Metropolitan Commuter Transportation Mobility Tax Tax NY Gov Form

What is the Metropolitan Commuter Transportation Mobility Tax (MTA)?

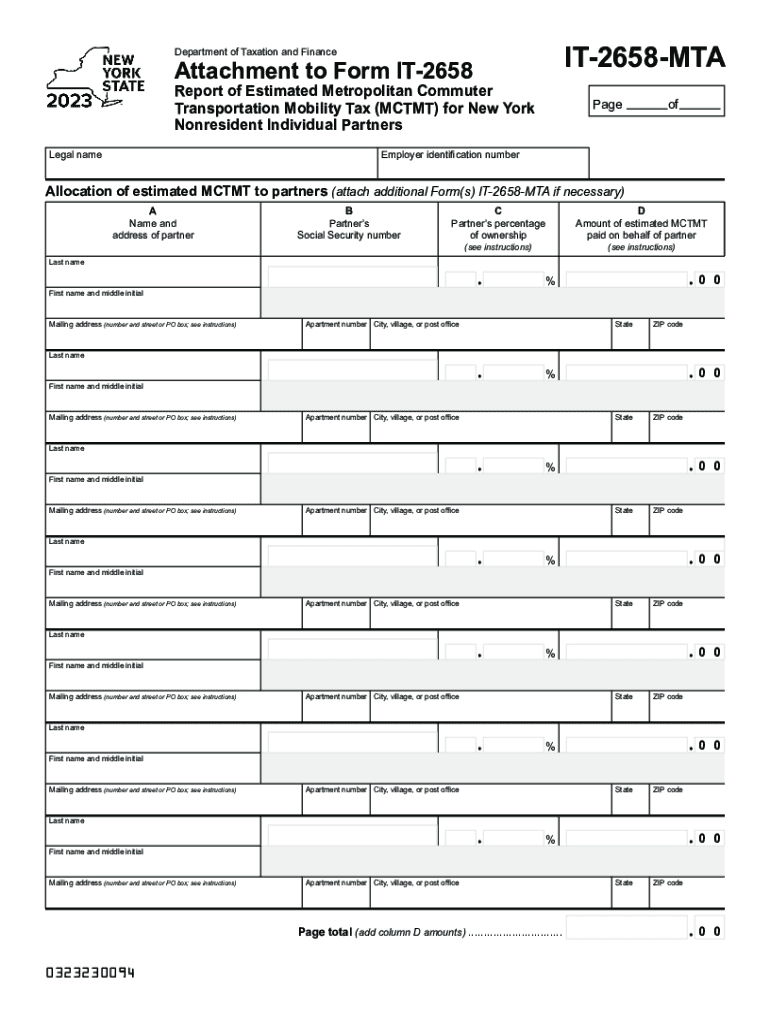

The Metropolitan Commuter Transportation Mobility Tax (MTA) is a tax imposed on employers and self-employed individuals who engage in business within the Metropolitan Commuter Transportation District (MCTD) of New York. This tax is designed to fund public transportation services in the region, ensuring that the transit system remains operational and efficient for commuters. The MTA applies to businesses with payroll expenses exceeding a specific threshold, as well as to self-employed individuals who earn above a certain income level.

How to use the Metropolitan Commuter Transportation Mobility Tax (MTA)

Utilizing the MTA tax form involves several steps to ensure compliance with state regulations. First, determine your eligibility based on your business type or self-employment status. Next, gather necessary financial documents, such as payroll records or income statements. The form requires detailed information about your business operations and payroll expenses. Once completed, the form can be submitted online, by mail, or in person, depending on your preference and the specific instructions provided by the New York State Department of Taxation and Finance.

Steps to complete the Metropolitan Commuter Transportation Mobility Tax (MTA)

Completing the MTA tax form involves a systematic approach:

- Review the eligibility criteria to confirm that you are required to file.

- Collect all necessary documentation, including payroll records and income statements.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check your calculations to avoid errors in reported payroll expenses.

- Submit the form by the designated deadline, choosing your preferred submission method.

Legal use of the Metropolitan Commuter Transportation Mobility Tax (MTA)

To ensure the legal use of the MTA tax form, it is essential to comply with all relevant federal and state regulations. This includes adhering to filing deadlines and accurately reporting income and payroll information. The MTA tax is legally binding, and failure to comply can result in penalties or legal repercussions. It is advisable to keep detailed records of all submissions and communications related to the tax for future reference and potential audits.

Required Documents for the Metropolitan Commuter Transportation Mobility Tax (MTA)

When preparing to file the MTA tax form, several documents are necessary:

- Payroll records for the reporting period, including employee wages and benefits.

- Income statements for self-employed individuals, detailing earnings during the year.

- Previous tax returns, if applicable, to provide a comprehensive financial overview.

- Any correspondence from the New York State Department of Taxation and Finance regarding your tax obligations.

Filing Deadlines for the Metropolitan Commuter Transportation Mobility Tax (MTA)

Filing deadlines for the MTA tax are critical to avoid penalties. The tax is typically filed quarterly, with specific due dates for each quarter. It is essential to stay informed about these deadlines, as they can vary year to year. Mark your calendar for the end of each quarter to ensure timely submission. Additionally, if you are filing for the first time, check for any changes in deadlines or requirements that may apply to new filers.

Quick guide on how to complete metropolitan commuter transportation mobility tax taxnygov

Effortlessly Complete Metropolitan Commuter Transportation Mobility Tax Tax NY gov on Any Device

Managing documents online has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed forms, enabling you to obtain the correct document and securely save it online. airSlate SignNow provides all the tools necessary to rapidly create, modify, and electronically sign your documents without delay. Handle Metropolitan Commuter Transportation Mobility Tax Tax NY gov on any device using the airSlate SignNow applications for Android or iOS, and simplify any document-related task today.

How to Adjust and Electronically Sign Metropolitan Commuter Transportation Mobility Tax Tax NY gov with Ease

- Locate Metropolitan Commuter Transportation Mobility Tax Tax NY gov and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using features specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose your method of sharing the form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form navigation, or errors that necessitate printing additional copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Metropolitan Commuter Transportation Mobility Tax Tax NY gov to ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the metropolitan commuter transportation mobility tax taxnygov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2658 mta in relation to airSlate SignNow?

The 2658 mta refers to the specific regulatory requirements that may impact eSignature processes. airSlate SignNow ensures compliance with the 2658 mta, making it easier for businesses to meet legal standards while sending and signing documents electronically.

-

How does airSlate SignNow pricing compare for businesses dealing with 2658 mta compliance?

airSlate SignNow offers competitive pricing plans tailored for businesses that need to comply with the 2658 mta. By providing affordable options, it allows organizations to integrate eSigning solutions without straining their budgets, all while ensuring compliance with necessary regulations.

-

What features of airSlate SignNow assist with 2658 mta compliance?

airSlate SignNow includes features such as secure eSignatures, customizable workflows, and audit trails that help businesses navigate the complexities of the 2658 mta. These features support compliance by ensuring that all eSigning actions are tracked and verifiable.

-

Can I integrate airSlate SignNow with other software to manage 2658 mta documents?

Yes, airSlate SignNow easily integrates with various software solutions, allowing businesses to effectively manage documents related to the 2658 mta. These integrations enable smoother workflows and ensure that all tools are aligned for comprehensive document management.

-

What are the benefits of using airSlate SignNow for 2658 mta related documents?

Using airSlate SignNow for documents relevant to the 2658 mta streamlines the signing process, reduces turnaround time, and enhances overall efficiency. Additionally, it helps businesses maintain compliance while freeing up resources for other operational tasks.

-

Is airSlate SignNow user-friendly for handling 2658 mta documentation?

Absolutely! airSlate SignNow is designed with user experience in mind, making it intuitive and easy to manage 2658 mta documentation. Users can effortlessly navigate the platform, ensuring that eSigning workflows are quick and straightforward.

-

What types of businesses can benefit from airSlate SignNow and the 2658 mta?

Any business that needs to handle eSignatures under the 2658 mta can benefit from airSlate SignNow. This includes industries such as finance, real estate, healthcare, and education, all of which require secure and compliant document management.

Get more for Metropolitan Commuter Transportation Mobility Tax Tax NY gov

- Mits transportation application form

- Printable thanksgiving potluck sign up sheet form

- Invitation to hunt biltong ministry of environment and tourism form

- Gateway referral form

- Ca 540 form

- Sunshine hamper order form

- Inspectormechanic application missouri state highway patrol form

- Garage sale permit application 782387582 form

Find out other Metropolitan Commuter Transportation Mobility Tax Tax NY gov

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter