RI 2210A RI Underpayment of Estimated Tax by Individuals 2024-2026

Understanding the RI 2210A Underpayment of Estimated Tax

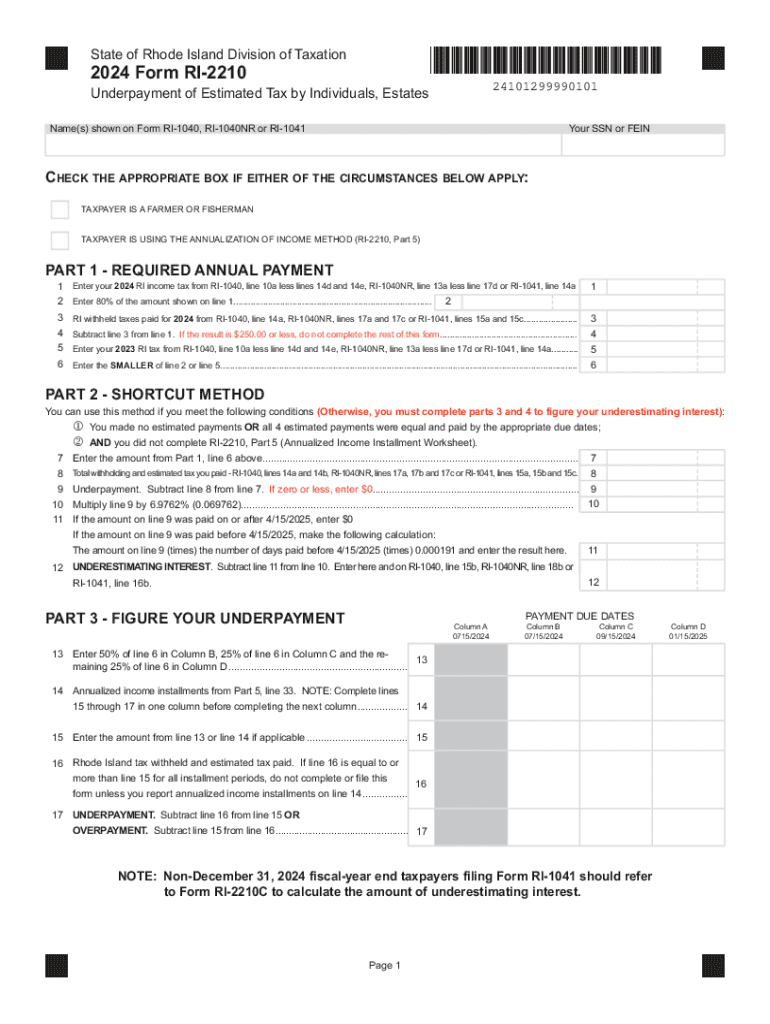

The RI 2210A form is designed for individuals in Rhode Island who may have underpaid their estimated state income tax. This form helps taxpayers calculate any penalties for underpayment and determine the amount owed. Understanding this form is crucial for compliance with state tax laws and to avoid unnecessary penalties.

Steps to Complete the RI 2210A Form

Filling out the RI 2210A involves several key steps:

- Gather Financial Information: Collect your income details, including wages, self-employment earnings, and any other taxable income.

- Calculate Estimated Tax Payments: Review your estimated tax payments made throughout the year and compare them to your total tax liability.

- Determine Underpayment: Use the form's instructions to calculate if you have underpaid your estimated taxes based on your income.

- Complete the Form: Fill out the required sections of the RI 2210A, ensuring all calculations are accurate.

- Review and Submit: Double-check your form for errors before submitting it to the Rhode Island Division of Taxation.

Legal Use of the RI 2210A Form

The RI 2210A form is legally mandated for individuals who do not meet the safe harbor provisions for estimated tax payments. This form allows taxpayers to report underpayment and calculate any penalties that may apply. It is essential to file this form accurately to comply with Rhode Island tax regulations and avoid potential legal issues.

Filing Deadlines and Important Dates

Timely filing of the RI 2210A is crucial. The form is generally due on the same date as your Rhode Island personal income tax return. For most taxpayers, this is April fifteenth. If you miss this deadline, you may incur additional penalties. Always check for any updates or changes to filing dates each tax year.

Examples of Using the RI 2210A Form

Consider a scenario where a self-employed individual underestimates their tax liability and makes insufficient estimated payments throughout the year. By using the RI 2210A form, they can calculate the penalty for underpayment and report it accurately. Another example includes a taxpayer who receives unexpected income, leading to a higher tax obligation than anticipated. The RI 2210A helps them address the shortfall appropriately.

Who Issues the RI 2210A Form

The RI 2210A form is issued by the Rhode Island Division of Taxation. This state agency is responsible for the administration of tax laws and ensures compliance among taxpayers. For any questions regarding the form or its requirements, individuals can contact the Division directly for assistance.

Create this form in 5 minutes or less

Find and fill out the correct ri 2210a ri underpayment of estimated tax by individuals

Create this form in 5 minutes!

How to create an eSignature for the ri 2210a ri underpayment of estimated tax by individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ri ri2210 form and why is it important?

The ri ri2210 form is a crucial document for taxpayers in certain states, used to report underpayment of estimated tax. Understanding this form is essential for ensuring compliance with tax regulations and avoiding penalties. By using airSlate SignNow, you can easily eSign and manage your ri ri2210 form efficiently.

-

How can airSlate SignNow help with the ri ri2210 form?

airSlate SignNow simplifies the process of completing and signing the ri ri2210 form. Our platform allows you to fill out the form digitally, ensuring accuracy and saving time. With our user-friendly interface, you can quickly send and eSign the ri ri2210 form from anywhere.

-

Is there a cost associated with using airSlate SignNow for the ri ri2210 form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage documents like the ri ri2210 form without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the ri ri2210 form?

airSlate SignNow provides a range of features for managing the ri ri2210 form, including customizable templates, secure eSigning, and document tracking. These features enhance your workflow and ensure that your documents are handled efficiently. You can also integrate with other tools to streamline your processes.

-

Can I integrate airSlate SignNow with other software for the ri ri2210 form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, making it easy to manage the ri ri2210 form alongside your existing tools. This integration capability enhances productivity and ensures that your document management processes are cohesive.

-

What are the benefits of using airSlate SignNow for the ri ri2210 form?

Using airSlate SignNow for the ri ri2210 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to eSign documents quickly and securely, ensuring that your tax filings are completed on time. Additionally, you can access your documents from any device.

-

How secure is airSlate SignNow when handling the ri ri2210 form?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your data when handling the ri ri2210 form. You can trust that your sensitive information is safe and secure while using our platform.

Get more for RI 2210A RI Underpayment Of Estimated Tax By Individuals

- General agency agreement fedex form

- Salestaxexemptionsdormogov form

- Broodmare lease agreement form

- Medications list form

- Medical laboratory scientist work experience documentation ascp form

- Gender affirming surgery letter template form

- Food stamp authorized representative form 100299540

- Asbestos removal control plan ar2 form

Find out other RI 2210A RI Underpayment Of Estimated Tax By Individuals

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter