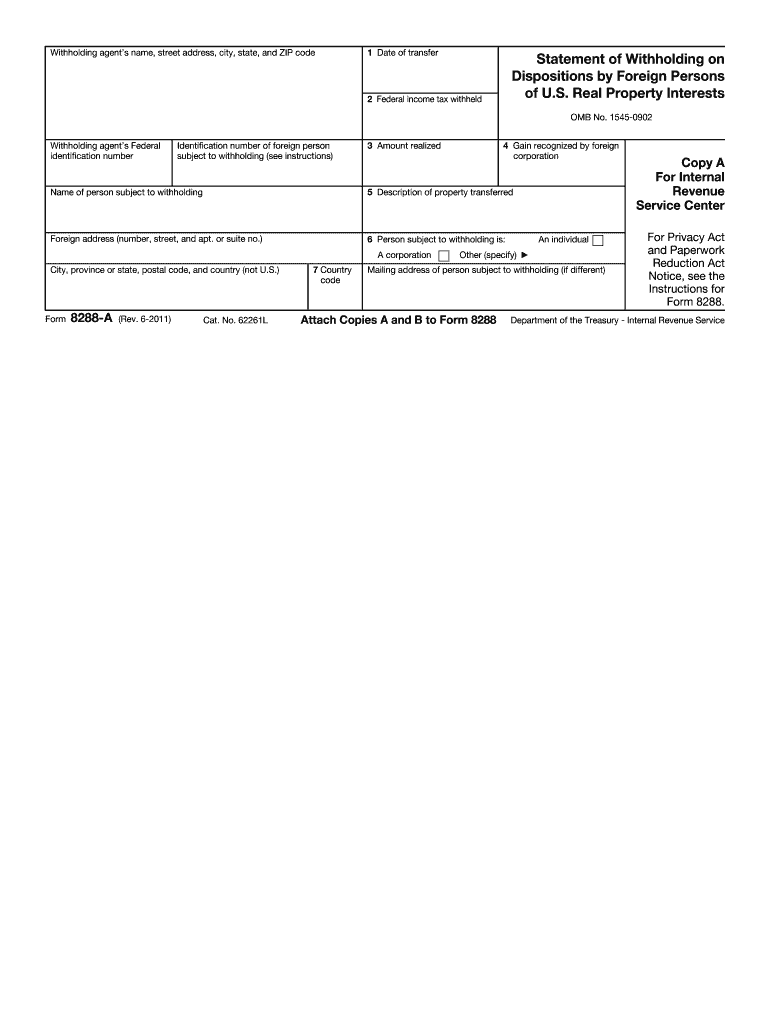

Form Withholding 2011

What is the Form Withholding

The Form Withholding is a crucial document used primarily for tax purposes in the United States. It allows employers to report the amount of income tax withheld from employees' paychecks. This form is essential for ensuring compliance with federal tax regulations and helps employees understand their tax obligations. Typically, the Form Withholding is associated with the IRS W-4 form, which employees complete to indicate their tax withholding preferences.

How to use the Form Withholding

Using the Form Withholding involves several steps. First, employees fill out the W-4 form to determine their withholding allowances. Employers then use this information to calculate the appropriate amount of federal income tax to withhold from each paycheck. It's important for employees to review their withholding status regularly, especially after major life changes such as marriage, divorce, or the birth of a child, as these can affect their tax situation.

Steps to complete the Form Withholding

Completing the Form Withholding requires careful attention to detail. Here are the steps to follow:

- Obtain the W-4 form from your employer or download it from the IRS website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your filing status (single, married, etc.) and any additional allowances you are claiming.

- Review your entries for accuracy and completeness.

- Submit the completed form to your employer.

Legal use of the Form Withholding

The legal use of the Form Withholding is governed by IRS regulations. Employers are required to withhold a certain percentage of an employee's wages for federal income tax based on the information provided in the W-4 form. Failure to comply with these regulations can result in penalties for both employers and employees. It is essential to ensure that the form is completed accurately and submitted on time to avoid any legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form Withholding are crucial for both employers and employees. Typically, employers must submit the withheld taxes to the IRS on a regular schedule, either monthly or quarterly, depending on the amount withheld. Employees should also be aware of tax filing deadlines, which usually fall on April 15 of each year. Keeping track of these dates helps ensure compliance and avoids potential penalties.

Penalties for Non-Compliance

Non-compliance with the Form Withholding regulations can lead to significant penalties. Employers who fail to withhold the correct amount of taxes may face fines and interest on unpaid taxes. Employees who do not accurately complete their W-4 forms may end up under-withheld, resulting in a tax bill at the end of the year. Understanding the consequences of non-compliance is essential for both parties to maintain their financial health.

Quick guide on how to complete 2011 form withholding

Effortlessly Prepare Form Withholding on Any Device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents promptly and without delays. Manage Form Withholding on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Easily Modify and eSign Form Withholding

- Locate Form Withholding and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form Withholding and ensure outstanding communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form withholding

Create this form in 5 minutes!

How to create an eSignature for the 2011 form withholding

The best way to make an electronic signature for your PDF file online

The best way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is Form Withholding in airSlate SignNow?

Form Withholding refers to the ability to manage and process documents that require signature and approval in a streamlined manner using airSlate SignNow. This feature helps businesses ensure compliance and accuracy in document handling, making the entire process faster and more efficient.

-

How does airSlate SignNow support Form Withholding?

airSlate SignNow supports Form Withholding by providing a secure platform to send, manage, and eSign important documents. Users can customize workflows, set required fields, and ensure that all necessary signatures are collected, enhancing the overall document management process.

-

Is there a cost associated with using the Form Withholding feature?

Yes, there are various pricing plans available that include the Form Withholding feature in airSlate SignNow. The plans cater to different business needs, ensuring that you can find a budget-friendly option that covers your organization's requirements for document management and eSigning.

-

What are the benefits of using airSlate SignNow for Form Withholding?

The benefits of using airSlate SignNow for Form Withholding include increased efficiency in document processing, improved compliance with legal standards, and reduced turnaround time for getting documents signed. This helps businesses save time and resources while enhancing the client experience.

-

Can I integrate airSlate SignNow with other applications for Form Withholding?

Absolutely! airSlate SignNow offers multiple integrations with popular applications and platforms, allowing you to streamline your Form Withholding process. This flexibility ensures that you can connect your existing tools and enhance your workflow without any disruptions.

-

How secure is my data when using airSlate SignNow for Form Withholding?

Your data security is a top priority for airSlate SignNow. The platform employs advanced encryption methods and complies with industry standards to ensure that all document handling, including Form Withholding, is protected from unauthorized access and data bsignNowes.

-

Can I track the status of my documents in airSlate SignNow when handling Form Withholding?

Yes, airSlate SignNow provides real-time tracking capabilities for all documents, including those related to Form Withholding. This feature allows you to monitor when a document has been sent, viewed, and signed, giving you complete visibility into the document lifecycle.

Get more for Form Withholding

- Illinois married form

- Il married form

- Illinois will form

- Mutual wills package with last wills and testaments for married couple with adult children illinois form

- Mutual wills package with last wills and testaments for married couple with no children illinois form

- Mutual wills package with last wills and testaments for married couple with minor children illinois form

- Legal last will and testament form for married person with adult and minor children from prior marriage illinois

- Civil marriage form

Find out other Form Withholding

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form