Form 8827 Rev December 2022-2026

What is the Form 8827 Rev December

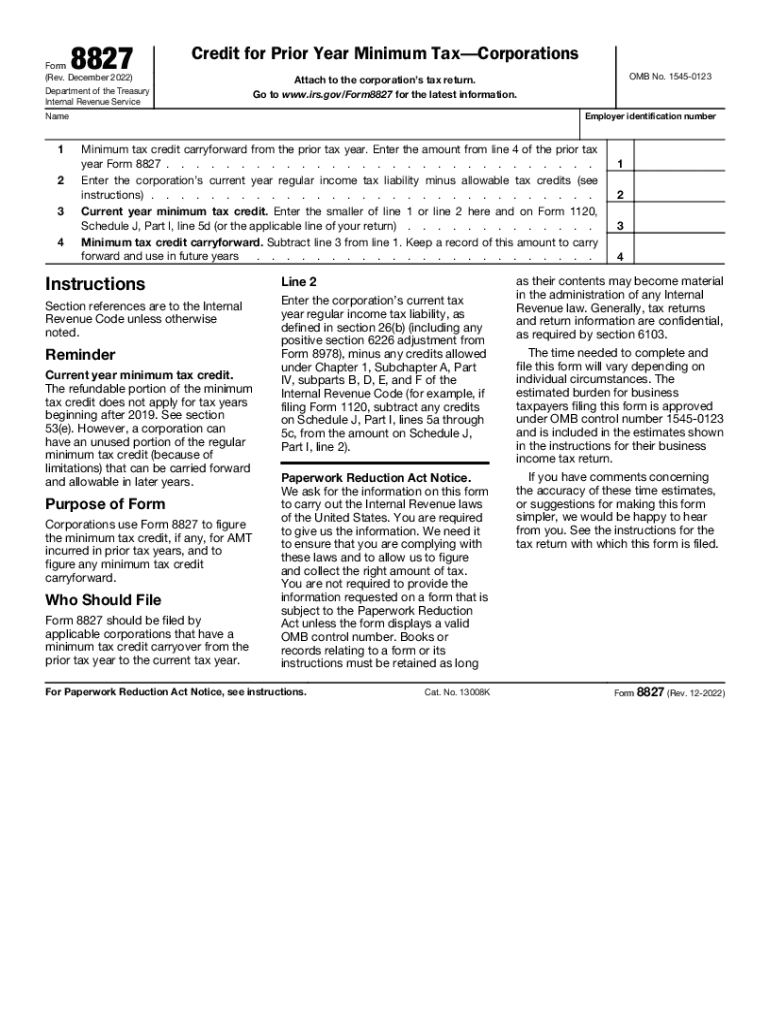

The Form 8827, also known as the IRS Minimum Tax Credit, is a tax form used by corporations to claim a credit for prior year minimum tax. This form is essential for businesses that have paid alternative minimum tax in previous years and are now eligible to recover some of those amounts. The form is designed to help taxpayers calculate the credit they can apply against their regular tax liability. Understanding the nuances of this form is crucial for ensuring compliance and maximizing potential tax benefits.

How to use the Form 8827 Rev December

Using the Form 8827 involves several steps that require careful attention to detail. First, gather all necessary financial documents, including prior year tax returns and records of any alternative minimum tax paid. Next, fill out the form by providing relevant information, including the amount of minimum tax credit being claimed. It's important to accurately calculate the credit to avoid discrepancies with the IRS. Once completed, the form can be submitted alongside your corporate tax return to ensure proper processing.

Steps to complete the Form 8827 Rev December

Completing the Form 8827 involves a systematic approach:

- Begin by entering your corporation's name, address, and Employer Identification Number (EIN).

- Indicate the tax year for which you are claiming the credit.

- Detail the amount of minimum tax paid in previous years that qualifies for credit.

- Calculate the allowable credit based on the instructions provided with the form.

- Review all entries for accuracy before submission.

Legal use of the Form 8827 Rev December

The legal use of Form 8827 is governed by IRS regulations. To ensure that the form is considered valid, it must be completed accurately and submitted in accordance with IRS guidelines. The form serves as a formal request for the minimum tax credit, and any misrepresentation or errors could lead to penalties or disallowance of the credit. It is advisable to keep thorough documentation supporting the claims made on the form in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8827 align with the corporate tax return deadlines. Generally, corporations must file their tax returns by the fifteenth day of the fourth month following the end of their tax year. For corporations operating on a calendar year, this means the deadline is April fifteenth. If you are claiming the minimum tax credit, ensure that Form 8827 is filed by this date to avoid penalties and ensure timely processing.

Form Submission Methods (Online / Mail / In-Person)

The Form 8827 can be submitted through various methods. Corporations can file electronically using IRS-approved software, which often streamlines the process and reduces the likelihood of errors. Alternatively, the form can be mailed to the appropriate IRS address based on the corporation's location. In-person submissions are generally not available for tax forms, but some tax professionals may offer assistance in completing and filing the form electronically.

Quick guide on how to complete form 8827 rev december 2022

Complete Form 8827 Rev December effortlessly on any device

Web-based document management has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage Form 8827 Rev December on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 8827 Rev December without hassle

- Obtain Form 8827 Rev December and then click Get Form to initiate.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with instruments offered by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or an invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that require printing additional copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 8827 Rev December and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8827 rev december 2022

Create this form in 5 minutes!

How to create an eSignature for the form 8827 rev december 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 8827?

airSlate SignNow is a powerful digital signature and document management platform that allows businesses to send and eSign documents efficiently. The reference to 8827 is related to specific user needs in document processing and compliance that SignNow effectively addresses.

-

How much does airSlate SignNow cost, and is it worth the investment for 8827?

airSlate SignNow offers competitive pricing plans that cater to different business sizes and requirements, making it an affordable choice. Investing in SignNow can streamline your document management processes associated with 8827, saving time and improving efficiency.

-

What features does airSlate SignNow offer for users dealing with 8827-related documents?

SignNow includes a range of features like customizable templates, bulk sending, and advanced security options, which are essential for handling 8827 documents effectively. These features enhance user experience and ensure that your documents are compliant and secure throughout the signing process.

-

Can airSlate SignNow integrate with other tools when handling 8827 tasks?

Yes, airSlate SignNow seamlessly integrates with various applications and tools, including CRM systems and cloud storage platforms, which is crucial for managing 8827-related workflows. This integration capability ensures that users can easily consolidate their document processes without hassle.

-

What benefits can businesses expect from using airSlate SignNow for 8827 document management?

By utilizing airSlate SignNow for your 8827 document management needs, businesses can expect improved efficiency, reduced operational costs, and enhanced document security. The easy-to-use interface allows for quick navigation and faster turnaround times on document completion.

-

Is airSlate SignNow legally compliant with 8827 documentation standards?

Absolutely! airSlate SignNow complies with major eSignature laws, ensuring that all documents signed through the platform, including those related to 8827, are legally binding. This compliance is critical for businesses looking to maintain legality and security in their documentation processes.

-

How easy is it to get started with airSlate SignNow for 8827-related tasks?

Getting started with airSlate SignNow for your 8827-related tasks is straightforward and user-friendly. Once you create an account, you can quickly follow the onboarding tutorials to familiarize yourself with the platform and utilize its features efficiently.

Get more for Form 8827 Rev December

- Form 9 fssai

- Sace j8 form

- F80 study guide form

- Owner operator tax deductions worksheet form

- Sample letter visitor visa graduation form

- Usc dar form

- Fillable online fundraising request form niagara falls

- Provincial education requisition credit and designated industrial requisition credit application application form for perc and

Find out other Form 8827 Rev December

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document