How to Fill Out a 1099 NECBox by Box Guide on FillingU S Withholding Agent Frequently Asked Questions1 Date of Transfer Statemen 2023-2026

Understanding the FIRPTA Withholding Certificate

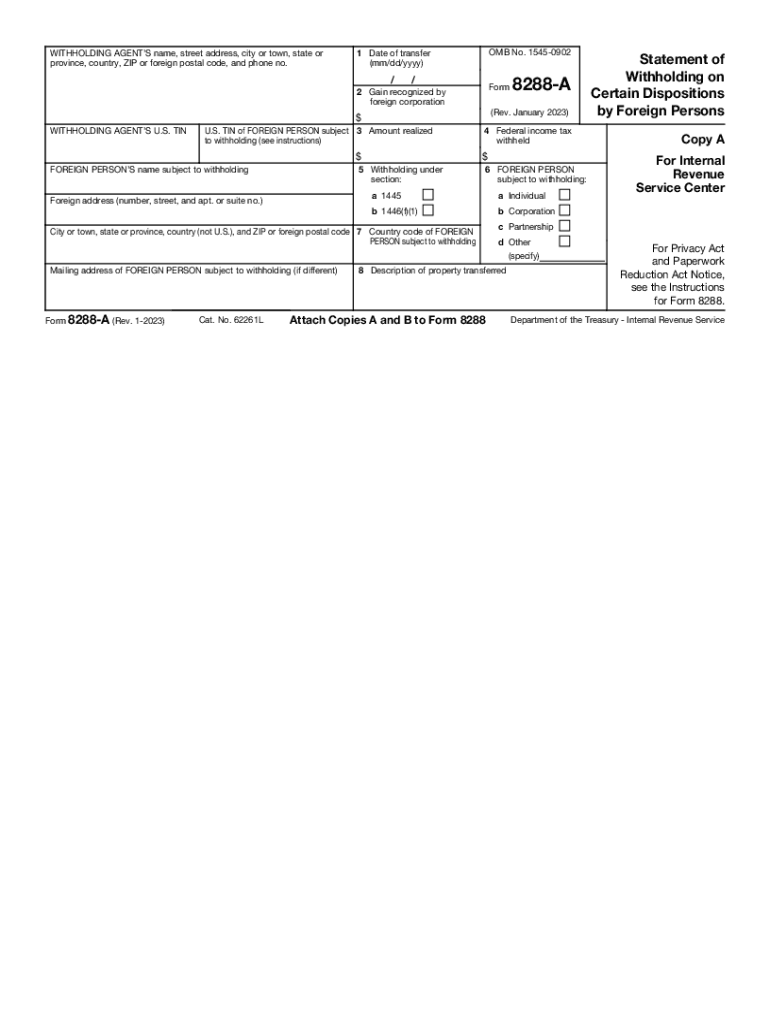

The FIRPTA withholding certificate is a crucial document for foreign sellers of U.S. real estate. Under the Foreign Investment in Real Property Tax Act (FIRPTA), the Internal Revenue Service (IRS) requires withholding on the sale of U.S. real property interests by foreign persons. This withholding is typically 15% of the gross sales price. However, sellers can apply for a withholding certificate to reduce or eliminate this amount, based on their actual tax liability.

The FIRPTA withholding certificate serves as an official request to the IRS, allowing sellers to provide evidence of their actual tax obligations. By obtaining this certificate, sellers can avoid over-withholding and ensure that the correct amount is withheld based on their specific circumstances.

Steps to Complete the FIRPTA Withholding Certificate

Filling out the FIRPTA withholding certificate involves several key steps to ensure compliance with IRS regulations. Here’s a simplified process:

- Gather necessary information, including the seller's tax identification number, the buyer's details, and the property information.

- Complete IRS Form 8288-B, which is the application for a withholding certificate. This form requires specific details about the transaction and the seller's tax situation.

- Submit the completed Form 8288-B to the IRS along with any required documentation that supports the request for a reduced withholding amount.

- Wait for the IRS to process the application. The processing time can vary, so it’s advisable to apply well in advance of the closing date.

- Once approved, the IRS will issue a withholding certificate that specifies the correct withholding amount.

Required Documents for FIRPTA Withholding Certificate

To successfully apply for a FIRPTA withholding certificate, certain documents must be submitted along with Form 8288-B. These documents may include:

- Proof of the seller's foreign status, such as a passport or other identification.

- Documentation of the property's sale price and details of the transaction.

- Any previous tax returns or IRS correspondence that may support the seller's claim for reduced withholding.

Having these documents ready can streamline the application process and help ensure compliance with IRS requirements.

IRS Guidelines for FIRPTA Withholding

The IRS has established specific guidelines regarding FIRPTA withholding and the use of withholding certificates. Key points include:

- The withholding rate is generally 15% of the gross sales price, but can be reduced based on the seller's actual tax liability.

- Sellers must apply for a withholding certificate before the closing of the sale to avoid unnecessary withholding.

- The IRS aims to process withholding certificate applications within 90 days, but delays can occur, so early application is recommended.

Understanding these guidelines helps sellers navigate the FIRPTA process more effectively.

Penalties for Non-Compliance with FIRPTA Regulations

Failing to comply with FIRPTA regulations can lead to significant penalties for both the seller and the buyer. Key penalties include:

- Withholding penalties, which can be assessed if the required amount is not withheld at the time of sale.

- Interest on any unpaid withholding amounts, which accrues until the IRS receives the correct payment.

- Potential legal consequences for failing to report the sale correctly, which could result in further financial penalties.

Being aware of these penalties emphasizes the importance of adhering to FIRPTA requirements during real estate transactions.

Quick guide on how to complete how to fill out a 1099 necbox by box guide on fillingus withholding agent frequently asked questions1 date of transfer

Complete How To Fill Out A 1099 NECBox by box Guide On FillingU S Withholding Agent Frequently Asked Questions1 Date Of Transfer Statemen effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, alter, and sign your documents quickly without delays. Handle How To Fill Out A 1099 NECBox by box Guide On FillingU S Withholding Agent Frequently Asked Questions1 Date Of Transfer Statemen on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign How To Fill Out A 1099 NECBox by box Guide On FillingU S Withholding Agent Frequently Asked Questions1 Date Of Transfer Statemen with ease

- Obtain How To Fill Out A 1099 NECBox by box Guide On FillingU S Withholding Agent Frequently Asked Questions1 Date Of Transfer Statemen and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign How To Fill Out A 1099 NECBox by box Guide On FillingU S Withholding Agent Frequently Asked Questions1 Date Of Transfer Statemen and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to fill out a 1099 necbox by box guide on fillingus withholding agent frequently asked questions1 date of transfer

Create this form in 5 minutes!

How to create an eSignature for the how to fill out a 1099 necbox by box guide on fillingus withholding agent frequently asked questions1 date of transfer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a withholding certificate and why do I need it?

A withholding certificate is a document that enables individuals or businesses to claim reduced withholding on certain types of income. Understanding what is a withholding certificate is essential for ensuring that you are not over-taxed and can manage your cash flow effectively.

-

How does airSlate SignNow help in managing withholding certificates?

airSlate SignNow offers an intuitive platform that allows users to easily create, send, and eSign withholding certificates digitally. This simplifies tracking and ensures that your tax documents are organized and accessible whenever needed, aligning with what is a withholding certificate.

-

What features does airSlate SignNow offer for handling withholding certificates?

With airSlate SignNow, users can take advantage of features like customizable templates, in-app signing, and secure document storage to manage withholding certificates seamlessly. These features contribute to a clear understanding of what is a withholding certificate and how it should be processed.

-

Is airSlate SignNow a cost-effective solution for eSigning withholding certificates?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By streamlining the process of managing withholding certificates, it reduces administrative costs and helps you maximize your savings while staying compliant with tax regulations.

-

What integrations does airSlate SignNow support for handling withholding certificates?

airSlate SignNow integrates seamlessly with a variety of platforms such as Google Drive, Dropbox, and Microsoft Office. These integrations are beneficial for understanding what is a withholding certificate and ensuring smooth workflow management across different applications.

-

Can I track the status of my withholding certificates with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking capabilities, allowing users to monitor the status of their withholding certificates at any time. This feature ensures you are always aware of when documents are signed and helps maintain compliance with what is a withholding certificate.

-

How secure is the information on my withholding certificates when using airSlate SignNow?

Security is a top priority at airSlate SignNow. With advanced encryption and secure cloud storage, your withholding certificates and other sensitive documents are protected against unauthorized access, making it trustworthy for handling what is a withholding certificate.

Get more for How To Fill Out A 1099 NECBox by box Guide On FillingU S Withholding Agent Frequently Asked Questions1 Date Of Transfer Statemen

Find out other How To Fill Out A 1099 NECBox by box Guide On FillingU S Withholding Agent Frequently Asked Questions1 Date Of Transfer Statemen

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure