Www Templateroller Comtemplate2134039Form RI 2210 "Underpayment of Estimated Tax by Individuals 2021

Understanding the 2021 RI 2210 Form

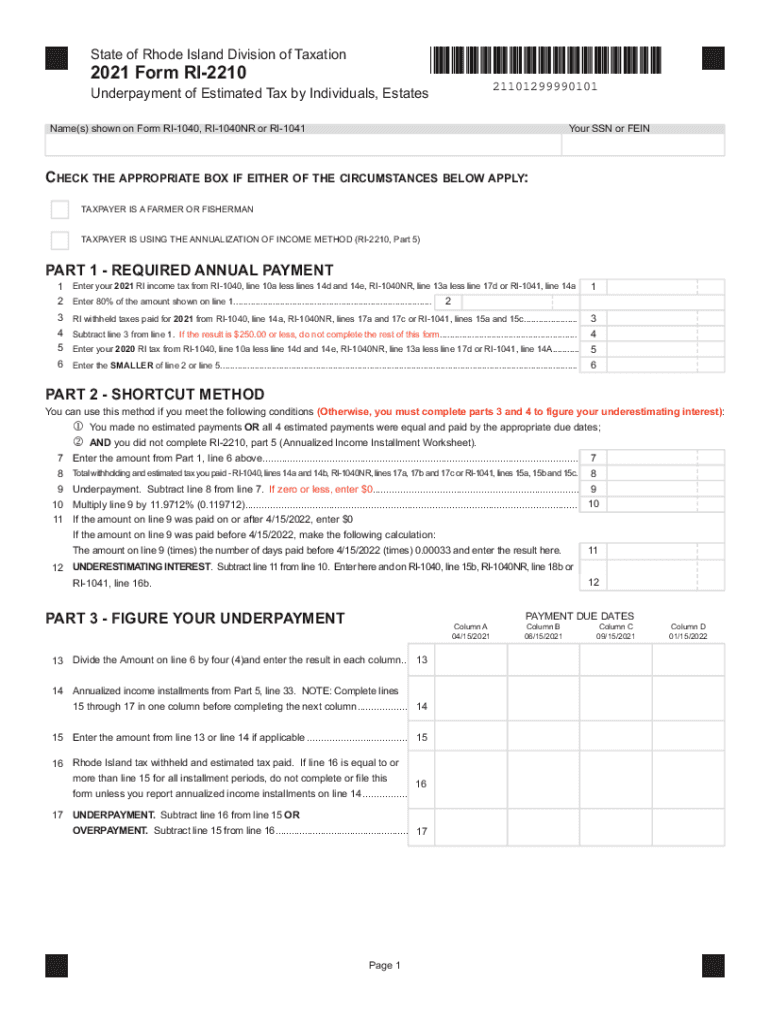

The 2021 RI 2210 form, officially known as the Rhode Island Underpayment of Estimated Tax by Individuals, is used by residents of Rhode Island to determine if they owe a penalty for underpaying their estimated tax. This form is essential for individuals who may not have withheld enough tax from their income throughout the year. It helps taxpayers calculate their estimated tax payments and assess any potential penalties based on their income levels and tax obligations.

Steps to Complete the 2021 RI 2210 Form

Completing the 2021 RI 2210 form involves several key steps:

- Gather all necessary financial documents, including income statements and prior tax returns.

- Calculate your total income for the year, including wages, interest, and dividends.

- Determine the amount of tax you have already paid through withholding or estimated payments.

- Use the form to calculate your required estimated tax payments and compare them to what you have already paid.

- If you find that you owe additional tax, complete the form to determine the penalty for underpayment.

Filing Deadlines for the 2021 RI 2210 Form

It is crucial to be aware of the filing deadlines associated with the 2021 RI 2210 form. Generally, the form must be filed by the same deadline as your Rhode Island personal income tax return. For the 2021 tax year, this typically falls on April fifteenth. If you need additional time, consider filing for an extension, but ensure that any estimated tax payments are made by the original deadline to avoid penalties.

Legal Use of the 2021 RI 2210 Form

The 2021 RI 2210 form is legally recognized as a valid document for reporting and calculating underpayment penalties. When filled out correctly, it serves as an official record of your tax obligations and payments. It is important to ensure that all information is accurate to avoid any legal issues or penalties from the state of Rhode Island.

Key Elements of the 2021 RI 2210 Form

Several key elements are included in the 2021 RI 2210 form:

- Taxpayer Information: Name, address, and Social Security number.

- Income Details: Total income and sources of income.

- Tax Payments: Amount of tax already paid through withholding or estimated payments.

- Penalty Calculation: Detailed calculations of any penalties due to underpayment.

Obtaining the 2021 RI 2210 Form

The 2021 RI 2210 form can be obtained through the Rhode Island Division of Taxation's website or by visiting local tax offices. It is available in a printable format, allowing taxpayers to complete it by hand or electronically. Ensure that you are using the correct version of the form for the 2021 tax year to avoid any discrepancies in your filing.

Quick guide on how to complete wwwtemplaterollercomtemplate2134039form ri 2210 ampquotunderpayment of estimated tax by individuals

Effortlessly complete Www templateroller comtemplate2134039Form RI 2210 "Underpayment Of Estimated Tax By Individuals on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent eco-friendly option compared to traditional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides all the tools needed to create, edit, and eSign your documents swiftly without any holdups. Handle Www templateroller comtemplate2134039Form RI 2210 "Underpayment Of Estimated Tax By Individuals on any device using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The easiest method to edit and eSign Www templateroller comtemplate2134039Form RI 2210 "Underpayment Of Estimated Tax By Individuals with minimal effort

- Obtain Www templateroller comtemplate2134039Form RI 2210 "Underpayment Of Estimated Tax By Individuals and click on Get Form to begin.

- Use the tools available to fill out your document.

- Highlight important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and has the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Www templateroller comtemplate2134039Form RI 2210 "Underpayment Of Estimated Tax By Individuals and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwtemplaterollercomtemplate2134039form ri 2210 ampquotunderpayment of estimated tax by individuals

Create this form in 5 minutes!

How to create an eSignature for the wwwtemplaterollercomtemplate2134039form ri 2210 ampquotunderpayment of estimated tax by individuals

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to create an e-signature straight from your mobile device

The best way to make an e-signature for a PDF file on iOS

The way to create an e-signature for a PDF document on Android devices

People also ask

-

What is the 2021 RI tax form and why is it important?

The 2021 RI tax form is the official document required for filing income taxes in Rhode Island for the year 2021. It is important because it ensures compliance with state tax laws and helps taxpayers accurately report their income and claim deductions. Completing this form can be streamlined using eSignature solutions from airSlate SignNow.

-

How can airSlate SignNow help me complete the 2021 RI tax form?

airSlate SignNow provides an intuitive platform that allows users to complete, sign, and send the 2021 RI tax form digitally. This reduces paperwork and speeds up the filing process. The software's user-friendly design makes it easy for anyone to manage their tax documents efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that are cost-effective for individuals and businesses alike. With various tiers to choose from, users can select a plan that fits their needs for managing documents, including the 2021 RI tax form. You can explore a free trial to better understand the features available.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow easily integrates with several popular software applications used for tax preparation. This allows users to import and export the 2021 RI tax form seamlessly, enhancing productivity and ensuring that all documents are organized in one place. Check out our integration options to find the best fit for your tax workflow.

-

Is it secure to use airSlate SignNow for the 2021 RI tax form?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive information, including the 2021 RI tax form. Our platform includes features such as encryption, secure storage, and user authentication to ensure your data remains safe during the signing process.

-

Can I access my 2021 RI tax form from any device?

Yes, airSlate SignNow is designed to be accessible from any device with internet connectivity. Whether you are using a smartphone, tablet, or computer, you can easily complete and manage your 2021 RI tax form wherever you are. This flexibility makes tax filing more convenient for everyone.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow includes features such as document templates, team collaboration, and customizable workflows specifically for managing tax forms, including the 2021 RI tax form. These tools help streamline the preparation process, making it easier to stay organized and meet filing deadlines.

Get more for Www templateroller comtemplate2134039Form RI 2210 "Underpayment Of Estimated Tax By Individuals

Find out other Www templateroller comtemplate2134039Form RI 2210 "Underpayment Of Estimated Tax By Individuals

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors