UC 018 Unemployment Tax and Wage Report 2023-2026

What is the UC 018 Unemployment Tax And Wage Report

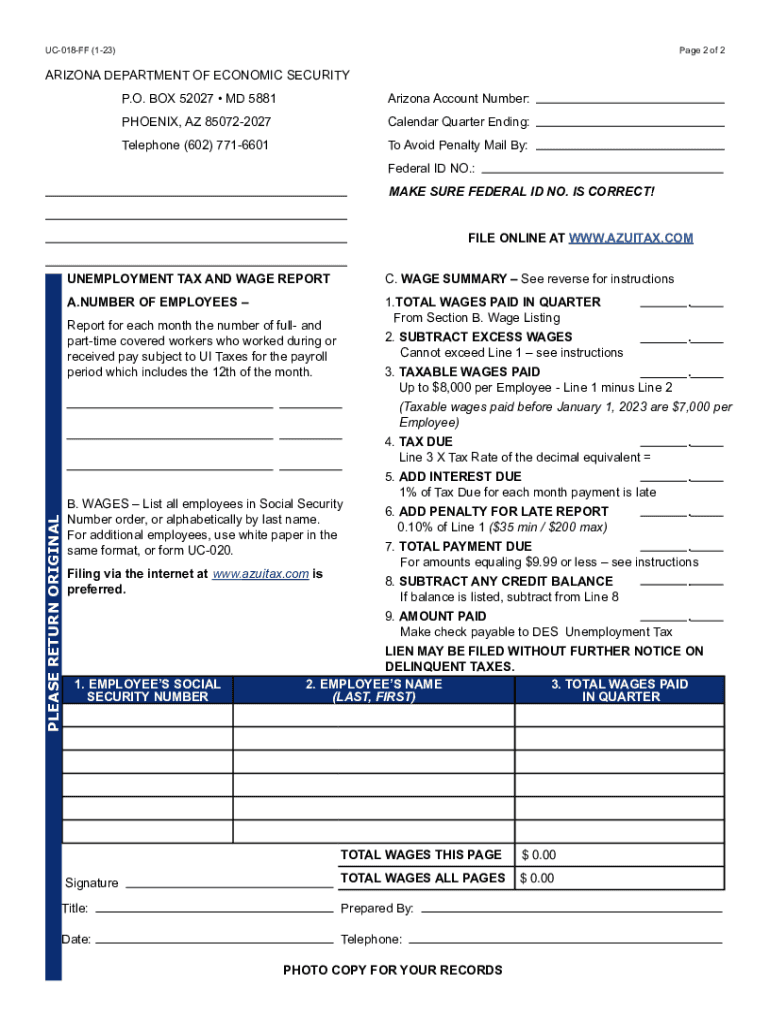

The UC 018 Unemployment Tax and Wage Report is a crucial document used by employers in Arizona to report wages paid to employees and to calculate unemployment insurance taxes. This form plays a vital role in the state’s unemployment insurance system, ensuring that accurate data is collected for benefits distribution. Employers are required to submit this report regularly to maintain compliance with state regulations.

Steps to complete the UC 018 Unemployment Tax And Wage Report

Completing the UC 018 form involves several key steps:

- Gather necessary information, including employee names, Social Security numbers, and total wages paid during the reporting period.

- Ensure that all data is accurate and up-to-date to avoid issues with the submission.

- Fill out the form, ensuring that all required sections are completed, including employer information and wage details.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the designated method, whether online, by mail, or in-person.

Key elements of the UC 018 Unemployment Tax And Wage Report

Understanding the key elements of the UC 018 form is essential for accurate reporting. Important components include:

- Employer Information: This section includes the employer's name, address, and identification number.

- Employee Information: Each employee's name, Social Security number, and total wages must be reported.

- Reporting Period: The specific time frame for which wages are being reported is crucial for compliance.

- Tax Calculation: The form includes calculations for determining the unemployment insurance tax owed based on reported wages.

Legal use of the UC 018 Unemployment Tax And Wage Report

The UC 018 form is legally binding and must be completed in accordance with Arizona state laws. Employers are obligated to file this report to ensure compliance with unemployment insurance regulations. Failure to submit the form accurately or on time can result in penalties, making it essential for employers to understand their responsibilities.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the UC 018 form:

- Online: Many employers prefer to submit the form electronically through the Arizona Department of Economic Security's website, which allows for quicker processing.

- Mail: The form can be printed and mailed to the appropriate state office. Ensure that it is sent well before the deadline to avoid late penalties.

- In-Person: Employers may also choose to submit the form in person at designated state offices, providing an opportunity to ask questions if needed.

Filing Deadlines / Important Dates

Timely submission of the UC 018 form is critical. Employers should be aware of the following deadlines:

- Quarterly reports are typically due on the last day of the month following the end of each quarter.

- Specific deadlines may vary, so it is advisable to check the Arizona Department of Economic Security's official guidelines regularly.

Quick guide on how to complete uc 018 unemployment tax and wage report

Effortlessly Prepare UC 018 Unemployment Tax And Wage Report on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as a superb eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage UC 018 Unemployment Tax And Wage Report across any device using the airSlate SignNow Android or iOS applications, and enhance any document-related process today.

How to Edit and eSign UC 018 Unemployment Tax And Wage Report with Ease

- Obtain UC 018 Unemployment Tax And Wage Report and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, exhausting form searches, or inaccuracies that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign UC 018 Unemployment Tax And Wage Report to ensure exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct uc 018 unemployment tax and wage report

Create this form in 5 minutes!

How to create an eSignature for the uc 018 unemployment tax and wage report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is uc 018 ff in the context of airSlate SignNow?

The term uc 018 ff refers to a specific feature set within airSlate SignNow that enhances document management and e-signature capabilities. It streamlines workflows and ensures documents are processed efficiently, addressing a critical need for businesses looking to optimize operations.

-

How does airSlate SignNow pricing work concerning uc 018 ff?

airSlate SignNow offers flexible pricing plans that include access to uc 018 ff features at competitive rates. Businesses can choose from various subscription models that best fit their needs, ensuring they get the most value for an effective document management tool.

-

What unique features does uc 018 ff provide for document e-signing?

uc 018 ff includes features such as template creation, auto-fill fields, and real-time tracking of document status. These functionalities help businesses save time and enhance accuracy in their e-signing processes, making it a powerful tool for any organization.

-

Can I integrate uc 018 ff with other applications?

Yes, airSlate SignNow allows seamless integration of uc 018 ff with various third-party applications like Google Drive, Salesforce, and more. This flexibility enables businesses to enhance their existing systems and improve overall productivity.

-

What are the benefits of using uc 018 ff for my organization?

Using uc 018 ff can signNowly reduce paperwork and streamline your document workflows. Enhanced security features and compliant e-signatures also ensure that your organization meets legal standards while providing a better experience for clients.

-

Is there a free trial for uc 018 ff features in airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows users to explore the functionalities of uc 018 ff. This trial period enables businesses to assess whether these features meet their specific document management needs.

-

How does uc 018 ff improve collaboration within teams?

uc 018 ff enhances team collaboration by providing shared access to documents and facilitating easy communication through comments and notifications. This promotes a more efficient drafting and approval process, ensuring everyone stays aligned.

Get more for UC 018 Unemployment Tax And Wage Report

Find out other UC 018 Unemployment Tax And Wage Report

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online