Form Schedule M Fillable Modifications to Adjusted Gross Income

What is the Form Schedule M Fillable Modifications To Adjusted Gross Income

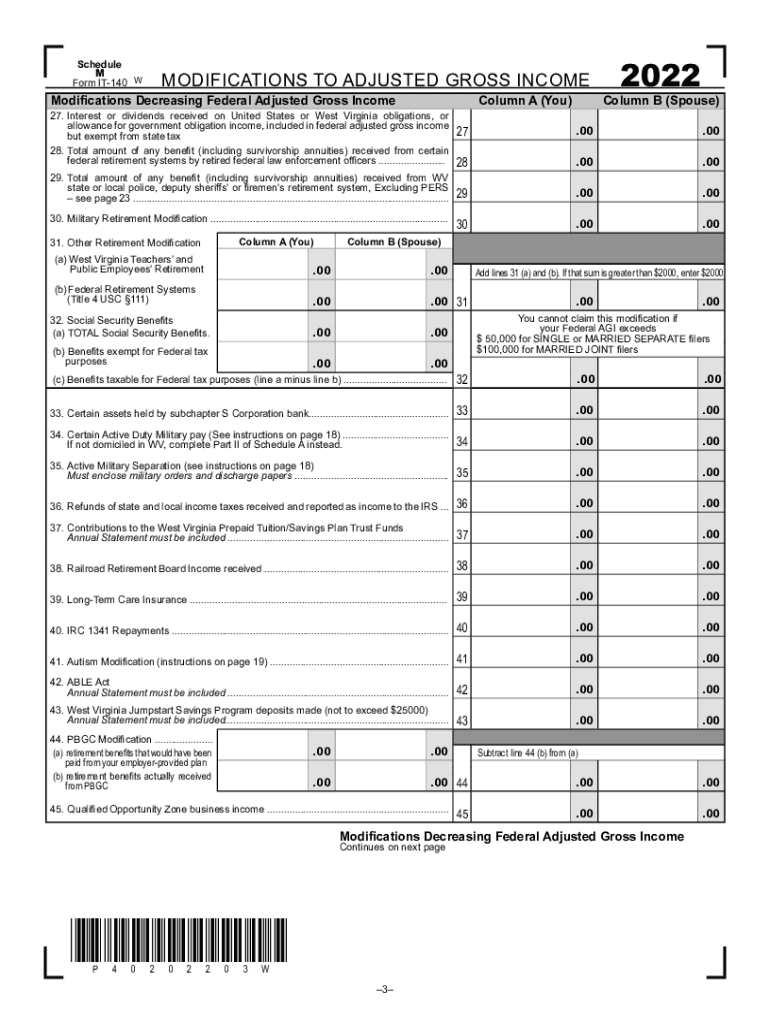

The West Virginia Schedule M is a tax form that allows individuals to report modifications to their adjusted gross income. This form is essential for taxpayers who need to make specific adjustments based on state tax laws. Modifications can include various income types, deductions, or credits that differ from federal tax calculations. Understanding the purpose of this form helps ensure accurate reporting and compliance with state tax regulations.

Steps to complete the Form Schedule M Fillable Modifications To Adjusted Gross Income

Completing the West Virginia Schedule M involves several key steps:

- Gather all necessary financial documents, including your federal tax return.

- Identify the specific modifications you need to report, such as income adjustments or deductions.

- Fill out the form accurately, ensuring that all figures are correct and correspond to your financial records.

- Review the completed form for any errors before submission.

- Submit the form along with your state tax return by the designated deadline.

Legal use of the Form Schedule M Fillable Modifications To Adjusted Gross Income

The Schedule M is legally recognized as a valid document for reporting modifications to income in West Virginia. To ensure its legal standing, it must be completed accurately and submitted in accordance with state tax laws. The form must be signed by the taxpayer, and any modifications reported should be supported by appropriate documentation. Adhering to these legal requirements helps prevent potential disputes with tax authorities.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the West Virginia Schedule M. Typically, the form must be submitted by the same deadline as your state tax return. For most taxpayers, this is usually April fifteenth of each year. However, if you are filing for an extension, be sure to check the specific dates applicable to your situation to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The West Virginia Schedule M can be submitted through various methods to accommodate different preferences:

- Online Submission: Many taxpayers opt to file electronically through approved tax software that supports state tax forms.

- Mail: You can print the completed form and send it via postal service to the appropriate state tax office.

- In-Person: Some individuals may choose to deliver their forms directly to local tax offices for immediate processing.

Key elements of the Form Schedule M Fillable Modifications To Adjusted Gross Income

The Schedule M includes several key elements that are essential for accurate completion:

- Taxpayer Information: This section requires personal details such as name, address, and Social Security number.

- Modification Details: Taxpayers must specify the types of income or deductions being reported.

- Signature Line: A signature is required to validate the form and confirm the accuracy of the information provided.

Quick guide on how to complete form schedule m fillable modifications to adjusted gross income

Effortlessly Prepare Form Schedule M Fillable Modifications To Adjusted Gross Income on Any Device

Digital document management has gained immense popularity among businesses and individuals. It offers a perfect environmentally friendly substitute to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any delays. Manage Form Schedule M Fillable Modifications To Adjusted Gross Income on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Alter and Electronically Sign Form Schedule M Fillable Modifications To Adjusted Gross Income with Ease

- Locate Form Schedule M Fillable Modifications To Adjusted Gross Income and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that reason.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and then click on the Done button to save your changes.

- Select your preferred method to deliver your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your device of choice. Modify and electronically sign Form Schedule M Fillable Modifications To Adjusted Gross Income to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form schedule m fillable modifications to adjusted gross income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is wv schedule m and how can it benefit my business?

wv schedule m is a powerful tool offered by airSlate SignNow that allows businesses to manage their document signing processes efficiently. By streamlining workflows, it enhances productivity and helps in reducing turnaround time for document approvals. Using wv schedule m, you can easily track and manage all your signing activities in one place.

-

What features does wv schedule m include?

wv schedule m includes a variety of features designed to simplify the eSigning process. These features include customizable templates, real-time tracking, in-app notifications, and integrations with popular applications, making it easier for businesses to manage their documents. Additionally, the platform supports team collaboration, allowing multiple users to work on a document simultaneously.

-

How much does wv schedule m cost?

The pricing for wv schedule m varies based on the specific needs of your business and the plan you choose. airSlate SignNow offers flexible pricing plans that cater to different business sizes and requirements. For a tailored quote based on your needs, you may want to contact our sales team directly or explore our website.

-

Is there a free trial available for wv schedule m?

Yes, airSlate SignNow offers a free trial for wv schedule m so you can experience its features before committing to a paid plan. This trial allows you to test the user-friendly interface and key functionalities, ensuring it meets your business needs. Sign up on our website to start your free trial today!

-

How does wv schedule m integrate with other applications?

wv schedule m seamlessly integrates with a variety of popular applications and software. This ensures that you can easily connect your existing tools with the airSlate SignNow platform. By leveraging these integrations, you can enhance your workflow efficiency and maintain your current processes without disruption.

-

Can I use wv schedule m on mobile devices?

Yes, wv schedule m is designed to be fully functional on mobile devices. With the mobile app, you can send and receive signed documents on the go, ensuring you have access to your important files whenever you need them. This flexibility helps maintain productivity even when you are not at your desk.

-

What security measures are in place for wv schedule m?

airSlate SignNow prioritizes the security of your documents with wv schedule m by implementing advanced security measures. This includes encryption, secure cloud storage, and compliance with various data protection regulations. You can trust that your documents are safe and secure while using our platform.

Get more for Form Schedule M Fillable Modifications To Adjusted Gross Income

Find out other Form Schedule M Fillable Modifications To Adjusted Gross Income

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online