State of New Mexico Taxation & Revenue Department 2016-2026

What is the State Of New Mexico Taxation & Revenue Department

The State Of New Mexico Taxation & Revenue Department is the governmental body responsible for managing tax collection and revenue generation within the state. This department oversees various tax types, including income, sales, and property taxes, ensuring compliance with state laws. It also plays a crucial role in the administration of tax credits and incentives designed to support economic growth and development in New Mexico.

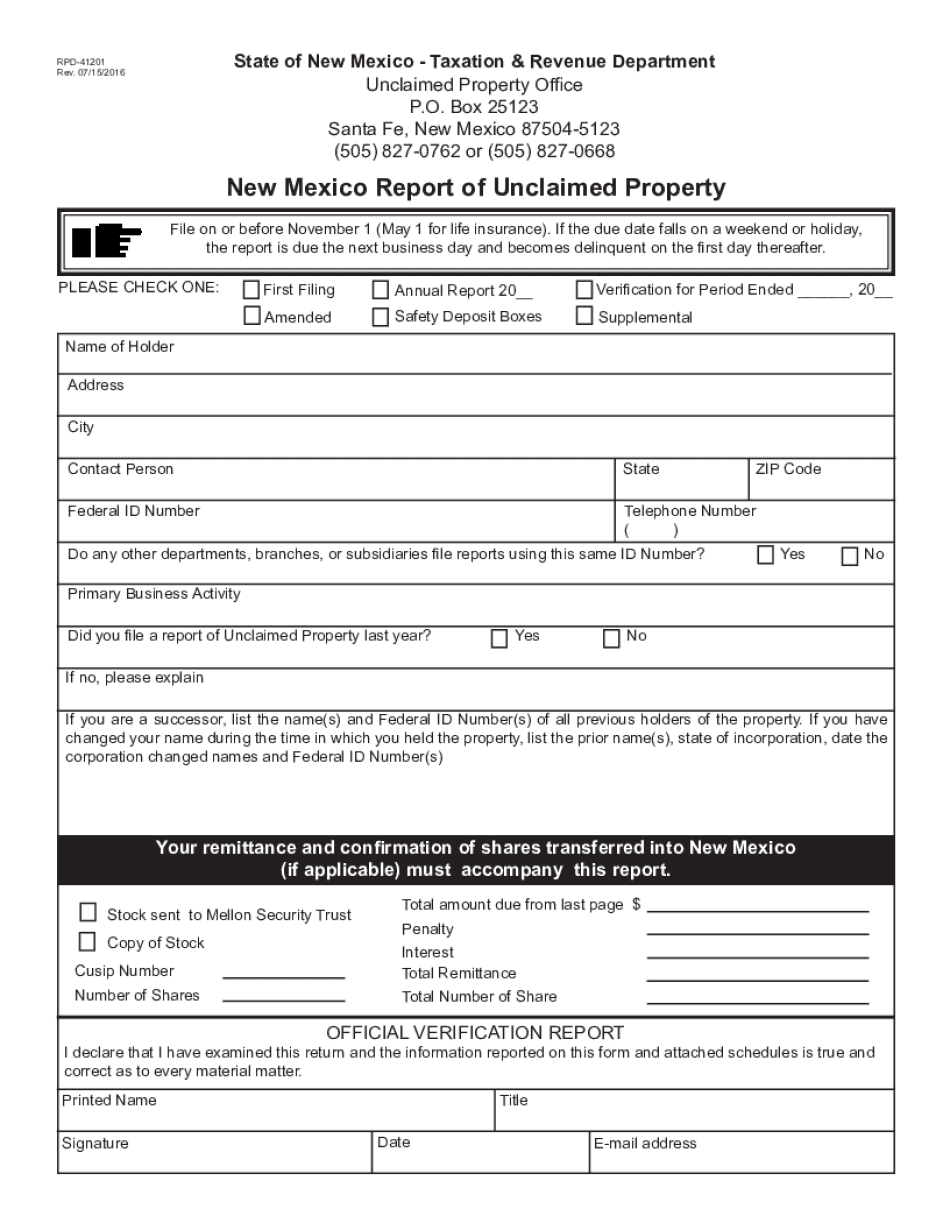

Steps to complete the State Of New Mexico Taxation & Revenue Department form

Completing the State Of New Mexico Taxation & Revenue Department form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, such as income statements, identification, and any relevant tax forms. Next, fill out the form carefully, ensuring that all information is accurate and complete. After completing the form, review it for any errors or omissions. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on the specific requirements of the form.

Legal use of the State Of New Mexico Taxation & Revenue Department

To ensure the legal validity of the State Of New Mexico Taxation & Revenue Department form, it is essential to comply with eSignature laws and regulations. Utilizing a reliable electronic signature solution can help establish the authenticity of the document. This includes ensuring that the signer’s identity is verified and that the signing process is secure. Compliance with the ESIGN Act and UETA is crucial for the form to be considered legally binding.

Filing Deadlines / Important Dates

Awareness of filing deadlines is vital for compliance with the State Of New Mexico Taxation & Revenue Department. Taxpayers should note key dates for tax submissions, including the annual income tax deadline, which typically falls on April 15. Additionally, specific deadlines may apply for estimated tax payments and other tax-related submissions. Keeping a calendar of these important dates can help ensure timely compliance and avoid penalties.

Required Documents

When completing the State Of New Mexico Taxation & Revenue Department form, certain documents are typically required. These may include proof of income, such as W-2 or 1099 forms, identification documents like a driver’s license or Social Security card, and any previous tax returns. Having these documents readily available can facilitate a smoother filing process and ensure that all necessary information is provided.

Form Submission Methods (Online / Mail / In-Person)

There are multiple methods for submitting the State Of New Mexico Taxation & Revenue Department form. Taxpayers can choose to file online through the department’s official website, which often provides a streamlined process. Alternatively, forms can be mailed directly to the department or submitted in person at designated offices. Each method has its own advantages, and taxpayers should select the one that best suits their needs and preferences.

Penalties for Non-Compliance

Failure to comply with the requirements of the State Of New Mexico Taxation & Revenue Department can result in various penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is important for taxpayers to understand the implications of non-compliance and to take proactive measures to ensure that all forms and payments are submitted accurately and on time.

Quick guide on how to complete state of new mexico taxation amp revenue department

Complete State Of New Mexico Taxation & Revenue Department seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle State Of New Mexico Taxation & Revenue Department on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to adjust and eSign State Of New Mexico Taxation & Revenue Department effortlessly

- Find State Of New Mexico Taxation & Revenue Department and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, a process that takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements within a few clicks from any device you prefer. Modify and eSign State Of New Mexico Taxation & Revenue Department and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of new mexico taxation amp revenue department

Create this form in 5 minutes!

How to create an eSignature for the state of new mexico taxation amp revenue department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the State Of New Mexico Taxation & Revenue Department?

The State Of New Mexico Taxation & Revenue Department is responsible for managing the state's tax policies, administering tax laws, and ensuring compliance. They facilitate tax revenue collection that supports public services and development initiatives throughout New Mexico.

-

How does airSlate SignNow support the State Of New Mexico Taxation & Revenue Department?

AirSlate SignNow offers a reliable eSignature platform that allows the State Of New Mexico Taxation & Revenue Department to streamline document management. This helps in expediting tax-related processes and improving efficiency in communications with taxpayers and other stakeholders.

-

What are the pricing options for airSlate SignNow for the State Of New Mexico Taxation & Revenue Department?

AirSlate SignNow provides flexible pricing plans, making it an affordable choice for the State Of New Mexico Taxation & Revenue Department. Plans vary based on features and usage requirements, ensuring that the department can select a package that suits its operational needs.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow includes features like templates, collaboration tools, and secure storage, which are vital for the State Of New Mexico Taxation & Revenue Department. These features enhance workflow efficiency, allowing for faster processing of documents required for tax filings and other administrative tasks.

-

Can airSlate SignNow integrate with existing systems used by the State Of New Mexico Taxation & Revenue Department?

Yes, airSlate SignNow provides seamless integrations with many popular applications and systems. This ensures that the State Of New Mexico Taxation & Revenue Department can incorporate eSigning into their current processes without disruption.

-

What are the benefits of using airSlate SignNow for tax compliance?

Utilizing airSlate SignNow helps the State Of New Mexico Taxation & Revenue Department ensure compliance with tax regulations. The platform offers a secure and legally binding way to sign documents, reducing errors and improving audit trails for tax-related documentation.

-

How does airSlate SignNow enhance the user experience for the State Of New Mexico Taxation & Revenue Department?

AirSlate SignNow is designed with user experience in mind, enabling the State Of New Mexico Taxation & Revenue Department to navigate the platform easily. With an intuitive interface, users can manage and send documents smoothly, leading to increased operational effectiveness.

Get more for State Of New Mexico Taxation & Revenue Department

Find out other State Of New Mexico Taxation & Revenue Department

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation