Il 8453 Form 2018

What is the IL 8453 Form

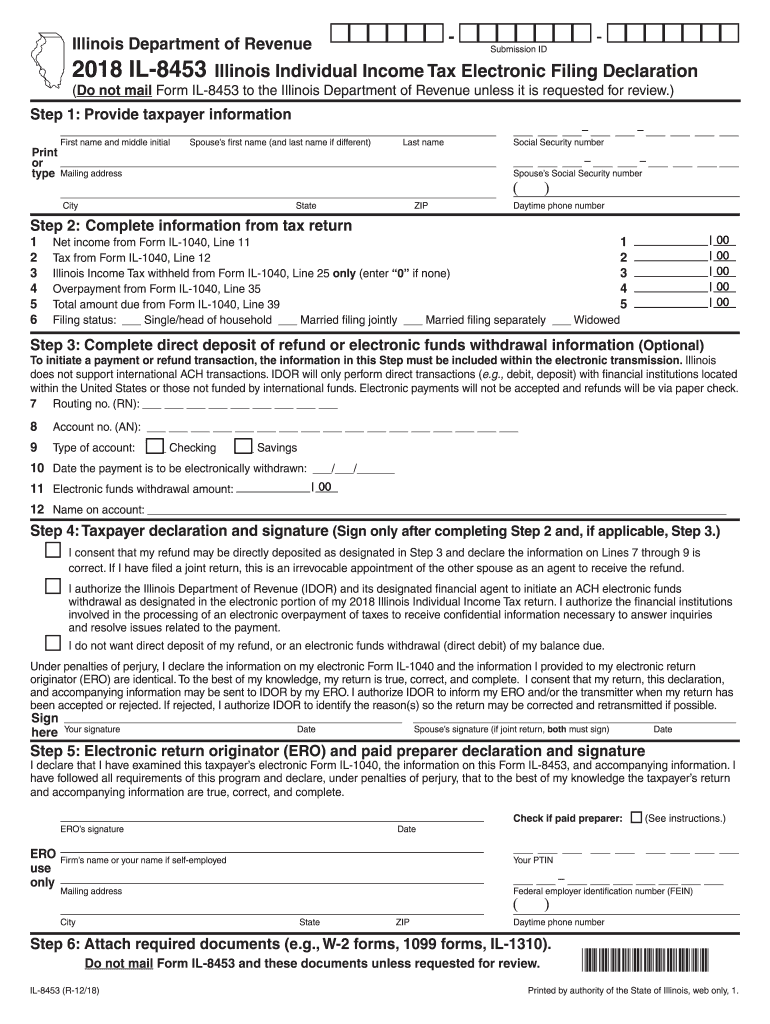

The IL 8453 form, also known as the Illinois Income Tax Declaration for e-File, is a crucial document for taxpayers who file their Illinois state tax returns electronically. This form serves as a declaration of the taxpayer's intent to file electronically and provides necessary information to authenticate the filing process. By using the IL 8453, taxpayers ensure compliance with state regulations while facilitating a smoother e-filing experience.

Steps to Complete the IL 8453 Form

Completing the IL 8453 form involves several straightforward steps. First, gather all necessary personal information, including your name, address, Social Security number, and the details of your tax return. Next, accurately fill out the form, ensuring all entries match the information provided in your electronic tax return. After completing the form, review it for accuracy and sign it digitally. Finally, submit the IL 8453 along with your electronic tax return to ensure proper processing.

Legal Use of the IL 8453 Form

The IL 8453 form is legally binding and must be completed in accordance with Illinois state law. To ensure its validity, taxpayers must adhere to the electronic signature requirements outlined in the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). By following these guidelines, the IL 8453 form can be used as a legally recognized document in case of audits or disputes.

Filing Deadlines / Important Dates

It is essential for taxpayers to be aware of the filing deadlines associated with the IL 8453 form. Typically, the deadline for filing Illinois state taxes aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should check for any updates or changes to ensure timely submission of their IL 8453 and accompanying tax returns.

Form Submission Methods

The IL 8453 form can be submitted through various methods, depending on how the taxpayer chooses to file their taxes. For electronic filers, the form is submitted alongside the electronic tax return. Alternatively, if taxpayers opt for paper filing, they can print the IL 8453 form, complete it, and mail it to the designated address provided by the Illinois Department of Revenue. Ensuring the correct submission method is vital for compliance and processing.

Examples of Using the IL 8453 Form

Taxpayers may encounter various scenarios where the IL 8453 form is necessary. For instance, individuals filing their income tax returns through online tax preparation software will typically be prompted to complete the IL 8453 as part of the e-filing process. Additionally, self-employed individuals or those with specific deductions may need to use this form to authenticate their electronic submissions, ensuring all relevant information is accurately represented.

Quick guide on how to complete il 8453 form

Effortlessly Prepare Il 8453 Form on Any Device

The management of online documents has become increasingly popular among both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly, without any delays. Handle Il 8453 Form on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Edit and Electronically Sign Il 8453 Form with Ease

- Locate Il 8453 Form and click on Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select the method of sharing your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Il 8453 Form while ensuring excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il 8453 form

Create this form in 5 minutes!

How to create an eSignature for the il 8453 form

The best way to create an eSignature for your PDF document in the online mode

The best way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the Illinois 8453 form and its purpose?

The Illinois 8453 form is a crucial document used by taxpayers in Illinois for electronic filing of tax returns. It serves as a declaration of the accuracy of the federal tax return and is required when e-filing certain tax types. Understanding the Illinois 8453 form is essential for ensuring compliance and a smooth e-filing experience.

-

How does airSlate SignNow simplify the signing process for the Illinois 8453 form?

AirSlate SignNow makes signing the Illinois 8453 form swift and efficient with its intuitive eSign solutions. Users can upload, sign, and send the document with just a few clicks, eliminating the need for printing or scanning. This streamlined process ensures you can meet deadlines without the hassles of traditional paperwork.

-

What are the pricing plans available for using airSlate SignNow?

AirSlate SignNow provides flexible pricing plans designed to accommodate businesses of all sizes that need to manage documents like the Illinois 8453 form. Plans vary based on features, including eSigning, document templates, and integrations. It's essential to compare plans to find the best fit for your specific needs.

-

Can I integrate airSlate SignNow with other applications for handling the Illinois 8453?

Yes, airSlate SignNow offers a variety of integrations with popular applications that facilitate managing the Illinois 8453 form along with other documents. Whether you're using CRM systems, document management software, or email services, integrating these tools can enhance workflow efficiency and productivity.

-

What are the benefits of using airSlate SignNow for the Illinois 8453 form?

Utilizing airSlate SignNow for the Illinois 8453 form comes with numerous benefits, including speed, security, and compliance. The electronic signing process reduces turnaround times and enhances document integrity with robust encryption. As a cost-effective solution, it enables users to manage their documents efficiently online.

-

Is airSlate SignNow compliant with regulations for the Illinois 8453 form?

Absolutely! AirSlate SignNow ensures compliance with legal and regulatory requirements pertaining to the Illinois 8453 form. This commitment to compliance means that your electronically signed documents hold up in court and maintain their validity under IRS standards.

-

How user-friendly is airSlate SignNow for first-time users dealing with the Illinois 8453?

AirSlate SignNow is designed with a user-friendly interface that helps first-time users navigate the eSigning process effortlessly, particularly for documents like the Illinois 8453 form. Clear instructions and a straightforward layout ensure that anyone, regardless of tech-savviness, can complete their tasks with ease.

Get more for Il 8453 Form

- Wi wife form

- Wisconsin property agreement form

- Wisconsin agreement form

- Wisconsin postnuptial form

- Quitclaim deed from husband and wife to an individual wisconsin form

- Warranty deed from husband and wife to an individual wisconsin form

- Wi form

- Warranty deed two grantors to three grantees as joint tenants wisconsin form

Find out other Il 8453 Form

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word