Republic Bank Taxpayer 2010

What is the Republic Bank Taxpayer

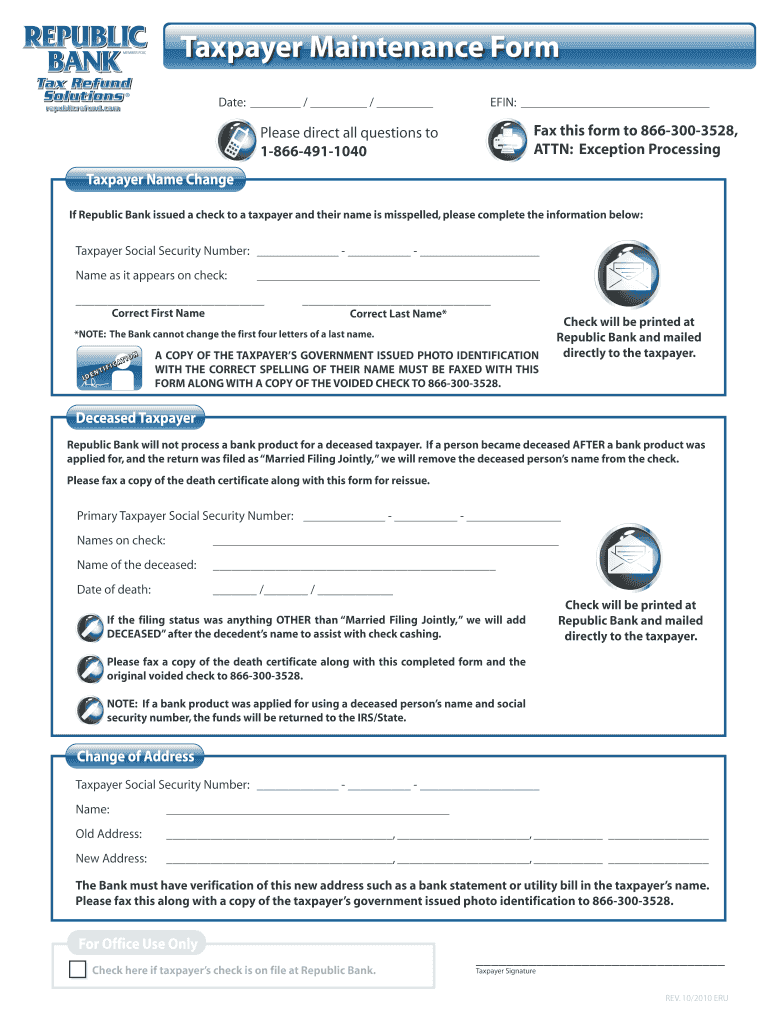

The Republic Bank Taxpayer refers to a specific form utilized for tax-related purposes within the United States. This form is essential for individuals and businesses to report their tax obligations accurately. It serves as a formal declaration of income, deductions, and credits, ensuring compliance with federal and state tax regulations. Understanding the Republic Bank Taxpayer is crucial for maintaining good standing with tax authorities and avoiding potential penalties.

Steps to complete the Republic Bank Taxpayer

Completing the Republic Bank Taxpayer involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, previous tax returns, and any relevant deductions. Next, carefully fill out the form, ensuring that all information is complete and accurate. Pay special attention to sections that require signatures or additional documentation. Once the form is completed, review it for any errors before submission. This thorough approach helps prevent delays and issues with tax authorities.

Legal use of the Republic Bank Taxpayer

The legal use of the Republic Bank Taxpayer is governed by federal and state tax laws. To be considered valid, the form must be completed accurately and submitted within the designated deadlines. Compliance with the Internal Revenue Service (IRS) guidelines is essential, as failure to adhere to these regulations may result in penalties or audits. Utilizing a reliable electronic signature solution, like signNow, can further enhance the legal standing of the form by ensuring secure and verified submission.

Required Documents

When preparing to complete the Republic Bank Taxpayer, several documents are required to provide accurate information. Key documents include:

- Income statements, such as W-2s or 1099s

- Previous tax returns for reference

- Documentation for deductions, such as receipts or invoices

- Identification information, including Social Security numbers

Having these documents readily available streamlines the completion process and ensures that all necessary information is included.

Form Submission Methods

The Republic Bank Taxpayer can be submitted through various methods, catering to different preferences and needs. Common submission methods include:

- Online submission via secure platforms

- Mailing a physical copy to the appropriate tax authority

- In-person submission at designated tax offices

Choosing the right submission method is important for ensuring timely processing and compliance with tax regulations.

Penalties for Non-Compliance

Failure to comply with the requirements of the Republic Bank Taxpayer can result in significant penalties. Common consequences include:

- Monetary fines for late submission or inaccuracies

- Increased scrutiny from tax authorities, potentially leading to audits

- Loss of eligibility for certain tax credits or deductions

Understanding these penalties underscores the importance of accurate and timely submission of the taxpayer maintenance form.

Quick guide on how to complete republic bank taxpayer

Complete Republic Bank Taxpayer effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Republic Bank Taxpayer on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Republic Bank Taxpayer without hassle

- Locate Republic Bank Taxpayer and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for these tasks.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select how you wish to send your form—via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Republic Bank Taxpayer and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct republic bank taxpayer

Create this form in 5 minutes!

How to create an eSignature for the republic bank taxpayer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for a republic bank taxpayer?

airSlate SignNow provides essential features for a republic bank taxpayer, including electronic signatures, document templates, and a user-friendly interface. These functionalities make it easy to manage and sign documents securely and efficiently. Moreover, you can streamline your workflow by integrating with various software tools to enhance productivity.

-

How does airSlate SignNow benefit a republic bank taxpayer?

For a republic bank taxpayer, airSlate SignNow offers signNow benefits such as reduced turnaround time for document approvals and enhanced compliance with local regulations. By transitioning to electronic signatures, you not only save on paper costs but also ensure a more secure method for handling sensitive information. This boosts overall efficiency for businesses looking to stay compliant.

-

What is the pricing structure for republic bank taxpayers using airSlate SignNow?

airSlate SignNow offers a competitive pricing structure suitable for a republic bank taxpayer. The pricing plans are designed to accommodate businesses of all sizes, ensuring you only pay for the features you need. You can choose from monthly or annual subscriptions, with options for additional integrations if required.

-

Can airSlate SignNow integrate with tools used by a republic bank taxpayer?

Yes, airSlate SignNow seamlessly integrates with a range of tools commonly used by a republic bank taxpayer. This includes popular applications such as Google Drive, Salesforce, and Microsoft Office. Such integrations allow for a streamlined workflow, enabling users to manage documents without leaving their preferred software environments.

-

Is airSlate SignNow secure for handling sensitive information for a republic bank taxpayer?

Absolutely! airSlate SignNow prioritizes security, making it an ideal choice for a republic bank taxpayer handling sensitive information. The platform employs advanced encryption methods to protect your data, along with compliance with industry standards to ensure that all documents are handled safely and securely.

-

What support options are available for a republic bank taxpayer using airSlate SignNow?

airSlate SignNow provides comprehensive support for a republic bank taxpayer, including 24/7 customer service and extensive online documentation. Users can access tutorials, FAQs, and live chat options to resolve any queries quickly. This level of support ensures that you can effectively utilize airSlate SignNow for all your document signing needs.

-

How easy is it to eSign documents with airSlate SignNow for a republic bank taxpayer?

eSigning documents with airSlate SignNow is incredibly easy for a republic bank taxpayer. The intuitive design allows users to upload documents, add signatures, and send them for signing in just a few clicks. This efficiency helps businesses reduce delays and improve their transaction processes.

Get more for Republic Bank Taxpayer

- Odes 400 atv repair manual form

- You will hear someone welcoming a group of visitors to ocean life sea park form

- Stop the pirates form

- Ankle brachial index form

- Cna live scan form

- Application for subpoena form

- Older adult full service partnership department of form

- Office use onlyclient no date receivedapplicat form

Find out other Republic Bank Taxpayer

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document