Schedule B Form 941 Rev March 2024-2026

What is the Schedule B Form 941 Rev March

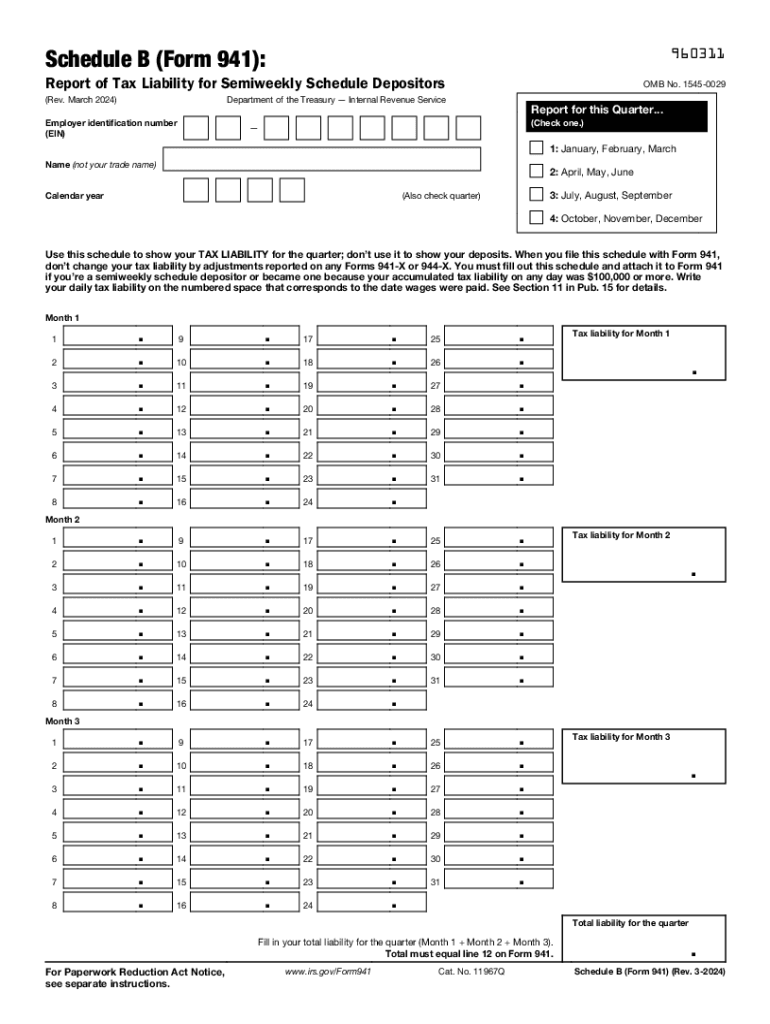

The Schedule B Form 941, revised in March 2025, is a crucial document used by employers in the United States to report their tax liabilities related to federal income tax withholding and Social Security and Medicare taxes. This form is specifically designed for employers who are required to report their tax deposits and reconcile them with the amounts reported on their Form 941. It provides the IRS with detailed information about the employer's tax deposits for the quarter, ensuring compliance with federal tax laws.

How to use the Schedule B Form 941 Rev March

To effectively use the Schedule B Form 941, employers should first ensure they have the correct version of the form for the 2025 tax year. The form must be completed accurately, reflecting the total tax liability for the quarter. Employers should fill out the form by entering the total tax liability for each month and the corresponding tax deposits made. This information helps the IRS verify that the employer has met their tax obligations. Once completed, the form should be submitted along with the quarterly Form 941.

Steps to complete the Schedule B Form 941 Rev March

Completing the Schedule B Form 941 involves several key steps:

- Gather all necessary financial records, including payroll information and tax deposit receipts.

- Fill in the employer's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report the total tax liability for each month in the quarter, ensuring accuracy in calculations.

- List the total deposits made for each month, including any adjustments for prior periods.

- Review the form for any errors or omissions before submission.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Schedule B Form 941. The form is typically due on the last day of the month following the end of the quarter. For example, for the first quarter ending March 31, the form must be filed by April 30. It is essential to keep track of these deadlines to avoid penalties for late submission.

Penalties for Non-Compliance

Failure to file the Schedule B Form 941 on time or inaccuracies in the form can result in penalties imposed by the IRS. These penalties may include fines based on the amount of tax owed and the length of time the form is late. Employers should ensure compliance with all filing requirements to avoid these financial repercussions.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Schedule B Form 941. Employers should refer to the IRS instructions accompanying the form for detailed information on how to report tax liabilities accurately. These guidelines also outline the necessary documentation required to support the information reported on the form, ensuring that employers remain compliant with federal tax regulations.

Quick guide on how to complete schedule b form 941 rev march

Finalize Schedule B Form 941 Rev March seamlessly on any device

Digital document management has gained traction with businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without hold-ups. Handle Schedule B Form 941 Rev March on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to adjust and eSign Schedule B Form 941 Rev March effortlessly

- Locate Schedule B Form 941 Rev March and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, by email, SMS, or invite link, or download it to your computer.

Put aside worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from a device of your choice. Adjust and eSign Schedule B Form 941 Rev March and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule b form 941 rev march

Create this form in 5 minutes!

How to create an eSignature for the schedule b form 941 rev march

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 941 schedule b 2025?

The form 941 schedule b 2025 is a supplemental form used by employers to report their tax liabilities for federal income tax withholding and social security and Medicare taxes. It is essential for accurately calculating and reporting payroll taxes. Understanding this form is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with the form 941 schedule b 2025?

airSlate SignNow provides an efficient platform for electronically signing and sending the form 941 schedule b 2025. Our solution simplifies the process, ensuring that your documents are securely signed and stored. This helps streamline your payroll tax reporting and compliance efforts.

-

What features does airSlate SignNow offer for managing the form 941 schedule b 2025?

With airSlate SignNow, you can easily create, edit, and send the form 941 schedule b 2025. Our platform includes features like templates, automated reminders, and secure storage, making it easier to manage your tax documents. These features enhance efficiency and reduce the risk of errors.

-

Is airSlate SignNow cost-effective for handling the form 941 schedule b 2025?

Yes, airSlate SignNow is a cost-effective solution for managing the form 941 schedule b 2025. Our pricing plans are designed to fit various business sizes and needs, ensuring you get the best value for your investment. By reducing paperwork and streamlining processes, you can save both time and money.

-

Can I integrate airSlate SignNow with other software for the form 941 schedule b 2025?

Absolutely! airSlate SignNow offers integrations with various accounting and payroll software, making it easy to manage the form 941 schedule b 2025 alongside your existing tools. This seamless integration helps ensure that your data is consistent and up-to-date across all platforms.

-

What are the benefits of using airSlate SignNow for the form 941 schedule b 2025?

Using airSlate SignNow for the form 941 schedule b 2025 provides numerous benefits, including enhanced security, faster processing times, and improved compliance. Our platform allows for easy tracking of document status, ensuring you never miss a deadline. This leads to a more organized and efficient workflow.

-

How secure is airSlate SignNow when handling the form 941 schedule b 2025?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect your sensitive information, including the form 941 schedule b 2025. Our compliance with industry standards ensures that your documents are safe from unauthorized access.

Get more for Schedule B Form 941 Rev March

Find out other Schedule B Form 941 Rev March

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter