Instructions for Form 1023 EZ Rev January Instructions for Form 1023 EZ, Streamlined Application for Recognition of Exemption Un 2023-2026

Understanding the Exemption Application

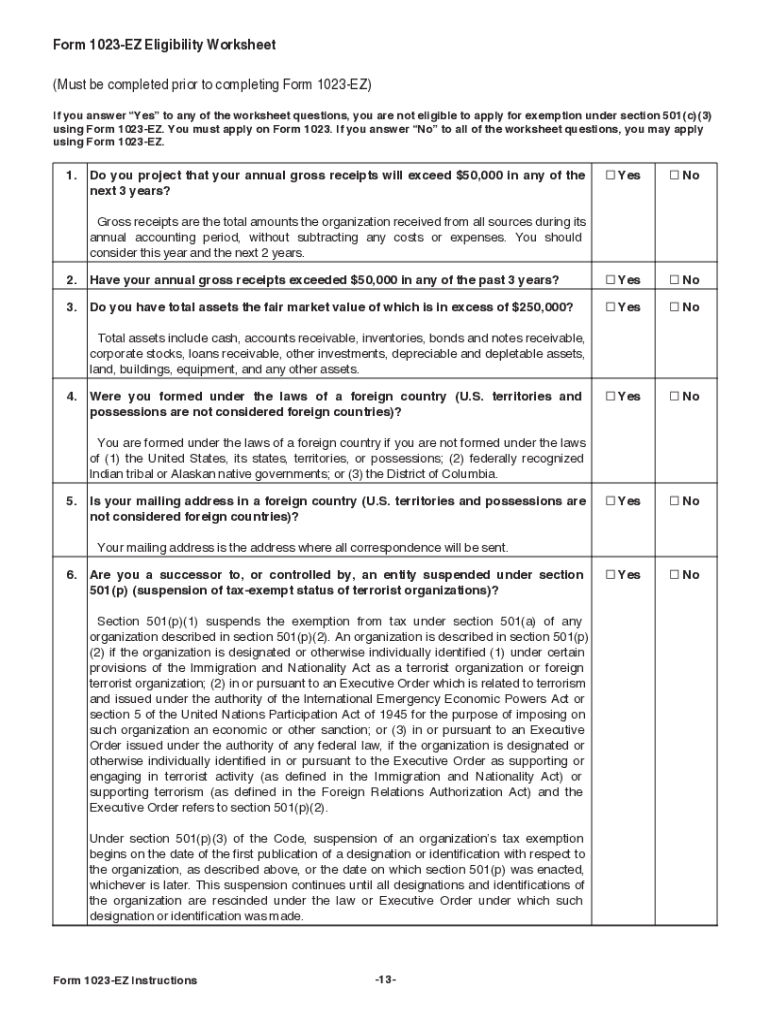

The exemption application is a streamlined process for organizations seeking recognition of tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This form simplifies the application procedure, making it more accessible for smaller nonprofits. The 2017 version includes specific guidelines and requirements that applicants must follow to ensure compliance with IRS regulations. Understanding these elements is crucial for a successful application.

Steps to Complete the Exemption Application

Completing the exemption application involves several key steps:

- Gather Required Information: Collect details about your organization, including its mission, activities, and financial data.

- Review Eligibility Criteria: Ensure that your organization meets the necessary requirements for 501(c)(3) status.

- Fill Out the Application: Carefully complete each section of the form, providing accurate and thorough information.

- Submit Supporting Documents: Include any required documentation that supports your application, such as bylaws and financial statements.

- File the Application: Submit the completed form and documents to the IRS, either online or by mail, according to the specified guidelines.

Key Elements of the Exemption Application

The exemption application includes several critical components that applicants must address:

- Organizational Structure: Describe the legal structure of your organization, including its governance and management.

- Purpose and Activities: Clearly outline the mission and the activities your organization will engage in to fulfill its purpose.

- Financial Information: Provide a detailed budget and financial projections for the next three years.

- Public Support Test: Demonstrate how your organization will receive support from the public, ensuring it meets the necessary thresholds.

Legal Use of the Exemption Application

Using the exemption application legally requires adherence to IRS guidelines. Organizations must ensure that all information provided is truthful and complete. Misrepresentation or omission of facts can lead to penalties or denial of tax-exempt status. It is advisable to consult with a legal expert in nonprofit law to navigate the complexities of the application process.

Filing Deadlines and Important Dates

Being aware of filing deadlines is essential for organizations applying for the exemption. Typically, the application should be filed within 27 months of the organization’s formation to receive retroactive tax-exempt status. Missing this window can result in a loss of benefits and require reapplication. It's important to check for any updates or changes to deadlines on the IRS website.

Application Process and Approval Time

The application process for the exemption can vary in duration, depending on the complexity of the application and the IRS's current workload. Generally, organizations can expect a processing time of three to six months. After submission, the IRS may request additional information, which can further extend the timeline. Staying organized and responsive to any inquiries can help facilitate a smoother approval process.

Quick guide on how to complete instructions for form 1023 ez rev january 2023 instructions for form 1023 ez streamlined application for recognition of

Complete Instructions For Form 1023 EZ Rev January Instructions For Form 1023 EZ, Streamlined Application For Recognition Of Exemption Un effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the accurate form and securely safeguard it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without delays. Manage Instructions For Form 1023 EZ Rev January Instructions For Form 1023 EZ, Streamlined Application For Recognition Of Exemption Un on any platform with the airSlate SignNow applications available for Android and iOS, and streamline any document-related task today.

The easiest method to edit and eSign Instructions For Form 1023 EZ Rev January Instructions For Form 1023 EZ, Streamlined Application For Recognition Of Exemption Un without exertion

- Obtain Instructions For Form 1023 EZ Rev January Instructions For Form 1023 EZ, Streamlined Application For Recognition Of Exemption Un and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Select key sections of your documents or redact sensitive details using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you wish to distribute your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Instructions For Form 1023 EZ Rev January Instructions For Form 1023 EZ, Streamlined Application For Recognition Of Exemption Un and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 1023 ez rev january 2023 instructions for form 1023 ez streamlined application for recognition of

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1023 ez rev january 2023 instructions for form 1023 ez streamlined application for recognition of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1023 2017 exemption?

The 1023 2017 exemption refers to an IRS provision that allows certain organizations to apply for tax-exempt status without the lengthy Form 1023 application. This exemption is beneficial for qualifying small nonprofits, simplifying the process.

-

How can airSlate SignNow help with the 1023 2017 exemption process?

airSlate SignNow provides a platform that allows nonprofits to easily prepare and send documents relevant to the 1023 2017 exemption. With customizable templates and eSignature capabilities, organizations can streamline their application process.

-

Are there any fees associated with using airSlate SignNow for 1023 2017 exemption documents?

While airSlate SignNow offers a cost-effective solution, pricing varies depending on the plan and features you choose. It's essential to evaluate the pricing structures to find the best fit for processing your 1023 2017 exemption documents.

-

What features does airSlate SignNow offer that can assist with the 1023 2017 exemption?

airSlate SignNow includes features such as document templates, real-time collaboration, and secure eSignatures—all of which can boost efficiency when applying for the 1023 2017 exemption. These tools make it easier for organizations to manage their paperwork.

-

Can airSlate SignNow integrate with other software for the 1023 2017 exemption?

Yes, airSlate SignNow offers several integrations with popular business tools. These integrations can enhance your workflow when preparing documents related to the 1023 2017 exemption, ensuring seamless data transfer and improved efficiency.

-

What benefits does airSlate SignNow provide for organizations seeking 1023 2017 exemption?

With airSlate SignNow, organizations benefit from a simplified document management process, reduced turnaround times, and cost savings. These advantages can signNowly help nonprofits effectively navigate the 1023 2017 exemption process.

-

How secure is the process when using airSlate SignNow for 1023 2017 exemption submissions?

Security is a priority at airSlate SignNow; their platform employs industry-leading encryption to protect sensitive information. This level of security is crucial for organizations submitting 1023 2017 exemption documents.

Get more for Instructions For Form 1023 EZ Rev January Instructions For Form 1023 EZ, Streamlined Application For Recognition Of Exemption Un

Find out other Instructions For Form 1023 EZ Rev January Instructions For Form 1023 EZ, Streamlined Application For Recognition Of Exemption Un

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe