Tsp Loan Application 1998-2026

What is the thrift savings plan loan application?

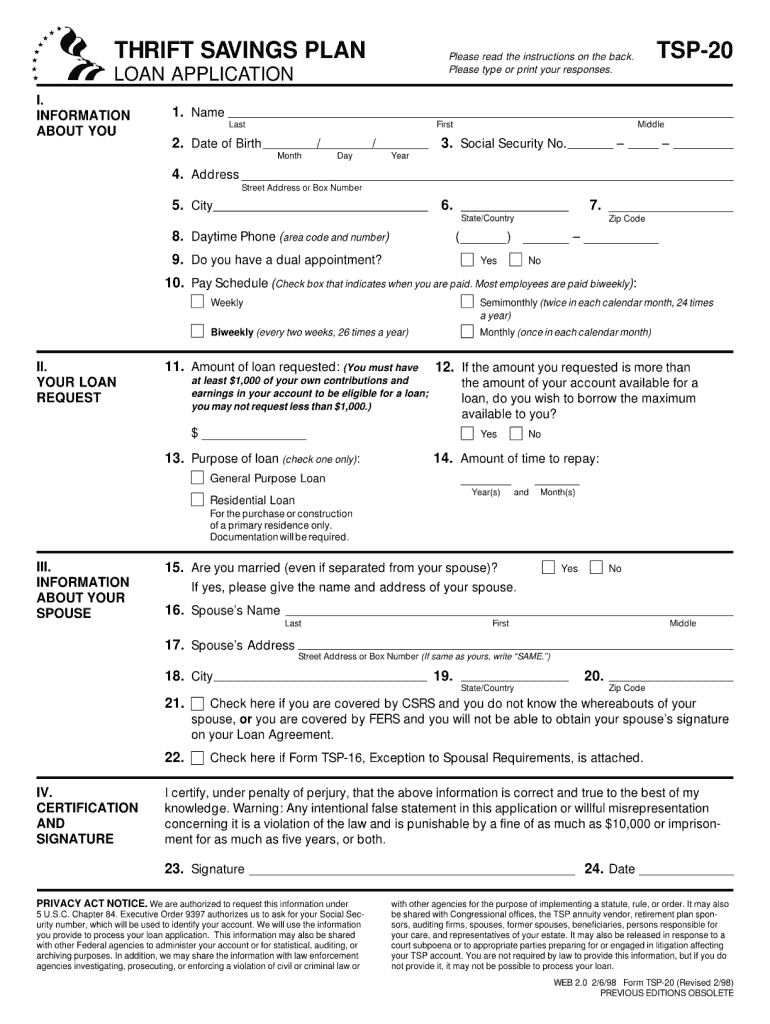

The thrift savings plan loan application is a formal request that allows participants in the Thrift Savings Plan (TSP) to borrow against their retirement savings. This application is essential for accessing funds during financial emergencies or significant expenses. The TSP loan application form, often referred to as the TSP-20 form, outlines the terms of the loan, including the amount borrowed, repayment schedule, and interest rate. Understanding this application is crucial for participants who wish to utilize their retirement funds responsibly.

Steps to complete the thrift savings plan loan application

Completing the thrift savings plan loan application involves several key steps to ensure accuracy and compliance. First, gather necessary personal information, including your TSP account number and employment details. Next, access the TSP-20 form, which can be filled out online or printed for manual completion. Carefully input the requested information, ensuring all sections are filled out correctly. After completing the form, review it for any errors before submitting it. Finally, choose your submission method, whether online, by mail, or in person, to ensure timely processing.

Eligibility criteria for the thrift savings plan loan

To qualify for a thrift savings plan loan, participants must meet specific eligibility criteria. Generally, you must be an active employee contributing to the TSP and have a minimum balance in your account. Additionally, you should not have any outstanding loans against your TSP balance. The TSP allows for two types of loans: general purpose and residential. Each type has its own limits and requirements, so it is important to review these conditions before applying.

Required documents for the thrift savings plan loan application

When applying for a thrift savings plan loan, certain documents are necessary to support your application. These typically include proof of identity, such as a government-issued ID, and your TSP account number. If you are applying for a residential loan, you may also need to provide documentation related to the property you intend to purchase or refinance. Ensuring that all required documents are prepared and submitted with your application can expedite the approval process.

Legal use of the thrift savings plan loan application

The legal use of the thrift savings plan loan application is governed by federal regulations that outline the rights and responsibilities of both the borrower and the TSP. It is essential to comply with these regulations to avoid potential penalties or issues with repayment. The application must be filled out accurately, and all terms must be understood before signing. Adhering to the legal framework ensures that the loan is valid and that participants can protect their retirement savings while accessing necessary funds.

Form submission methods for the thrift savings plan loan application

Participants can submit the thrift savings plan loan application through various methods, depending on their preference and convenience. The most common options include online submission via the TSP website, mailing a completed paper form, or delivering it in person to the appropriate TSP office. Each method has its own processing times, so it is advisable to choose the one that best fits your timeline and needs. Online submissions typically offer faster processing and confirmation.

Quick guide on how to complete tsp loan application

Complete Tsp Loan Application effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, since you can locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and eSign your documents quickly without delays. Manage Tsp Loan Application on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Tsp Loan Application without difficulty

- Locate Tsp Loan Application and click Get Form to begin.

- Utilize the instruments we offer to finish your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Adjust and eSign Tsp Loan Application and ensure exceptional communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tsp loan application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a thrift savings plan loan application?

A thrift savings plan loan application is a formal request for a loan against the balance of your thrift savings plan. This loan allows you to access funds for various personal needs while repaying it through payroll deductions. Understanding the process of submitting a thrift savings plan loan application can help you manage your finances effectively.

-

How do I complete a thrift savings plan loan application using airSlate SignNow?

To complete a thrift savings plan loan application using airSlate SignNow, simply upload your completed form to our platform. Our intuitive eSigning features allow you to fill out and sign your application securely and efficiently. AirSlate SignNow makes submitting your thrift savings plan loan application straightforward and fast.

-

What are the benefits of using airSlate SignNow for my thrift savings plan loan application?

Using airSlate SignNow for your thrift savings plan loan application provides numerous benefits, including enhanced security and a user-friendly interface. Our platform accelerates the application process, allowing for quick approvals and reducing paperwork. Additionally, you can track your application status easily through our system.

-

Are there any fees associated with submitting a thrift savings plan loan application?

Typically, there are no fees to submit a thrift savings plan loan application via airSlate SignNow. Our service is designed to be cost-effective, making it easier for you to manage your loan applications without added financial burden. Always check with the specific conditions of your thrift savings plan for any applicable fees.

-

Can I track the status of my thrift savings plan loan application?

Yes, airSlate SignNow allows you to track the status of your thrift savings plan loan application in real-time. Our platform provides notifications and updates, ensuring that you remain informed throughout the application process. This feature helps you stay on top of your finances and planning.

-

What integrations does airSlate SignNow offer for my thrift savings plan loan application?

airSlate SignNow integrates seamlessly with various platforms to enhance your thrift savings plan loan application experience. By linking our service with your HR systems or financial management tools, you can streamline the application process and improve efficiency. Explore our integrations for enhanced functionality.

-

Is my information secure when submitting a thrift savings plan loan application?

Absolutely! airSlate SignNow prioritizes the security of your documents, including your thrift savings plan loan application. We use advanced encryption and secure access protocols to protect your personal and financial information. You can trust that your data is safe with us.

Get more for Tsp Loan Application

Find out other Tsp Loan Application

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement