Indemnity Bond Format

What is the indemnity bond format?

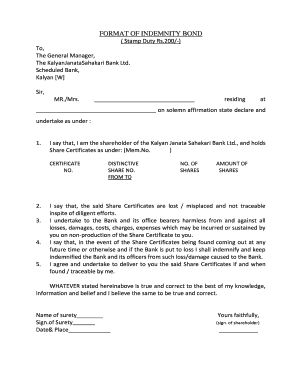

The indemnity bond format is a legal document that serves as a guarantee to protect one party from potential losses or damages incurred by another party. This format is essential in various situations, such as securing loans, leases, or other financial agreements. An indemnity bond typically outlines the responsibilities of the parties involved, the conditions under which the bond is valid, and the specific amounts that may be claimed in case of a breach of contract or other specified events.

In the United States, the indemnity bond format may vary slightly depending on state laws and the specific requirements of the entity requesting the bond. However, most indemnity bonds share common elements, including the names of the parties involved, the purpose of the bond, and the signatures of the parties or their authorized representatives.

Key elements of the indemnity bond format

Understanding the key elements of the indemnity bond format is crucial for ensuring its validity and effectiveness. The following components are typically included:

- Parties involved: Clearly identify the indemnitor (the party providing the bond) and the indemnitee (the party protected by the bond).

- Purpose: Specify the reason for the bond, such as securing a loan or fulfilling a contractual obligation.

- Amount: State the maximum amount that can be claimed under the bond in case of a loss or damage.

- Conditions: Outline the specific conditions under which the bond will be enforced, including any time limits or requirements for making a claim.

- Signatures: Ensure that all parties involved sign the document, as this is essential for its legal enforceability.

Steps to complete the indemnity bond format

Completing the indemnity bond format involves several steps to ensure that all necessary information is accurately provided. Follow these steps for a successful completion:

- Gather information: Collect all relevant details about the parties involved, the purpose of the bond, and any specific conditions that must be included.

- Fill out the form: Carefully complete the indemnity bond format, ensuring that all sections are filled in clearly and accurately.

- Review: Double-check the document for any errors or omissions. Ensure that all required information is included.

- Obtain signatures: Have all parties sign the document, ensuring that each signature is dated.

- Distribute copies: Provide copies of the signed indemnity bond to all relevant parties for their records.

Legal use of the indemnity bond format

The legal use of the indemnity bond format is governed by various laws and regulations in the United States. To ensure that the bond is enforceable, it must comply with state-specific requirements and adhere to the principles of contract law. This includes ensuring that the bond is executed voluntarily, that all parties have the legal capacity to enter into the agreement, and that the purpose of the bond is lawful.

Additionally, the indemnity bond must be properly notarized or witnessed, depending on state regulations. Failure to comply with these legal requirements may render the bond invalid, which could expose the indemnitor to potential liabilities.

Examples of using the indemnity bond format

Indemnity bonds are commonly used in various scenarios, providing protection and assurance in financial transactions. Some examples include:

- Construction projects: Contractors may require an indemnity bond to protect against claims arising from accidents or damages during the project.

- Leases: Landlords may request an indemnity bond from tenants to cover potential damages to the property.

- Loans: Financial institutions often require an indemnity bond as collateral to secure loans, ensuring repayment in case of default.

How to obtain the indemnity bond format

Obtaining the indemnity bond format can be done through various means. Many legal and financial institutions provide templates that can be customized to meet specific needs. Additionally, online resources and legal document services offer downloadable formats that comply with state regulations.

It is advisable to consult with a legal professional when obtaining an indemnity bond format to ensure that it meets all legal requirements and adequately protects the interests of all parties involved.

Quick guide on how to complete indemnity bond format 409508806

Effortlessly Prepare Indemnity Bond Format on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow gives you all the resources necessary to create, modify, and electronically sign your files promptly without any holdups. Manage Indemnity Bond Format on any device using the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The easiest way to modify and electronically sign Indemnity Bond Format without hassle

- Obtain Indemnity Bond Format and click Get Form to begin.

- Make use of our provided tools to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes only a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Edit and electronically sign Indemnity Bond Format to guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indemnity bond format 409508806

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bond format in the context of electronic signatures?

A bond format is a specific type of document structure that can be utilized for electronic signatures. When using airSlate SignNow, you can easily create and manage documents in a bond format, ensuring they meet legal requirements for binding agreements. This allows for a seamless signing experience for all parties involved.

-

How can airSlate SignNow help simplify the creation of bond formats?

airSlate SignNow provides intuitive tools that make it easy to create bond formats without extensive legal knowledge. Users can choose from customizable templates and drag-and-drop features to design documents that suit their needs. This simplifies the process, allowing users to focus on their core business activities.

-

Is there a pricing plan for using airSlate SignNow for bond format documents?

Yes, airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. You can select a plan that allows you to manage multiple bond format documents efficiently, while also considering additional features like integrations and advanced security options. Explore our pricing page for specific details.

-

What benefits does airSlate SignNow offer for managing bond formats?

Using airSlate SignNow to manage bond formats offers several benefits, including enhanced compliance, reduced turnaround times, and increased efficiency. The platform's user-friendly interface makes it easy to track document statuses and obtain signatures quickly. This ensures that your bond-related documents are handled professionally and securely.

-

Can airSlate SignNow integrate with other applications when handling bond formats?

Absolutely! airSlate SignNow integrates with various third-party applications, allowing you to efficiently manage bond format documents alongside your existing tools. This integration capability helps streamline your workflow, making it easier to collaborate and share information across platforms without any disruptions.

-

How secure is the bond format documentation using airSlate SignNow?

Security is a top priority at airSlate SignNow. When handling bond formats, the platform employs advanced encryption and security protocols to protect your documents. We also offer features such as identity verification and audit trails to ensure that your bond format documents are kept safe from unauthorized access.

-

Can multiple users collaborate on bond format documents in airSlate SignNow?

Yes, airSlate SignNow allows for seamless collaboration among multiple users on bond format documents. You can invite team members or clients to review and sign documents, ensuring everyone involved can provide input and approvals in real-time. This fosters better communication and speeds up the completion of essential documents.

Get more for Indemnity Bond Format

- There is there are exercises pdf form

- Gehs savings calculator form

- Motion to stop wage garnishment alabama form

- Semiconductor material and device characterization solution manual pdf form

- Lic 618 form

- Daca renewal cover letter form

- Csio application for mobile homes form

- Gio workers compensation reimbursement invoice form

Find out other Indemnity Bond Format

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney