Tax Invoice Cum Acknowledgement Number Form

Understanding the Tax Invoice Cum Acknowledgement Number

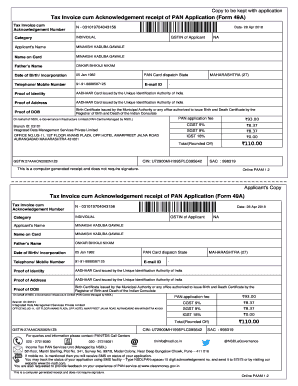

The Tax Invoice Cum Acknowledgement Number serves as a vital reference for individuals and businesses when dealing with tax-related documentation. This unique identifier is essential for tracking the submission of forms, especially those related to PAN applications and tax invoices. It ensures that the application is acknowledged by the relevant authorities, providing a layer of security and verification for the applicant.

In the context of PAN applications, the acknowledgement number is crucial for confirming that the application has been received and is being processed. This number can often be found on the tax invoice or acknowledgement receipt, making it an important piece of documentation for future reference.

How to Use the Tax Invoice Cum Acknowledgement Number

Using the Tax Invoice Cum Acknowledgement Number is straightforward. Once you receive this number after submitting your application, keep it secure for future reference. It can be used to track the status of your application online or to resolve any issues that may arise during processing.

When communicating with tax authorities or financial institutions regarding your application, include this number to facilitate quicker responses and ensure that your inquiries are directed to the correct department. This practice helps maintain clarity and efficiency in your dealings.

Steps to Complete the Tax Invoice Cum Acknowledgement Number

Completing the Tax Invoice Cum Acknowledgement Number involves several key steps:

- Fill out the necessary application form accurately, ensuring all required fields are completed.

- Submit the application form through the designated method, whether online or in person.

- Upon submission, you will receive a tax invoice that includes the acknowledgement number.

- Keep the invoice and the acknowledgement number in a safe place for future reference.

Following these steps ensures that you have a complete and valid record of your application, which is essential for any follow-up actions.

Legal Use of the Tax Invoice Cum Acknowledgement Number

The Tax Invoice Cum Acknowledgement Number holds legal significance in the context of tax compliance and record-keeping. It serves as proof that an application has been submitted and acknowledged by the relevant authorities. This number can be referenced in legal situations, such as audits or disputes regarding tax obligations.

Maintaining accurate records, including this acknowledgement number, is crucial for compliance with IRS regulations and can protect against potential penalties for non-compliance.

Key Elements of the Tax Invoice Cum Acknowledgement Number

Several key elements define the Tax Invoice Cum Acknowledgement Number:

- Unique Identifier: Each number is unique to the specific application, ensuring that it can be tracked effectively.

- Document Reference: It links directly to the submitted application, allowing for easy retrieval of information.

- Date of Submission: The acknowledgement number typically includes the date the application was received, providing a timeline for processing.

Understanding these elements can help applicants navigate their tax obligations with greater confidence.

Required Documents for the Tax Invoice Cum Acknowledgement Number

To obtain the Tax Invoice Cum Acknowledgement Number, certain documents are typically required. These may include:

- Completed application form (such as the PAN application form 49A).

- Proof of identity and address, which can include government-issued IDs or utility bills.

- Any additional documentation specified by the tax authority or financial institution.

Ensuring that all required documents are prepared and submitted correctly will facilitate a smoother application process and help in receiving the acknowledgement number promptly.

Quick guide on how to complete tax invoice cum acknowledgement number

Complete Tax Invoice Cum Acknowledgement Number effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Tax Invoice Cum Acknowledgement Number on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign Tax Invoice Cum Acknowledgement Number without any hassle

- Obtain Tax Invoice Cum Acknowledgement Number and click on Get Form to begin.

- Utilize the tools we offer to submit your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, frustrating form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Invoice Cum Acknowledgement Number and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax invoice cum acknowledgement number

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of an acknowledgement of application in the document signing process?

An acknowledgement of application confirms that your document has been received and is under consideration. This is crucial as it provides assurance to all parties involved that the application is being processed, reducing uncertainty and enhancing communication.

-

How does airSlate SignNow facilitate the acknowledgement of application process?

airSlate SignNow streamlines the acknowledgement of application by enabling users to send documents for eSignature quickly. Once signed, the platform automatically creates a confirmation receipt that serves as an acknowledgement of application, ensuring you have documented proof of submission.

-

Can I customize the acknowledgement of application templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your acknowledgement of application templates. You can easily create tailored messages that fit your brand, ensuring that the communication is professional and aligned with your business identity.

-

What are the pricing options for airSlate SignNow and does it cover the acknowledgement of application feature?

airSlate SignNow offers several pricing plans to accommodate different business needs, all of which include the acknowledgement of application feature. From essential to advanced plans, you will find suitable options that provide value without compromising essential functionalities.

-

What benefits does using airSlate SignNow for acknowledgement of application offer?

Using airSlate SignNow for your acknowledgement of application needs simplifies document management and enhances the speed of your operations. It saves you time and effort while providing a secure, legally-binding way to handle applications, which can lead to improved customer satisfaction.

-

Are there any integrations available with airSlate SignNow for managing acknowledgements of applications?

Yes, airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Salesforce, and many others. This connectivity allows for easier management of the acknowledgement of application processes, enabling efficient workflows and better data management.

-

How secure is the acknowledgement of application process with airSlate SignNow?

The acknowledgement of application process in airSlate SignNow is highly secure, utilizing industry-standard encryption and authentication measures. This ensures that all documents, including acknowledgements, are protected and that your sensitive information stays safe.

Get more for Tax Invoice Cum Acknowledgement Number

Find out other Tax Invoice Cum Acknowledgement Number

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast