Colorado River Indian Tribes Form 2016

What is the Colorado River Indian Tribes Form?

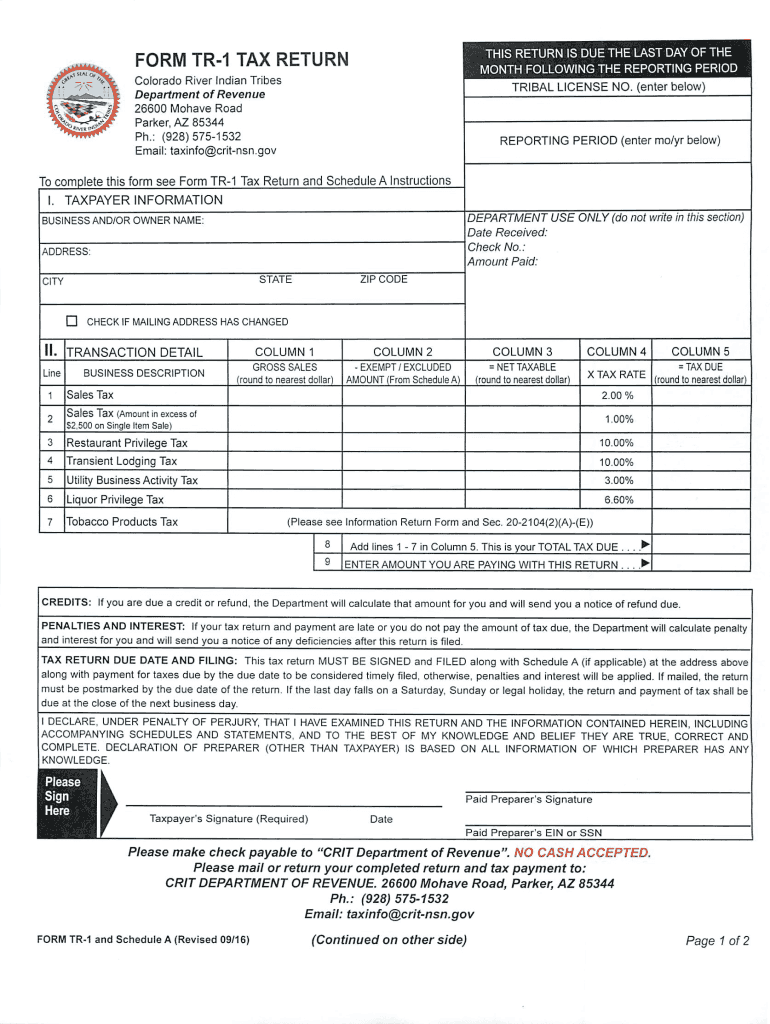

The Colorado River Indian Tribes Form is a specific document used by individuals and businesses associated with the Colorado River Indian Tribes for various administrative and tax-related purposes. This form is essential for reporting income and ensuring compliance with federal tax regulations. It is designed to facilitate accurate reporting and streamline the process for both taxpayers and the IRS. Understanding the purpose and requirements of this form is crucial for those who need to file it.

Steps to Complete the Colorado River Indian Tribes Form

Completing the Colorado River Indian Tribes Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including personal identification details, income documentation, and any relevant financial records. Next, fill out the form carefully, ensuring that all fields are completed correctly. Review the form for any errors or omissions before signing. Once completed, the form can be submitted electronically or by mail, depending on your preference.

How to Obtain the Colorado River Indian Tribes Form

The Colorado River Indian Tribes Form can be obtained through various channels. It is typically available on the official website of the Colorado River Indian Tribes or through designated government offices. Additionally, taxpayers can request the form directly from the IRS or consult with tax professionals for assistance. Ensuring you have the correct and most recent version of the form is important for compliance.

Legal Use of the Colorado River Indian Tribes Form

The legal use of the Colorado River Indian Tribes Form is governed by federal tax laws and regulations. This form must be completed accurately and submitted in accordance with IRS guidelines to be considered valid. Using the form correctly helps avoid potential legal issues, such as penalties for non-compliance. It is essential for taxpayers to be aware of their responsibilities when using this form to ensure they meet all legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Colorado River Indian Tribes Form are crucial for taxpayers to observe. Typically, the form must be submitted by a specific date each year, often aligning with federal tax filing deadlines. It is important to stay informed about any changes to these dates, as they can vary based on legislative updates or IRS announcements. Missing the deadline can result in penalties, so timely submission is essential.

Form Submission Methods

The Colorado River Indian Tribes Form can be submitted through various methods, including online submission, mail, or in-person delivery. Online submission is often the fastest and most efficient option, allowing for immediate processing. For those who prefer traditional methods, mailing the form or submitting it in person at designated offices are viable alternatives. Each method has its own guidelines and requirements, so it is important to choose the one that best fits your needs.

Quick guide on how to complete colorado river indian tribes 2016 2019 form

Your assistance manual on how to prepare your Colorado River Indian Tribes Form

If you wish to learn how to create and submit your Colorado River Indian Tribes Form, here are some brief guidelines on how to simplify tax processing.

First, you simply need to register your airSlate SignNow account to revolutionize your online document handling. airSlate SignNow is an exceptionally intuitive and robust document solution that allows you to modify, create, and complete your tax forms effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and return to edit details as necessary. Optimize your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Colorado River Indian Tribes Form in no time:

- Create your account and begin working on PDFs within minutes.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Click Get form to access your Colorado River Indian Tribes Form in our editor.

- Enter the necessary fillable fields with your information (text, numbers, checkmarks).

- Use the Sign Tool to affix your legally-binding eSignature (if required).

- Examine your document and rectify any mistakes.

- Preserve changes, print your duplicate, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting by mail can increase errors in returns and delay refunds. Additionally, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct colorado river indian tribes 2016 2019 form

FAQs

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

Create this form in 5 minutes!

How to create an eSignature for the colorado river indian tribes 2016 2019 form

How to make an eSignature for your Colorado River Indian Tribes 2016 2019 Form online

How to create an eSignature for your Colorado River Indian Tribes 2016 2019 Form in Google Chrome

How to generate an eSignature for putting it on the Colorado River Indian Tribes 2016 2019 Form in Gmail

How to create an eSignature for the Colorado River Indian Tribes 2016 2019 Form right from your smartphone

How to make an eSignature for the Colorado River Indian Tribes 2016 2019 Form on iOS

How to generate an electronic signature for the Colorado River Indian Tribes 2016 2019 Form on Android devices

People also ask

-

What is TR 1 tax and how can airSlate SignNow help me with it?

TR 1 tax refers to the tax return form that businesses use to report income. airSlate SignNow simplifies the process by allowing you to send, receive, and eSign important documents related to TR 1 tax quickly and securely.

-

Are there any specific features in airSlate SignNow that assist with TR 1 tax documentation?

Yes, airSlate SignNow offers features such as document templates and integrated workflows that streamline the preparation and submission of TR 1 tax forms. This makes managing your tax documents more efficient and less time-consuming.

-

How does airSlate SignNow ensure the security of my TR 1 tax documents?

airSlate SignNow utilizes advanced encryption methods and secure servers to protect your TR 1 tax documents. This ensures that your sensitive information remains confidential and secure while being signed and shared.

-

What are the pricing options for using airSlate SignNow for TR 1 tax management?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Regardless of whether you're a small business or a large enterprise, you can find a plan that suits your budget while effectively managing TR 1 tax forms.

-

Can airSlate SignNow integrate with other software I use for TR 1 tax processing?

Absolutely! airSlate SignNow seamlessly integrates with several accounting and tax software solutions, making it easier to manage your TR 1 tax documentation alongside your existing systems.

-

What are the benefits of using airSlate SignNow for my TR 1 tax needs?

By using airSlate SignNow, you can streamline your TR 1 tax filing process, saving time and reducing errors. The electronic signing features enhance collaboration and ensure that documents are signed and submitted promptly.

-

Is there customer support available for TR 1 tax-related queries when using airSlate SignNow?

Yes, airSlate SignNow provides dedicated customer support to assist you with any TR 1 tax-related inquiries or issues. Our team is available to help you navigate the platform and optimize your tax document management.

Get more for Colorado River Indian Tribes Form

- Va form 40 1330 claim for standard lamar county

- Application for medicaid nc dhhs online publications nc info dhhs state nc form

- Sample survey form in achaelogy

- Residential appeal form will county supervisor of assessments

- Irs sample qprt form

- Capital district habitat for humanity habitatcd form

- Kitchen cabinet contract template form

- Kitchen contract template form

Find out other Colorado River Indian Tribes Form

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now