Itr V Acknowledgement Ay 21 PDF Form

What is the ITR V Acknowledgement AY 21 PDF?

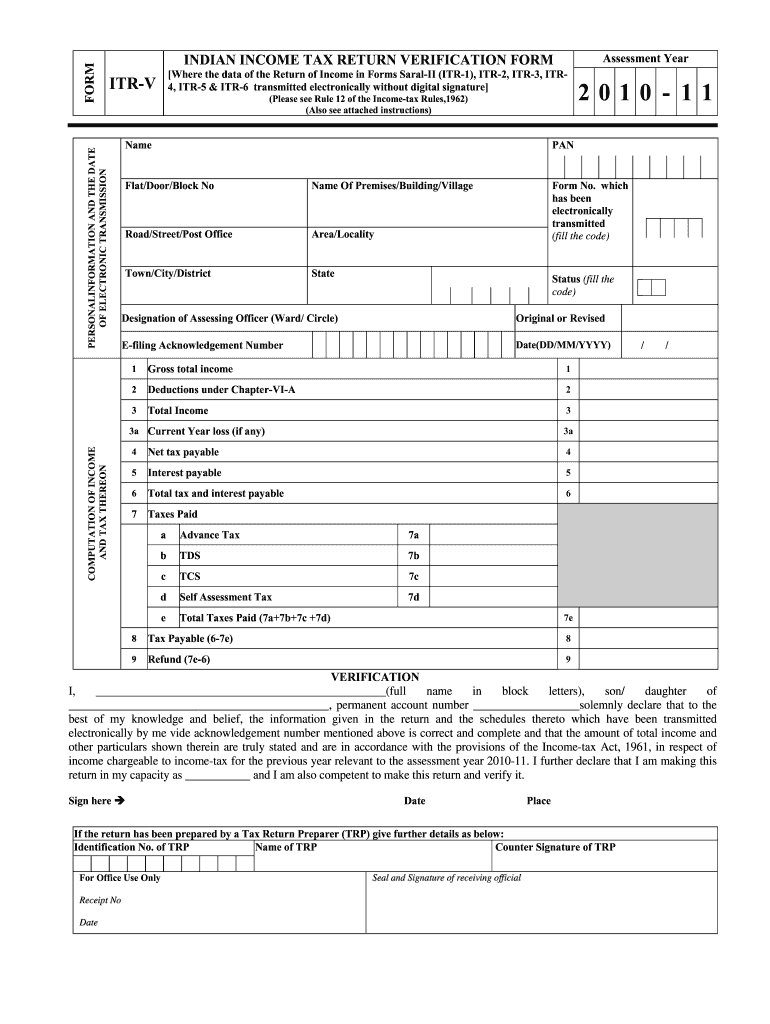

The ITR V Acknowledgement AY 21 PDF serves as a crucial document for taxpayers in the United States who have filed their income tax returns for the assessment year 2. This form acts as a receipt, confirming that the Income Tax Return (ITR) has been successfully submitted to the Internal Revenue Service (IRS). It contains essential details such as the taxpayer's name, PAN (Permanent Account Number), and the acknowledgment number, which can be used for future reference or verification purposes.

Key Elements of the ITR V Acknowledgement AY 21 PDF

Understanding the key elements of the ITR V Acknowledgement AY 21 PDF is vital for ensuring that your tax filing is complete and accurate. The primary components include:

- Acknowledgment Number: A unique identifier for your tax return submission.

- Taxpayer Information: Includes your name, address, and PAN.

- Filing Status: Indicates whether the return is filed as an individual, joint, or other status.

- Assessment Year: Specifies the year for which the tax return is applicable.

- Signature: An electronic signature may be included if the return was filed using an e-filing platform.

Steps to Complete the ITR V Acknowledgement AY 21 PDF

Completing the ITR V Acknowledgement AY 21 PDF involves a few straightforward steps:

- Gather necessary documents, including your PAN and previous tax filings.

- Access the ITR V form through the IRS website or authorized e-filing platforms.

- Fill in the required fields accurately, ensuring all information matches your official documents.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or print it for mailing, depending on your chosen filing method.

Legal Use of the ITR V Acknowledgement AY 21 PDF

The ITR V Acknowledgement AY 21 PDF holds legal significance as it serves as proof of tax compliance. It is essential for various legal and financial processes, such as applying for loans or resolving disputes with the IRS. Retaining this document is advisable for at least six years, as it may be required for audits or further verification by tax authorities.

How to Obtain the ITR V Acknowledgement AY 21 PDF

Obtaining the ITR V Acknowledgement AY 21 PDF is a simple process. After filing your income tax return online, you will receive the acknowledgment instantly. You can download the PDF directly from the e-filing portal or request a copy from your tax consultant. If you filed by mail, you may need to wait for processing confirmation before obtaining your acknowledgment.

Form Submission Methods (Online / Mail / In-Person)

There are several methods available for submitting the ITR V Acknowledgement AY 21 PDF:

- Online Submission: The most common method, allowing you to file directly through the IRS website or authorized e-filing services.

- Mail Submission: You can print the completed form and send it to the IRS via postal service if you prefer traditional filing.

- In-Person Submission: Some taxpayers may opt to submit their forms at designated IRS offices, although this is less common.

Quick guide on how to complete itr v acknowledgement ay 2020 21 pdf

Complete Itr V Acknowledgement Ay 21 Pdf with ease on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-conscious substitute for conventional printed and signed papers, allowing you to locate the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Itr V Acknowledgement Ay 21 Pdf on any device with airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

The simplest way to modify and electronically sign Itr V Acknowledgement Ay 21 Pdf effortlessly

- Locate Itr V Acknowledgement Ay 21 Pdf and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to save your adjustments.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, exhausting document searches, or mistakes that necessitate reprinting new copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you prefer. Edit and electronically sign Itr V Acknowledgement Ay 21 Pdf and ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the itr v acknowledgement ay 2020 21 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ITR receipt?

An ITR receipt is a confirmation received after submitting your Income Tax Return. It serves as proof of filing and includes details such as the acknowledgment number and the date of filing. Keeping your ITR receipt is important for future reference and possible audits.

-

How does airSlate SignNow facilitate the signing of ITR receipts?

airSlate SignNow provides a secure platform for electronically signing documents, including your ITR receipt. With its user-friendly interface, you can easily upload, sign, and share your ITR receipt with confidence. This prevents delays and ensures your submission is handled efficiently.

-

Is there a cost associated with using airSlate SignNow for ITR receipts?

Yes, airSlate SignNow offers affordable pricing plans tailored to various business needs. The cost ensures you have access to reliable tools for managing your documents, including ITR receipts. You can choose a plan that fits your budget while still benefiting from our robust features.

-

What are the benefits of using airSlate SignNow for handling ITR receipts?

Using airSlate SignNow to manage your ITR receipts simplifies the entire process. It not only allows for quick and secure electronic signatures but also provides a comprehensive audit trail. This way, you can keep track of any changes made to your ITR receipt, enhancing reliability and accountability.

-

Can I integrate airSlate SignNow with other tools for processing ITR receipts?

Yes, airSlate SignNow offers integrations with various applications to streamline your workflow. You can connect it to accounting software or cloud storage systems, making it easier to manage your ITR receipts alongside other financial documents. This integration capability enhances efficiency in your business operations.

-

How does airSlate SignNow ensure the security of my ITR receipts?

Security is a top priority for airSlate SignNow. We use advanced encryption technologies and multi-factor authentication to protect your ITR receipts and documents. Our platform complies with industry standards, ensuring that your sensitive information remains safe and confidential.

-

Is there customer support available for issues with ITR receipts?

Absolutely! airSlate SignNow provides robust customer support for any queries or issues related to your ITR receipts. Our dedicated team is available to assist you via live chat, email, or phone, ensuring you get the help you need to effectively manage your documents.

Get more for Itr V Acknowledgement Ay 21 Pdf

- Days inn credit card authorization form 446679518

- Non refundable gpf form odisha

- Posture assessment documentation form

- Daily observation report template form

- Family dollar application pdf form

- Valley childrens healthcare outpatient referral form

- Www axosadvisorservices comforms andsolo 401k profit sharing plan adoption agreement

- Split annuity fillable sheet form

Find out other Itr V Acknowledgement Ay 21 Pdf

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now