this form in 5 minutes!

How to create an eSignature for the fillable il 4506 request for copy of tax return illinois fill io

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IL 8453 and how does it relate to airSlate SignNow?

IL 8453 is a form used for electronic signatures in the filing of tax documents. airSlate SignNow simplifies the process of signing and storing IL 8453 forms securely, ensuring compliance with IRS regulations while offering a user-friendly experience.

-

How can airSlate SignNow help me with IL 8453 submissions?

With airSlate SignNow, you can easily eSign IL 8453 documents and streamline your submission process. Our platform offers secure electronic signatures that enhance efficiency and ensure your forms are filed accurately and on time.

-

What are the pricing options for using airSlate SignNow for IL 8453?

airSlate SignNow offers flexible pricing plans tailored to suit various business needs. You can start with a free trial and explore our various tiers that provide comprehensive features, including eSigning for IL 8453 and other essential document management tools.

-

Does airSlate SignNow provide templates for IL 8453?

Yes, airSlate SignNow provides customizable templates for IL 8453, making it easier for users to efficiently create, send, and sign these forms. These templates are designed to streamline the completion of tax document submissions.

-

What features does airSlate SignNow offer for IL 8453 document management?

With airSlate SignNow, you gain access to a suite of features such as secure eSigning, document tracking, and automated workflows specifically designed for IL 8453. These features enhance productivity and accuracy in your tax filing processes.

-

Is it easy to integrate airSlate SignNow with other applications for IL 8453 processing?

Absolutely! airSlate SignNow offers seamless integrations with various business applications, allowing you to incorporate IL 8453 processing into your existing workflows. This connectivity helps to enhance efficiency and keeps your operations synchronized.

-

Can airSlate SignNow help ensure compliance when using IL 8453?

Yes, airSlate SignNow is designed to meet regulatory compliance for electronic signatures, including the requirements for IL 8453 submissions. Our platform ensures your documents are signed securely, helping you comply with IRS standards.

Get more for Fillable IL 4506 Request For Copy Of Tax Return Illinois Fill Io

Find out other Fillable IL 4506 Request For Copy Of Tax Return Illinois Fill Io

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple