CO DR 0104AD Form 2022

What is the CO DR 0104AD Form

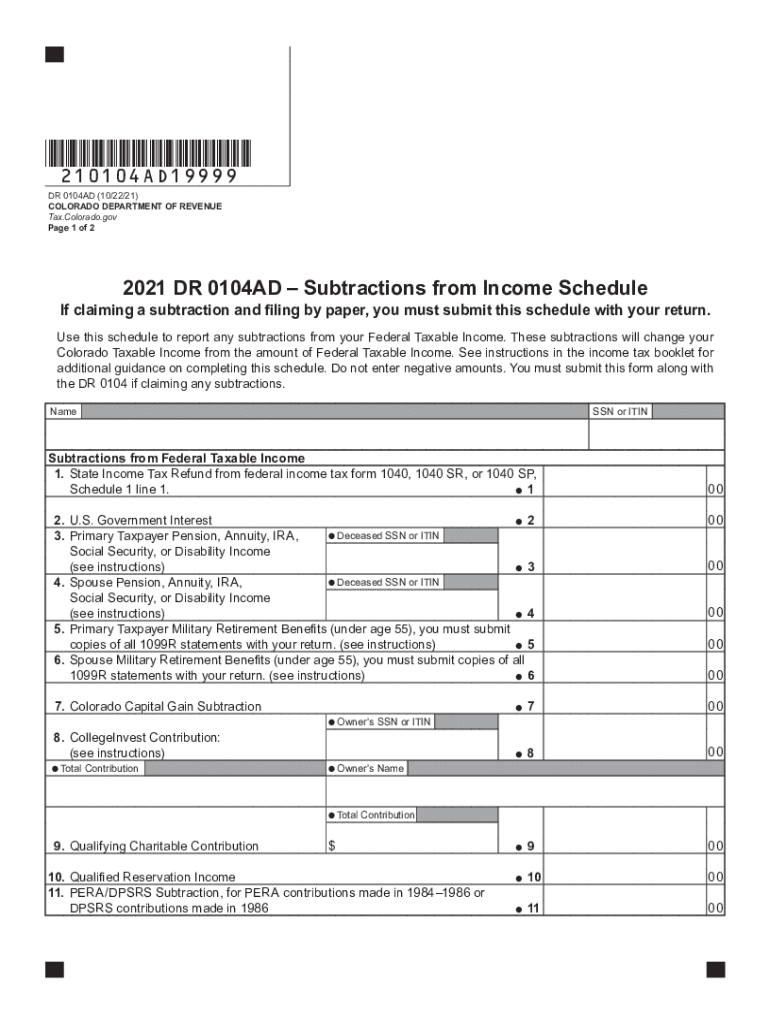

The CO DR 0104AD Form is a document used in the state of Colorado for the purpose of reporting and calculating certain tax credits and deductions. This form is typically utilized by individuals and businesses to claim specific tax benefits that can reduce their overall tax liability. It is essential for taxpayers to understand the purpose and requirements of this form to ensure accurate reporting and compliance with state tax laws.

How to use the CO DR 0104AD Form

To effectively use the CO DR 0104AD Form, taxpayers must first gather all necessary financial documents, including income statements and previous tax returns. The form requires detailed information about the taxpayer's income, deductions, and credits. Carefully follow the instructions provided on the form to complete each section accurately. Once filled out, the form can be submitted along with the Colorado income tax return.

Steps to complete the CO DR 0104AD Form

Completing the CO DR 0104AD Form involves several key steps:

- Gather all relevant financial documents, including W-2s and 1099s.

- Review the instructions provided with the form to understand each section's requirements.

- Fill in personal information, including name, address, and Social Security number.

- Report income and any applicable deductions or credits as instructed.

- Double-check all entries for accuracy before submission.

- Submit the completed form with your Colorado tax return.

Legal use of the CO DR 0104AD Form

The CO DR 0104AD Form is legally recognized as a valid document for claiming tax credits and deductions in Colorado. To ensure its legal standing, it is crucial to complete the form accurately and submit it within the designated filing periods. Compliance with state tax regulations is necessary to avoid penalties and ensure that the claimed credits are honored by the Colorado Department of Revenue.

Key elements of the CO DR 0104AD Form

Several key elements are essential to the CO DR 0104AD Form:

- Personal Information: This includes the taxpayer's name, address, and Social Security number.

- Income Reporting: Taxpayers must report all sources of income accurately.

- Deductions and Credits: The form allows for the reporting of various tax credits and deductions that can reduce tax liability.

- Signature: A signature is required to validate the form, confirming that the information provided is accurate and complete.

Form Submission Methods

The CO DR 0104AD Form can be submitted in several ways, providing flexibility for taxpayers:

- Online: Many taxpayers choose to file electronically through the Colorado Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address listed on the form.

- In-Person: Taxpayers may also submit the form in person at local tax offices.

Quick guide on how to complete co dr 0104ad form

Finalize CO DR 0104AD Form effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features needed to create, edit, and eSign your documents promptly without delays. Handle CO DR 0104AD Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest method to modify and eSign CO DR 0104AD Form seamlessly

- Obtain CO DR 0104AD Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign CO DR 0104AD Form while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct co dr 0104ad form

Create this form in 5 minutes!

How to create an eSignature for the co dr 0104ad form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CO DR 0104AD Form?

The CO DR 0104AD Form is a tax form used in Colorado for individuals who need to report their alternative minimum tax. This form is crucial for ensuring compliance with state tax regulations and can be easily completed and filed using airSlate SignNow.

-

How can airSlate SignNow help with the CO DR 0104AD Form?

airSlate SignNow provides a streamlined platform for completing and electronically signing the CO DR 0104AD Form. With user-friendly templates and features, our solution simplifies the process, ensuring that all necessary information is accurately captured and that your form is submitted efficiently.

-

Is there a cost associated with using airSlate SignNow for the CO DR 0104AD Form?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet different business needs. By choosing our service for handling the CO DR 0104AD Form, businesses can benefit from an affordable and flexible pricing structure that saves time and reduces paperwork.

-

What features does airSlate SignNow offer for the CO DR 0104AD Form?

airSlate SignNow includes features such as document templates, eSignatures, and secure cloud storage, which are particularly useful for managing the CO DR 0104AD Form. These tools enhance productivity and reduce the likelihood of errors, making tax filing simpler and quicker.

-

Are electronic signatures on the CO DR 0104AD Form legally valid?

Yes, electronic signatures on the CO DR 0104AD Form are legally valid and recognized by the state of Colorado. Using airSlate SignNow ensures that your eSignature meets all compliance requirements, letting you sign your form confidently and securely.

-

Can I integrate airSlate SignNow with other software for the CO DR 0104AD Form?

Absolutely! airSlate SignNow offers integrations with various productivity and document management tools. This compatibility allows for seamless data transfer and enhanced workflow management when completing the CO DR 0104AD Form.

-

How does airSlate SignNow improve efficiency for handling the CO DR 0104AD Form?

airSlate SignNow optimizes the process of handling the CO DR 0104AD Form by allowing users to complete, sign, and send documents digitally. This eliminates the need for printing and mailing, thereby signNowly speeding up processing times and enhancing overall efficiency.

Get more for CO DR 0104AD Form

- Two way tables worksheet with answer key form

- Education canadian form

- Expedited reinstatement form

- Exponents worksheets grade 9 with answers pdf form

- Credit reference sheet form

- Owcp ach form

- Employeremployee agreement to select ohio as the state of form

- City of south san francisco plan check application form

Find out other CO DR 0104AD Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document