RI Form RI 2210 2022

What is the RI Form RI 2210

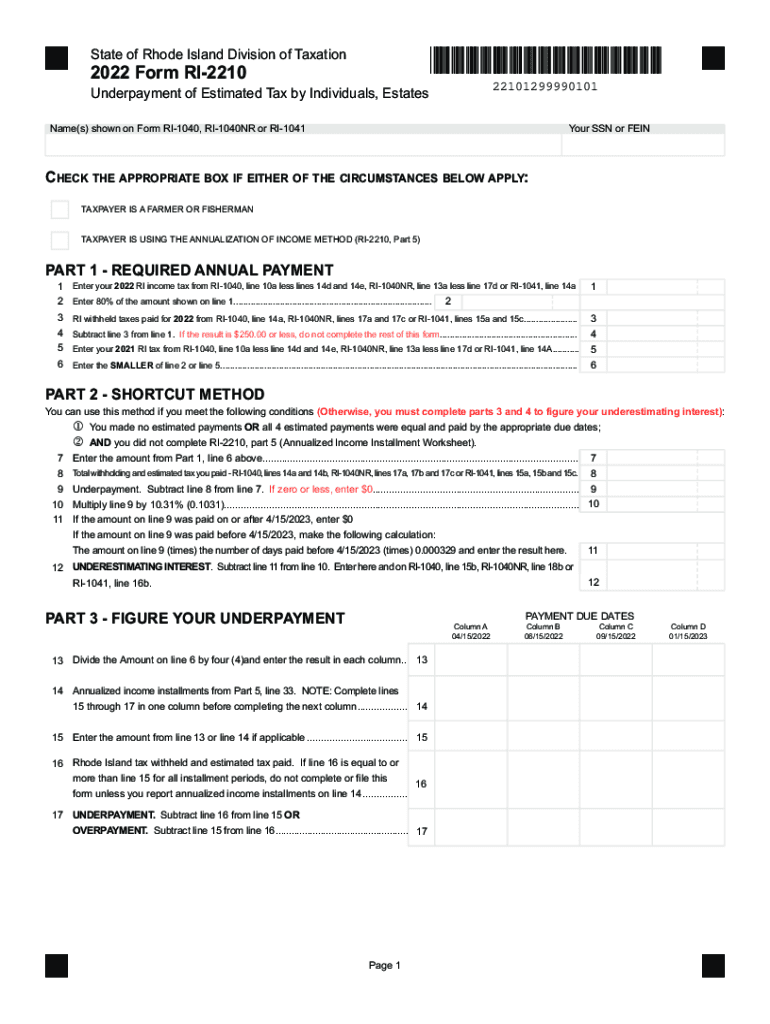

The RI Form RI 2210 is a tax form used by individuals and businesses in Rhode Island to report underpayment of estimated tax. This form is essential for taxpayers who did not pay enough tax throughout the year, either through withholding or estimated payments. The RI 2210 helps calculate any penalties that may apply due to underpayment, ensuring compliance with state tax regulations. Understanding this form is crucial for avoiding unnecessary penalties and maintaining good standing with the Rhode Island Division of Taxation.

How to use the RI Form RI 2210

Using the RI Form RI 2210 involves several steps. First, you need to determine if you owe any underpayment penalties. This can be assessed by comparing your total tax liability to the amount you have paid throughout the year. If you find that you have underpaid, you will need to fill out the form accurately, providing details of your income and tax payments. The form includes sections for calculating the underpayment amount and any applicable penalties. After completing the form, it should be submitted according to the filing guidelines provided by the Rhode Island Division of Taxation.

Steps to complete the RI Form RI 2210

Completing the RI Form RI 2210 requires careful attention to detail. Here are the steps to follow:

- Gather your financial documents, including income statements and records of tax payments made during the year.

- Calculate your total tax liability for the year based on your income.

- Determine the total amount of tax you have paid through withholding and estimated payments.

- Complete the relevant sections of the form, inputting your income and tax payment information.

- Calculate any penalties for underpayment as outlined in the form instructions.

- Review the completed form for accuracy before submission.

Legal use of the RI Form RI 2210

The RI Form RI 2210 is legally binding when completed correctly and submitted on time. To ensure its legal standing, it must comply with the regulations set forth by the Rhode Island Division of Taxation. This includes providing accurate and truthful information regarding your tax situation. Failure to comply with these legal requirements can result in penalties or further legal action. Therefore, it is essential to understand the legal implications of the form and ensure all information is complete and accurate.

Filing Deadlines / Important Dates

Filing deadlines for the RI Form RI 2210 are crucial for avoiding penalties. Typically, the form must be filed by the same deadline as your Rhode Island personal income tax return. For most taxpayers, this is April 15 of each year. However, if you are unable to meet this deadline, it is important to check for any extensions or changes in deadlines that may apply. Keeping track of these dates ensures that you remain compliant and avoid unnecessary penalties for late submission.

Penalties for Non-Compliance

Non-compliance with the requirements of the RI Form RI 2210 can lead to significant penalties. If you fail to file the form or underreport your tax liability, you may incur penalties based on the amount of underpayment. These penalties can accumulate over time, increasing the total amount owed to the state. Understanding the potential consequences of non-compliance is essential for all taxpayers, as it emphasizes the importance of accurate reporting and timely submission of the form.

Quick guide on how to complete ri form ri 2210

Effortlessly Prepare RI Form RI 2210 on Any Device

Managing documents online has gained traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your paperwork without any holdups. Handle RI Form RI 2210 on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related procedure today.

How to Edit and eSign RI Form RI 2210 with Ease

- Find RI Form RI 2210 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require new document prints. airSlate SignNow fulfills your document management needs in just a few clicks on your chosen device. Edit and eSign RI Form RI 2210 to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ri form ri 2210

Create this form in 5 minutes!

How to create an eSignature for the ri form ri 2210

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's solution for managing 2022 ri tax documents?

airSlate SignNow provides an efficient platform for managing and electronically signing all your 2022 ri tax documents. With easy-to-use features, businesses can ensure compliance while simplifying the document management process.

-

How does airSlate SignNow help with filing 2022 ri tax forms?

With airSlate SignNow, you can easily prepare and eSign your 2022 ri tax forms online. The platform ensures that your documents are securely handled and saves you time through its seamless electronic signing process.

-

What are the costs associated with using airSlate SignNow for 2022 ri tax documents?

airSlate SignNow offers cost-effective pricing plans tailored to the needs of businesses handling 2022 ri tax documents. Depending on the selected plan, users benefit from features like unlimited eSigning and document templates at a competitive price.

-

Can airSlate SignNow integrate with other software for 2022 ri tax management?

Yes, airSlate SignNow integrates seamlessly with various applications to streamline the management of your 2022 ri tax documents. This allows you to connect with accounting software and enhance your workflow efficiency.

-

What are the security features of airSlate SignNow for handling sensitive 2022 ri tax information?

airSlate SignNow prioritizes security with advanced encryption and authentication measures when handling your 2022 ri tax documents. This ensures that your sensitive information remains protected throughout the signing process.

-

Is it easy to use airSlate SignNow for those unfamiliar with electronic signatures for 2022 ri tax?

Absolutely! airSlate SignNow is designed to be user-friendly, making it simple for anyone, even those unfamiliar with electronic signatures, to manage their 2022 ri tax documents effortlessly. Our intuitive interface guides users through each step of the process.

-

What are the benefits of using airSlate SignNow for 2022 ri tax processing?

Using airSlate SignNow for your 2022 ri tax processing brings numerous benefits, including reduced turnaround time and improved accuracy. The electronic signing features help eliminate the hassle of paperwork while ensuring that all documents are legally compliant.

Get more for RI Form RI 2210

- Nj 2440 statement in support of exclusion for amounts received under accident and health insurance plan nj 2440 statement in form

- 2022 form 990 t exempt organization business income tax return and proxy tax under section 6033e

- About form 8863 education credits american

- Limited liability company registration limited liability company registration form

- Building the digital revenue agency of the future deloitte form

- Sample copy only bergen county clerk form

- Form 1040 es pr federales estimadas del trabajo por

- Forms fees and information packages

Find out other RI Form RI 2210

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy

- Sign Illinois Deposit Receipt Template Myself

- Sign Illinois Deposit Receipt Template Free

- Sign Missouri Joint Venture Agreement Template Free

- Sign Tennessee Joint Venture Agreement Template Free