FORM TR 1 TAX RETURN Parker 2020-2026

What is the FORM TR 1 TAX RETURN Parker

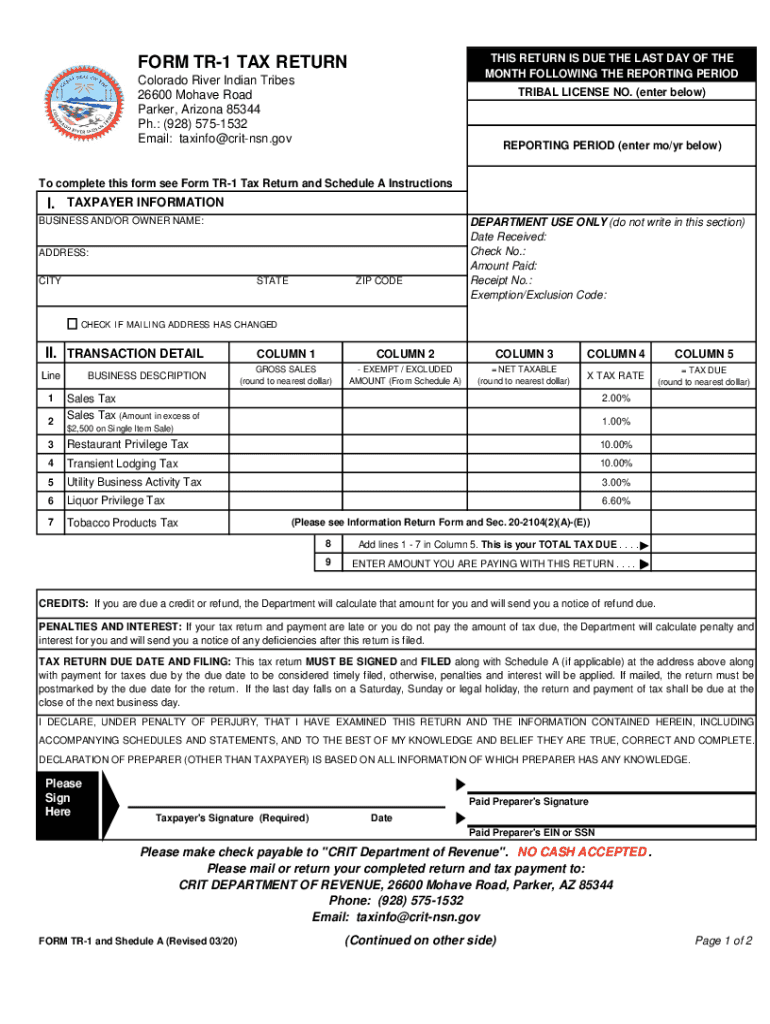

The FORM TR 1 TAX RETURN Parker is a specific tax return form used by taxpayers in the United States to report their income and calculate their tax obligations. This form is essential for individuals and businesses alike, as it helps ensure compliance with federal tax regulations. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the FORM TR 1 TAX RETURN Parker

Using the FORM TR 1 TAX RETURN Parker involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements, deductions, and credits. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. After completing the form, review it for any errors before submission. It is advisable to keep a copy for your records.

Steps to complete the FORM TR 1 TAX RETURN Parker

Completing the FORM TR 1 TAX RETURN Parker requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Begin filling out the form, starting with personal information, including your name, address, and Social Security number.

- Report your income in the appropriate sections, ensuring all figures are accurate.

- Include any deductions or credits you qualify for, as these can significantly impact your tax liability.

- Review the completed form for accuracy, checking for any missing information or errors.

- Sign and date the form before submitting it to the appropriate tax authority.

Legal use of the FORM TR 1 TAX RETURN Parker

The legal use of the FORM TR 1 TAX RETURN Parker is governed by federal tax laws. This form must be filled out accurately and submitted on time to avoid penalties. It serves as a legal document that reflects your income and tax obligations. Failure to comply with the regulations surrounding this form can result in fines or legal action, making it essential to understand its proper use.

Filing Deadlines / Important Dates

Filing deadlines for the FORM TR 1 TAX RETURN Parker are typically set by the Internal Revenue Service (IRS). Generally, individual tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these deadlines to ensure timely filing and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The FORM TR 1 TAX RETURN Parker can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online: Many taxpayers choose to file electronically through tax software or e-filing services, which can streamline the process and reduce errors.

- Mail: The form can be printed and mailed to the appropriate tax authority, ensuring it is sent well before the deadline.

- In-Person: Some taxpayers may opt to deliver their forms in person at local tax offices, which can provide immediate confirmation of submission.

Quick guide on how to complete form tr 1 tax return parker

Effortlessly prepare FORM TR 1 TAX RETURN Parker on any device

Digital document administration has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents rapidly without holdups. Manage FORM TR 1 TAX RETURN Parker on any platform using airSlate SignNow's Android or iOS applications and streamline any document-focused task today.

The simplest way to modify and electronically sign FORM TR 1 TAX RETURN Parker with ease

- Locate FORM TR 1 TAX RETURN Parker and click Get Form to initiate the process.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign FORM TR 1 TAX RETURN Parker and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form tr 1 tax return parker

Create this form in 5 minutes!

How to create an eSignature for the form tr 1 tax return parker

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FORM TR 1 TAX RETURN Parker?

The FORM TR 1 TAX RETURN Parker is a specific tax return form required by residents of Parker who need to report their income and calculate their tax obligations. This form is essential for ensuring compliance with local tax laws and providing accurate financial reporting.

-

How can airSlate SignNow help with filing the FORM TR 1 TAX RETURN Parker?

airSlate SignNow provides an efficient platform to complete and eSign the FORM TR 1 TAX RETURN Parker. Our user-friendly interface streamlines the process, allowing users to fill out, sign, and send the form securely from any device.

-

What are the benefits of using airSlate SignNow for the FORM TR 1 TAX RETURN Parker?

Using airSlate SignNow for the FORM TR 1 TAX RETURN Parker offers several benefits, including ease of use, document security, and rapid turnaround times. Our cloud-based solution ensures that your forms are accessible whenever you need them, while also enhancing collaboration with tax professionals.

-

Is there a cost associated with using airSlate SignNow for the FORM TR 1 TAX RETURN Parker?

Yes, there is a pricing plan associated with using airSlate SignNow for the FORM TR 1 TAX RETURN Parker. However, our service is designed to be cost-effective, providing various subscription options to suit different business needs while delivering exceptional value.

-

Can I integrate airSlate SignNow with other software while filing the FORM TR 1 TAX RETURN Parker?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and business management software, making it easier to file the FORM TR 1 TAX RETURN Parker. This integration allows for better data management and streamlined workflows.

-

What features does airSlate SignNow offer for handling the FORM TR 1 TAX RETURN Parker?

airSlate SignNow offers multiple features tailored for handling the FORM TR 1 TAX RETURN Parker, such as customizable templates, bulk sending, and advanced security measures. These features work together to simplify the document signing process and enhance user experience.

-

How secure is using airSlate SignNow for the FORM TR 1 TAX RETURN Parker?

Security is a priority for airSlate SignNow. We use advanced encryption methods and comply with industry standards to ensure that your FORM TR 1 TAX RETURN Parker and other documents are protected throughout the signing process.

Get more for FORM TR 1 TAX RETURN Parker

Find out other FORM TR 1 TAX RETURN Parker

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed