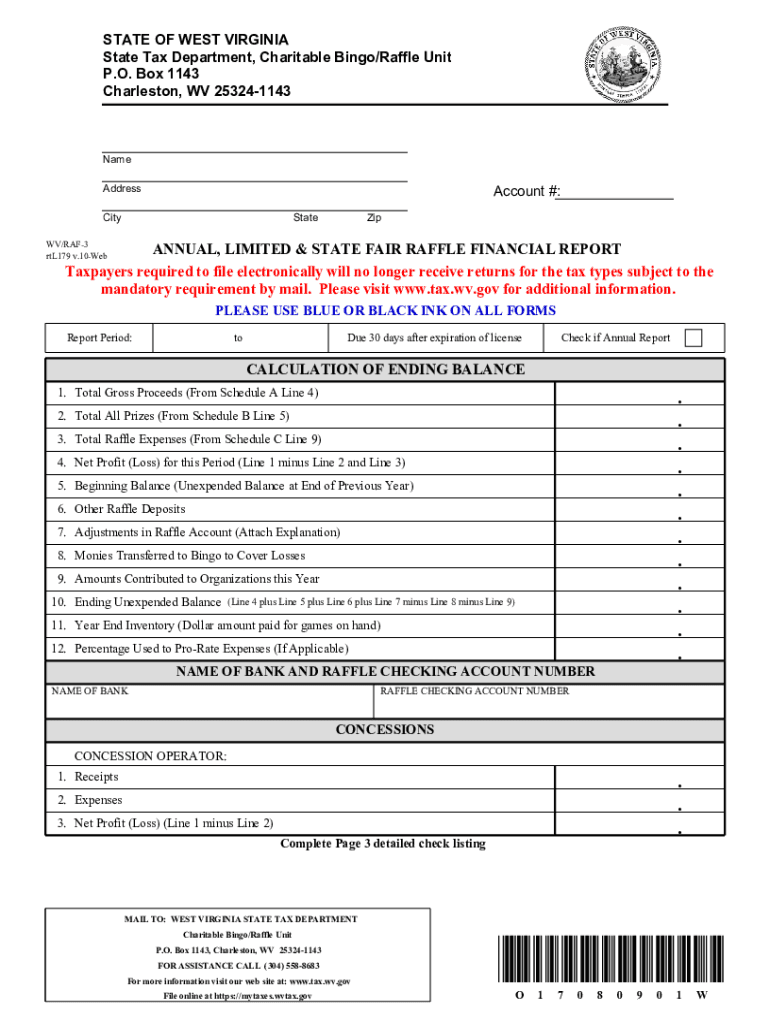

STATE of WEST VIRGINIA State Tax Department, Charitable BingoRaffle Form

What is the West Virginia State Tax Department, Charitable Bingo Raffle?

The West Virginia State Tax Department oversees the regulation of charitable gaming activities, including the limited raffle system. This system allows organizations to conduct raffles as a means of fundraising for charitable purposes. The rules and regulations governing these raffles ensure that they are conducted fairly and transparently, providing a legal framework that protects both the organizers and participants. Understanding the structure and purpose of the West Virginia limited raffle is essential for any organization looking to engage in this form of fundraising.

How to Use the West Virginia State Tax Department, Charitable Bingo Raffle

To utilize the limited raffle system in West Virginia, organizations must first apply for a license through the State Tax Department. This process involves submitting an application that details the raffle's purpose, the organization’s status, and compliance with state regulations. Once approved, organizations can begin selling tickets and promoting their raffle. It is crucial to follow all guidelines set forth by the State Tax Department to ensure the raffle's legality and success.

Steps to Complete the West Virginia State Tax Department, Charitable Bingo Raffle

Completing the limited raffle process involves several key steps:

- Determine eligibility by confirming that your organization qualifies as a charitable entity.

- Complete the application for a raffle license and submit it to the West Virginia State Tax Department.

- Once approved, plan the raffle event, including ticket pricing and prize selection.

- Conduct the raffle in compliance with state laws, ensuring transparency and fairness.

- Report the results to the State Tax Department as required, including financial details of the raffle.

Legal Use of the West Virginia State Tax Department, Charitable Bingo Raffle

Engaging in a limited raffle in West Virginia requires adherence to specific legal guidelines. Organizations must possess a valid license and must conduct the raffle in accordance with state laws. This includes ensuring that all proceeds are used for the stated charitable purpose and that all participants are informed of the raffle rules. Legal compliance not only protects the organization but also fosters trust among participants.

State-Specific Rules for the West Virginia State Tax Department, Charitable Bingo Raffle

West Virginia has established specific rules governing charitable raffles, including regulations on ticket sales, prize distribution, and reporting requirements. Organizations must familiarize themselves with these rules to avoid penalties. For instance, there may be limits on the total value of prizes and requirements for how funds are allocated. Compliance with these state-specific rules is essential for the successful operation of a limited raffle.

Eligibility Criteria for the West Virginia State Tax Department, Charitable Bingo Raffle

To qualify for conducting a limited raffle in West Virginia, organizations must meet certain eligibility criteria. These typically include being a recognized charitable organization, having a valid tax-exempt status, and demonstrating that the raffle proceeds will be used for charitable purposes. Organizations should review the specific requirements set by the West Virginia State Tax Department to ensure compliance before applying for a raffle license.

Quick guide on how to complete state of west virginia state tax department charitable bingoraffle

Prepare STATE OF WEST VIRGINIA State Tax Department, Charitable BingoRaffle effortlessly on any gadget

Digital document management has gained traction with companies and individuals alike. It offers a superb eco-friendly substitute to conventional printed and signed documents, as you can access the right form and securely keep it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly and without interruptions. Manage STATE OF WEST VIRGINIA State Tax Department, Charitable BingoRaffle on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign STATE OF WEST VIRGINIA State Tax Department, Charitable BingoRaffle with ease

- Find STATE OF WEST VIRGINIA State Tax Department, Charitable BingoRaffle and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize vital sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and eSign STATE OF WEST VIRGINIA State Tax Department, Charitable BingoRaffle and ensure exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of west virginia state tax department charitable bingoraffle

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the west virginia raf and how does it benefit businesses?

The west virginia raf refers to the unique requirements and frameworks for document handling in West Virginia. Utilizing airSlate SignNow for your west virginia raf needs allows businesses to streamline their document workflows, ensuring compliance and efficiency while reducing turnaround time.

-

How does airSlate SignNow integrate with my existing systems?

airSlate SignNow offers seamless integrations with various CRM, ERP, and cloud storage solutions. This flexibility ensures that your existing systems can efficiently work together to enhance your west virginia raf processes, improving overall productivity for your business.

-

What are the pricing options for using airSlate SignNow for west virginia raf?

airSlate SignNow offers competitive pricing plans to cater to different business sizes and needs. Specific to west virginia raf requirements, you will find a plan that best fits your budget while providing essential tools for document signing and management.

-

Is airSlate SignNow compliant with West Virginia laws for electronic signatures?

Yes, airSlate SignNow complies with all relevant laws and regulations regarding electronic signatures in West Virginia. This compliance ensures that your west virginia raf processes are legally binding, secure, and accepted across the state.

-

What key features should I consider for west virginia raf with airSlate SignNow?

Key features to consider include customizable templates, robust security measures, and user-friendly design. For your west virginia raf, these features enhance the signing process, making it easier for users to manage documents efficiently.

-

Can I access my documents on mobile devices with airSlate SignNow?

Absolutely! airSlate SignNow provides a mobile-friendly platform, allowing you to access and manage your documents on the go. This flexibility is essential for meeting the demands of your west virginia raf tasks anytime and anywhere.

-

How does airSlate SignNow improve collaboration among teams in West Virginia?

airSlate SignNow enhances collaboration by allowing multiple users to interact with documents in real-time. For west virginia raf workflows, this means teams can efficiently collaborate on proposals, agreements, and contracts without delays.

Get more for STATE OF WEST VIRGINIA State Tax Department, Charitable BingoRaffle

- Two way tables worksheet with answer key form

- Education canadian form

- Expedited reinstatement form

- Exponents worksheets grade 9 with answers pdf form

- Credit reference sheet form

- Owcp ach form

- Employeremployee agreement to select ohio as the state of form

- City of south san francisco plan check application form

Find out other STATE OF WEST VIRGINIA State Tax Department, Charitable BingoRaffle

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form