Totals for This Return 2020

Understanding the Totals for This Return

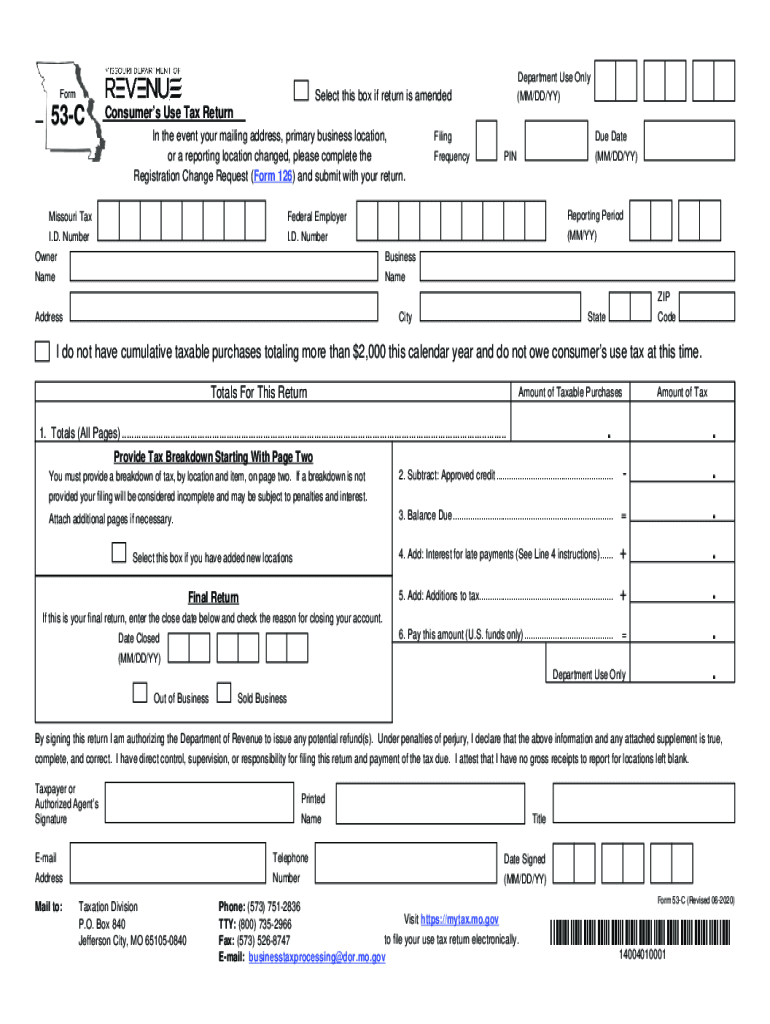

The totals for the Missouri use tax return, also known as the mo use tax form, represent the total amount of use tax owed by a taxpayer for the reporting period. This total is calculated based on purchases made during the period that are subject to use tax. It is important to accurately report these totals to ensure compliance with state tax regulations.

Steps to Complete the Totals for This Return

To complete the totals for the Missouri use tax return, follow these steps:

- Gather all receipts and records of taxable purchases made during the reporting period.

- Calculate the total amount of purchases subject to use tax.

- Apply the appropriate use tax rate to the total purchases to determine the total use tax owed.

- Enter the calculated total on the designated line of the mo use tax form.

Legal Use of the Totals for This Return

Accurate reporting of the totals for the Missouri use tax return is essential for legal compliance. The totals must reflect the actual amount of use tax owed based on purchases made. Failure to report accurately can result in penalties and interest on unpaid taxes. It is advisable to maintain thorough records to support the reported totals in case of an audit.

Filing Deadlines / Important Dates

Timely filing of the Missouri use tax return is crucial. The filing deadlines typically align with the end of the calendar year, and returns are generally due by April fifteenth of the following year. Taxpayers should be aware of any specific state announcements regarding extensions or changes to these deadlines.

Form Submission Methods

The Missouri use tax return can be submitted through various methods. Taxpayers can file online through the Missouri Department of Revenue's website, mail a completed paper form, or submit it in person at a local revenue office. Each method has its own processing times and requirements, so it is important to choose the one that best fits your needs.

Penalties for Non-Compliance

Failure to file the Missouri use tax return or to pay the correct amount of use tax can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action from the state. It is important to understand these penalties to avoid financial repercussions and ensure compliance with state tax laws.

Examples of Using the Totals for This Return

Understanding how to apply the totals for the Missouri use tax return can help clarify the process. For example, if a taxpayer made taxable purchases totaling $1,000 and the applicable use tax rate is four percent, the total use tax owed would be $40. This amount should be reported on the mo use tax form to ensure accurate tax compliance.

Quick guide on how to complete totals for this return

Easily Prepare Totals For This Return on Any Device

Digital document management has gained traction among both businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the suitable form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your files quickly and without delays. Handle Totals For This Return on any platform using the airSlate SignNow applications for Android or iOS and streamline your document-related tasks today.

The Easiest Way to Edit and Electronically Sign Totals For This Return

- Locate Totals For This Return and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides for that specific purpose.

- Generate your electronic signature using the Sign tool, which takes just moments and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you prefer to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, frustrating form searches, or errors requiring new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Totals For This Return to guarantee excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct totals for this return

Create this form in 5 minutes!

How to create an eSignature for the totals for this return

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the MO use tax form?

The MO use tax form is a document used by Missouri residents to report and pay taxes on items purchased out-of-state for use in Missouri. This form is essential for compliance with Missouri tax laws and ensures that residents fulfill their tax obligations effectively. By using the airSlate SignNow platform, you can easily eSign and submit the MO use tax form digitally.

-

How can airSlate SignNow help me with the MO use tax form?

airSlate SignNow offers a seamless way to prepare, eSign, and send your MO use tax form quickly and securely. Our platform simplifies the process, making it easy for you to manage your tax documents without the hassle of paper forms. Additionally, you can access important tax-related documents from anywhere, ensuring you never miss a deadline.

-

Is there a cost associated with using airSlate SignNow for the MO use tax form?

Yes, airSlate SignNow offers flexible pricing plans that cater to different needs and budgets. Our services for preparing and eSigning the MO use tax form are cost-effective compared to traditional paper methods. You can choose from monthly or annual subscriptions based on your expected usage.

-

Are there integrations available for airSlate SignNow that can help with the MO use tax form?

Absolutely! airSlate SignNow integrates seamlessly with various applications that facilitate the process of completing and managing the MO use tax form. These integrations enhance your workflow, allowing you to sync data and documents across platforms for a streamlined experience.

-

Can I track the status of my MO use tax form with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking features, allowing you to monitor the status of your MO use tax form after it's sent out for signatures. You will receive notifications once your document is viewed and signed, ensuring you stay updated throughout the process. This level of transparency is essential for timely tax compliance.

-

What security measures does airSlate SignNow have for the MO use tax form?

At airSlate SignNow, we prioritize the security of your documents, including the MO use tax form. Our platform uses encryption protocols and secure servers to protect your information. You can confidently eSign, store, and send your tax forms knowing that your sensitive data is safeguarded.

-

Is it easy to use airSlate SignNow for those unfamiliar with eSigning the MO use tax form?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with eSigning processes. Our platform provides intuitive navigation and helpful tutorials to guide you through completing the MO use tax form efficiently. You’ll find that preparing and submitting your tax documents has never been easier.

Get more for Totals For This Return

- Amendment to prenuptial or premarital agreement vermont form

- Financial statements only in connection with prenuptial premarital agreement vermont form

- Revocation of premarital or prenuptial agreement vermont form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children vermont form

- Petition to open an estate under foreign will vermont form

- Vermont foreign form

- Petition open estate form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497428617 form

Find out other Totals For This Return

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy