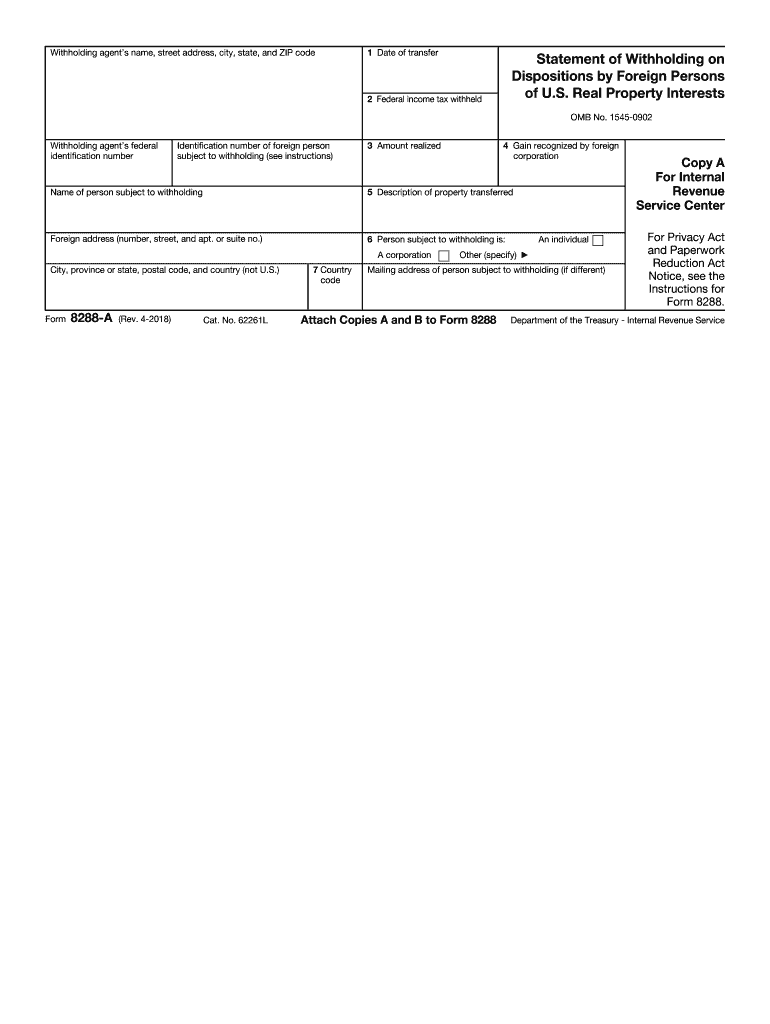

Form 8288a 2018

What is the Form 8288A

The Form 8288A, also known as the FIRPTA withholding certificate, is a crucial document used by foreign sellers of U.S. real estate. This form is part of the Foreign Investment in Real Property Tax Act (FIRPTA) regulations. It allows the Internal Revenue Service (IRS) to collect tax on gains from the sale of U.S. real property interests by foreign persons. The form provides the necessary information to determine the appropriate withholding amount, ensuring compliance with U.S. tax laws.

How to Use the Form 8288A

To effectively use the Form 8288A, the seller must complete it accurately and submit it alongside the FIRPTA withholding certificate. This process typically involves providing details such as the seller's identification, property information, and the amount realized from the sale. The completed form is then submitted to the IRS, which will review it to determine if the withholding amount is appropriate. It is essential to ensure that all information is accurate to avoid delays or penalties.

Steps to Complete the Form 8288A

Completing the Form 8288A involves several key steps:

- Gather necessary information, including the seller's details and property specifics.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form to the IRS along with the FIRPTA withholding certificate.

Following these steps carefully can help ensure compliance with IRS requirements and facilitate a smoother transaction process.

Legal Use of the Form 8288A

The Form 8288A is legally required for foreign sellers of U.S. real estate to report their transactions to the IRS. It serves as a safeguard for the government to collect taxes owed on the sale of real property. Proper use of this form is essential to avoid legal complications and ensure that all tax obligations are met. Sellers should consult with tax professionals to ensure compliance with all applicable laws and regulations.

IRS Guidelines

The IRS provides specific guidelines for the use of Form 8288A, including instructions on how to fill it out, submission deadlines, and the necessary documentation required for processing. It is important for sellers to familiarize themselves with these guidelines to avoid potential issues. The IRS updates its instructions periodically, so staying informed about any changes can help ensure compliance.

Filing Deadlines / Important Dates

Timely submission of the Form 8288A is critical. The IRS generally requires that the form be filed within twenty days of the sale of the property. Missing this deadline can result in penalties and complications in the transaction. Sellers should keep track of important dates related to their real estate transactions to ensure all forms are submitted on time.

Quick guide on how to complete form 8288 a 2018 2019

Explore the easiest method to complete and endorse your Form 8288a

Are you still spending time on preparatory formal documentation on paper instead of online? airSlate SignNow offers a superior way to complete and endorse your Form 8288a and similar forms for public services. Our advanced eSignature solution equips you with all the necessary tools to handle paperwork swiftly and in line with official standards - comprehensive PDF editing, managing, securing, signing, and sharing features are all available through an intuitive interface.

Only a few steps are required to finish filling out and signing your Form 8288a:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you need to input in your Form 8288a.

- Navigate between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the blanks with your information.

- Enhance the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Conceal sections that are no longer relevant.

- Select Sign to create a legally binding eSignature using any method of your choice.

- Add the Date alongside your signature and conclude your task with the Done button.

Store your finished Form 8288a in the Documents folder within your profile, download it, or transfer it to your preferred cloud storage. Our service also provides adaptable form sharing. There’s no need to print your forms when you need to submit them to the appropriate public office - manage it through email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it now!

Create this form in 5 minutes or less

Find and fill out the correct form 8288 a 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the form 8288 a 2018 2019

How to generate an eSignature for your Form 8288 A 2018 2019 online

How to generate an eSignature for your Form 8288 A 2018 2019 in Google Chrome

How to generate an electronic signature for putting it on the Form 8288 A 2018 2019 in Gmail

How to create an electronic signature for the Form 8288 A 2018 2019 right from your smart phone

How to generate an eSignature for the Form 8288 A 2018 2019 on iOS devices

How to create an eSignature for the Form 8288 A 2018 2019 on Android devices

People also ask

-

What is Form 8288a and why is it important?

Form 8288a is a tax form used by the IRS to report the sale or transfer of U.S. real property interests. It's crucial for foreign investors as it ensures compliance with U.S. tax laws. Using airSlate SignNow can simplify the process of signing and submitting Form 8288a, making it easier for businesses to manage their transactions.

-

How can airSlate SignNow help with completing Form 8288a?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and sign Form 8288a online. The software ensures that all necessary fields are completed accurately, reducing the chances of errors during submission. This streamlined process saves time and enhances compliance with IRS regulations.

-

Is there a cost associated with using airSlate SignNow for Form 8288a?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for users who need to manage Form 8288a efficiently. Our plans are designed to be cost-effective, providing excellent value for businesses that require reliable eSigning solutions.

-

What features does airSlate SignNow offer for handling Form 8288a?

airSlate SignNow includes features such as customizable templates, in-app signing, and cloud storage, which are particularly useful for processing Form 8288a. These features help streamline document workflows and ensure that all parties can access and sign the form quickly and securely.

-

Can I integrate airSlate SignNow with other software to manage Form 8288a?

Absolutely! airSlate SignNow offers integrations with various third-party applications, making it easy to manage Form 8288a alongside your existing tools. This interoperability enhances your workflow by allowing you to send, sign, and store documents without switching between platforms.

-

What benefits does using airSlate SignNow provide for Form 8288a submissions?

Using airSlate SignNow for Form 8288a submissions offers numerous benefits, including improved efficiency, reduced paperwork, and secure document management. The digital signature process is legally binding, ensuring that your submissions are compliant with IRS requirements and minimizing the risk of delays.

-

How secure is airSlate SignNow when handling Form 8288a?

Security is a top priority for airSlate SignNow. Our platform utilizes advanced encryption methods to protect your data while handling Form 8288a and other sensitive documents. We are committed to ensuring that your information remains confidential and secure throughout the signing process.

Get more for Form 8288a

- 8158 delta dental claim form cdr

- Cameroon embassy power of attorney form cgseries04

- Tenderfoot rank worksheet form

- Highmark member change form 34095550

- Titanium cortex screws icp form

- Amag assist reimbursement program enrollment form needymeds

- Stock transfer agreement template 787747895 form

- Stock sale and purchase agreement template form

Find out other Form 8288a

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word