Bir Form 1801 January Excel

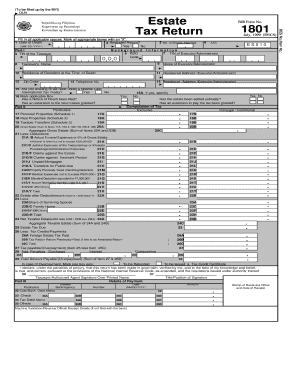

What is the BIR Form 1801?

The BIR Form 1801 is a specific document used for reporting estate tax in the Philippines. This form is essential for individuals who are responsible for filing estate taxes on behalf of deceased persons. It includes detailed information about the estate's assets, liabilities, and the tax due. The form is part of the Bureau of Internal Revenue's requirements to ensure compliance with tax laws regarding estate transfers.

Steps to Complete the BIR Form 1801

Completing the BIR Form 1801 involves several key steps:

- Gather necessary documents, including the death certificate, property titles, and any relevant financial statements.

- Fill out the form accurately, providing details about the deceased's assets and liabilities.

- Calculate the total estate tax due based on the current tax rates.

- Sign the form and ensure all required signatures are included.

- Submit the completed form to the appropriate BIR office, either online or in person.

Legal Use of the BIR Form 1801

The BIR Form 1801 is legally binding once submitted and accepted by the Bureau of Internal Revenue. It serves as a formal declaration of the estate's tax obligations and must be completed in accordance with the law. Failure to file this form accurately and on time can result in penalties and interest on unpaid taxes. It is crucial to ensure compliance with all relevant tax regulations when using this form.

Filing Deadlines / Important Dates

Filing deadlines for the BIR Form 1801 are critical to avoid penalties. Generally, the estate tax return must be filed within six months from the date of death of the decedent. Extensions may be available under certain circumstances, but it is essential to check with the Bureau of Internal Revenue for specific dates and requirements. Missing these deadlines can lead to significant financial repercussions.

Required Documents for BIR Form 1801

To successfully complete the BIR Form 1801, several documents are required:

- Death certificate of the deceased

- Property titles and deeds

- Bank statements and financial records

- Any existing wills or estate plans

- Previous tax returns, if applicable

Form Submission Methods

The BIR Form 1801 can be submitted through various methods. Taxpayers can file the form online via the BIR's e-filing system or submit a physical copy at the relevant BIR office. Each method has its own requirements and procedures, so it is advisable to confirm the preferred submission method based on individual circumstances.

Quick guide on how to complete bir form 1801 january 2018 excel

Prepare Bir Form 1801 January Excel seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed papers, as you can locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Bir Form 1801 January Excel on any device with airSlate SignNow Android or iOS applications and simplify any document-centered workflow today.

The easiest way to modify and eSign Bir Form 1801 January Excel without effort

- Obtain Bir Form 1801 January Excel and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and then click the Done button to save your adjustments.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Bir Form 1801 January Excel and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bir form 1801 january 2018 excel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a BIR Form 1801 sample and why is it important?

A BIR Form 1801 sample is a template used for various tax filing purposes in the Philippines. It is important because it helps businesses ensure compliance with tax regulations when reporting income. Using a BIR Form 1801 sample can streamline your filing process, reducing errors and saving you time.

-

How can airSlate SignNow assist with handling BIR Form 1801?

airSlate SignNow allows users to easily create, send, and eSign BIR Form 1801 samples. With its user-friendly interface, you can fill out the form, request signatures, and securely store completed documents. This eliminates the hassle of manual processing and promotes efficient document management.

-

What are the pricing options for using airSlate SignNow for BIR Form 1801?

airSlate SignNow offers various pricing tiers based on your business needs, starting with a free trial to experience the platform's features. Subscription plans include access to tools for managing and sending BIR Form 1801 samples effectively. You can choose a plan that best fits your budget and requirements.

-

Are there specific features in airSlate SignNow tailored for BIR Form 1801?

Yes, airSlate SignNow includes features specifically beneficial for handling BIR Form 1801 samples, such as customizable templates and the option to set signing order. These features enhance workflow efficiency, ensuring that your forms are completed correctly and in a timely manner.

-

Can I integrate airSlate SignNow with other applications for managing BIR Form 1801?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and Salesforce, allowing you to seamlessly manage your BIR Form 1801 samples alongside your other documents. This enhances your workflow, making it easier to access and share your important paperwork.

-

Is airSlate SignNow secure for handling BIR Form 1801 samples?

Yes, airSlate SignNow employs robust security measures to protect your documents, including BIR Form 1801 samples, throughout the signing process. With encryption and compliant systems in place, you can trust that your sensitive information remains confidential and secure.

-

What benefits can I expect from using airSlate SignNow for my BIR Form 1801?

Using airSlate SignNow for your BIR Form 1801 enhances efficiency, promotes accuracy, and simplifies the signing process. You’ll save time and reduce paperwork errors, leading to a smoother tax filing experience. Additionally, the platform’s tracking features help ensure you stay organized.

Get more for Bir Form 1801 January Excel

- Nj reg c form

- Som1 01 form

- Letterland handwriting practice pdf form

- Us healthworks authorization form

- Future 1 student book pdf form

- Assignment of mortgage template form

- Twin lakes meats beef pork and chicken order form

- Www gov ukgovernmentpublicationsself assessment tax return for trustees of registered form

Find out other Bir Form 1801 January Excel

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors