X 0845 4204 2 0 2 1 Louisiana Department of Revenue 2022-2026

Understanding the 2020 MO 53C Form

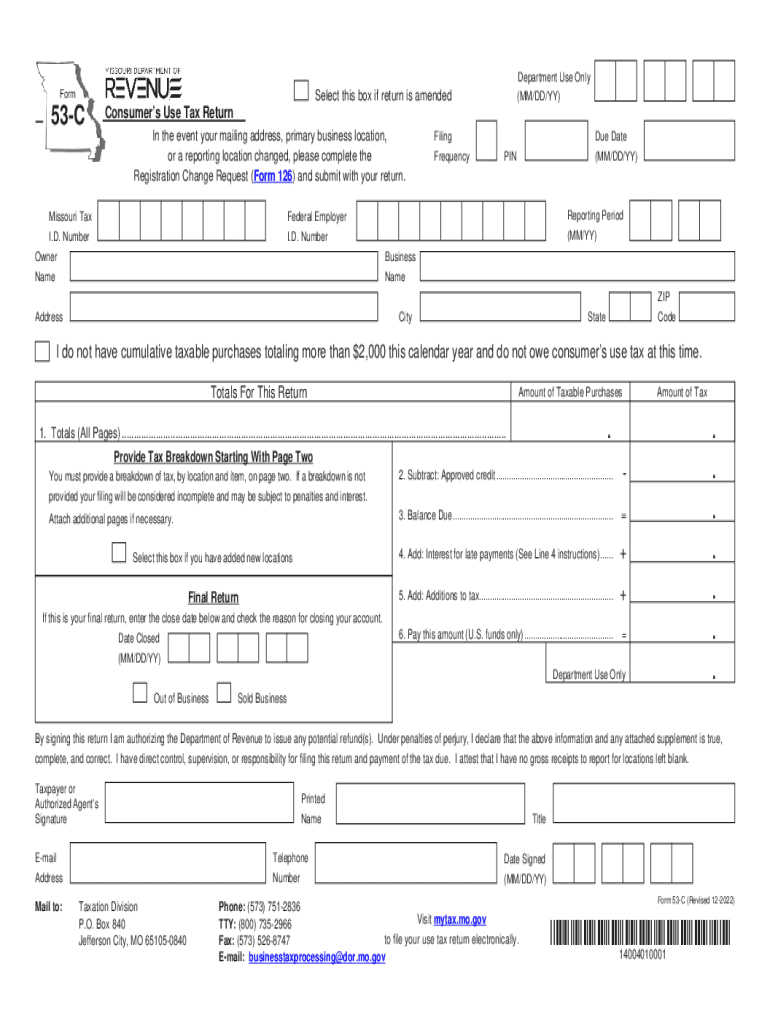

The 2020 MO 53C form, also known as the Missouri Use Tax Return, is essential for individuals and businesses that have purchased taxable goods or services from out-of-state vendors. This form allows Missouri residents to report and pay use tax on items that were not taxed at the time of purchase. It is particularly important for maintaining compliance with state tax laws, ensuring that all purchases are accounted for, and that the appropriate taxes are remitted to the Missouri Department of Revenue.

Steps to Complete the 2020 MO 53C Form

Completing the 2020 MO 53C form involves several key steps:

- Gather Information: Collect all relevant purchase receipts and documents that detail the items bought out of state.

- Calculate Use Tax: Determine the total amount of use tax owed based on the purchase price of the items.

- Fill Out the Form: Accurately complete the 2020 MO 53C form, ensuring that all required fields are filled in.

- Submit the Form: File the completed form either online or by mail, following the guidelines set forth by the Missouri Department of Revenue.

Important Filing Deadlines for the 2020 MO 53C Form

Timely submission of the 2020 MO 53C form is crucial to avoid penalties. The filing deadline typically aligns with the state income tax deadline, which is usually April 15. However, it is advisable to confirm the exact date each year, as it may vary based on state regulations or specific circumstances.

Required Documents for Filing the 2020 MO 53C Form

When preparing to file the 2020 MO 53C form, certain documents are necessary:

- Receipts for all out-of-state purchases.

- Records of any sales tax paid at the time of purchase.

- Previous tax returns that may provide context for the current year's filing.

Penalties for Non-Compliance with the 2020 MO 53C Form

Failure to file the 2020 MO 53C form or underreporting use tax can result in penalties imposed by the Missouri Department of Revenue. These penalties may include:

- Fines for late filing or payment.

- Interest on unpaid taxes.

- Potential audits for repeated non-compliance.

Digital vs. Paper Version of the 2020 MO 53C Form

The 2020 MO 53C form can be completed and submitted in both digital and paper formats. The digital version offers several advantages, including ease of use and quicker processing times. However, some individuals may prefer the traditional paper method for record-keeping purposes. Regardless of the method chosen, it is essential to ensure that the form is filled out accurately and submitted by the deadline.

Quick guide on how to complete x 0845 4204 2 0 2 1 louisiana department of revenue

Easily Prepare X 0845 4204 2 0 2 1 Louisiana Department Of Revenue on Any Device

The management of online documents has gained traction among businesses and individuals. It serves as an optimal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the right format and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage X 0845 4204 2 0 2 1 Louisiana Department Of Revenue on any device with airSlate SignNow's Android or iOS applications and simplify any document-centered workflow today.

How to Modify and eSign X 0845 4204 2 0 2 1 Louisiana Department Of Revenue Effortlessly

- Locate X 0845 4204 2 0 2 1 Louisiana Department Of Revenue and click on Get Form to initiate the process.

- Utilize the tools provided to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive data with tools specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your alterations.

- Choose your preferred method of sharing your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign X 0845 4204 2 0 2 1 Louisiana Department Of Revenue, ensuring efficient communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct x 0845 4204 2 0 2 1 louisiana department of revenue

Create this form in 5 minutes!

How to create an eSignature for the x 0845 4204 2 0 2 1 louisiana department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2020 mo 53c form used for?

The 2020 mo 53c form is primarily used for reporting income and deductions for taxpayers in Missouri. It allows individuals and businesses to accurately file their taxes, ensuring compliance with state regulations. Utilizing airSlate SignNow can simplify signing and submitting your 2020 mo 53c documents securely and efficiently.

-

How can airSlate SignNow help with filling out the 2020 mo 53c?

airSlate SignNow provides templates and tools to streamline the process of completing the 2020 mo 53c form. Our platform allows users to enter data, save progress, and easily collaborate with professionals if needed. This ensures that your tax documents are accurate and ready for submission.

-

Is there a cost associated with using airSlate SignNow for the 2020 mo 53c?

Yes, airSlate SignNow offers various pricing plans tailored to meet different needs. While there is a fee associated with using our eSigning services, they are designed to be cost-effective compared to traditional signing methods. This makes it a practical choice when handling your 2020 mo 53c forms.

-

What features does airSlate SignNow offer for managing the 2020 mo 53c?

AirSlate SignNow includes features such as electronic signatures, document storage, and real-time tracking for the 2020 mo 53c forms. Users can also create templates for repeated use, ensuring a seamless experience for similar documents. These features enhance productivity while maintaining compliance.

-

Can I integrate airSlate SignNow with other software for my 2020 mo 53c processing?

Yes, airSlate SignNow offers integrations with various applications, which can facilitate the processing of your 2020 mo 53c form. These integrations allow for seamless workflows with CRMs, document management systems, and other tools you may already use. This flexibility helps you manage your documents more efficiently.

-

What are the benefits of using airSlate SignNow for my 2020 mo 53c?

Using airSlate SignNow for your 2020 mo 53c form provides numerous benefits, including enhanced security, ease of use, and fast turnaround times. The electronic signature process eliminates the need for printing and mailing documents, saving time and resources. Additionally, this solution ensures that your forms are compliant with tax regulations.

-

How does airSlate SignNow ensure the security of the 2020 mo 53c documents?

AirSlate SignNow employs advanced encryption and security protocols to protect your 2020 mo 53c documents. This includes secure access controls and audit trails that track document changes, ensuring that your sensitive information remains confidential. Choosing our platform allows you to sign with confidence.

Get more for X 0845 4204 2 0 2 1 Louisiana Department Of Revenue

- Reiki intake form

- Sample credit report equifax pdf form

- Workers compensation waiver 100081833 form

- Fifa pre competition medical assessment form

- Complete these sixteen sentences to score your knowledge of possessive grammar form

- Merl reagle printable crossword puzzles form

- Container checklist excel 403951687 form

- Newborn baby information sheet

Find out other X 0845 4204 2 0 2 1 Louisiana Department Of Revenue

- Help Me With Integrate eSignature in Jitterbit

- Can I Integrate eSignature in Jitterbit

- How To Use eSignature in G Suite

- How To Install eSignature in Android

- Help Me With Use eSignature in G Suite

- Can I Use eSignature in G Suite

- How Can I Use eSignature in G Suite

- How To Integrate eSignature in 1Password

- How Do I Integrate eSignature in 1Password

- Help Me With Integrate eSignature in 1Password

- Can I Add eSignature in ERP

- How To Use eSignature in Oracle

- How Do I Use eSignature in Oracle

- How Can I Use eSignature in Oracle

- Can I Use eSignature in Oracle

- How Can I Add eSignature in CMS

- Can I Add eSignature in CMS

- Help Me With Add eSignature in SalesForce

- How To Add eSignature in DropBox

- How Do I Add eSignature in DropBox