Mi 1040ez Form

What is the Mi 1040ez

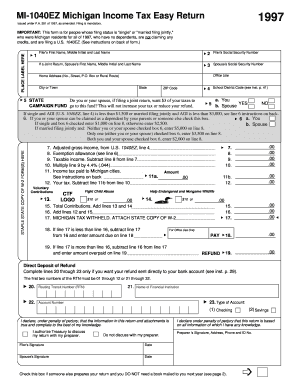

The Mi 1040ez is a simplified state income tax form used by residents of Michigan to file their annual tax returns. This form is designed for individuals with straightforward tax situations, typically those who do not have complex income sources or significant deductions. The Mi 1040ez allows eligible taxpayers to report their income, calculate their tax liability, and claim any applicable credits in a streamlined manner. It is important for taxpayers to ensure they meet the eligibility criteria to use this form, as it simplifies the filing process significantly.

How to use the Mi 1040ez

Using the Mi 1040ez involves a few straightforward steps. First, gather all necessary documents, including W-2 forms and any other income statements. Next, carefully read the instructions provided with the form to understand the requirements and ensure proper completion. Fill out the form by entering your personal information, income details, and any applicable deductions or credits. Finally, review the completed form for accuracy before submitting it. This form can be filed electronically or mailed to the appropriate tax authority, depending on your preference.

Steps to complete the Mi 1040ez

Completing the Mi 1040ez requires careful attention to detail. Follow these steps for a successful submission:

- Gather all relevant tax documents, such as your Michigan W-2 form and any other income records.

- Download the Mi 1040ez form from the Michigan Department of Treasury website or obtain a physical copy.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income from all sources as indicated on your W-2 forms.

- Calculate your tax liability using the provided tax tables or instructions.

- Claim any eligible credits that apply to your situation.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail to the Michigan Department of Treasury.

Legal use of the Mi 1040ez

The Mi 1040ez is legally recognized as a valid tax form for filing state income taxes in Michigan. To ensure its legal standing, it is essential to follow all instructions and guidelines provided by the Michigan Department of Treasury. Additionally, when submitting the form electronically, using a compliant eSignature solution can enhance the legal validity of the submission. Compliance with state regulations ensures that the form is accepted by tax authorities and can withstand any potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the Mi 1040ez are crucial for taxpayers to avoid penalties. Typically, the deadline for submitting the Mi 1040ez is April fifteenth of each year, aligning with federal tax filing deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any specific updates or changes to deadlines each tax year, as they can vary based on state regulations or special circumstances.

Required Documents

To complete the Mi 1040ez accurately, certain documents are necessary. These include:

- Your Michigan W-2 form(s) showing your income and tax withholdings.

- Any additional income statements, such as 1099 forms, if applicable.

- Records of any tax credits or deductions you plan to claim.

- Your Social Security number and personal identification information.

Having these documents ready will facilitate a smoother and more efficient filing process.

Quick guide on how to complete mi w2

Finalize mi w2 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without any holdups. Manage w2 michigan on any platform using airSlate SignNow's Android or iOS applications and simplify your document-centric tasks today.

The easiest way to alter and eSign w2 form michigan without any hassle

- Obtain michigan w2 and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight important sections of the documents or obscure sensitive information with tools designed specifically for that function by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your adjustments.

- Choose how you wish to deliver your form, via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Revise and eSign michigan w2 form while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to michigan 1040 ez

Create this form in 5 minutes!

How to create an eSignature for the 1040 ez

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask 1040ez state form printable

-

What is a 1040 EZ form and who can use it?

The 1040 EZ form is a simple tax return form for individuals with straightforward financial situations. It is designed for taxpayers with no dependents, who earn under a certain income threshold, and who meet specific criteria. Using the 1040 EZ can streamline the filing process and may make eSigning documents easier through airSlate SignNow.

-

How can airSlate SignNow simplify the 1040 EZ filing process?

AirSlate SignNow allows you to sign your 1040 EZ forms electronically, eliminating the need for printing and mailing documents. With its user-friendly platform, you can complete your forms quickly and send them securely. This makes managing your taxes more efficient and less stressful.

-

Does airSlate SignNow support integration with tax software for the 1040 EZ?

Yes, airSlate SignNow can seamlessly integrate with various tax software platforms that handle the 1040 EZ form. This integration helps you eSign and manage your tax documents without switching between multiple applications. You can prepare your taxes and easily send your completed form for signatures.

-

What are the pricing options for using airSlate SignNow in filing the 1040 EZ?

AirSlate SignNow offers flexible pricing plans, which cater to businesses and individuals looking to manage their documents, including the 1040 EZ. Depending on your needs, you can choose from various subscription tiers that provide features suitable for eSigning and document management at a cost-effective rate.

-

Can I use airSlate SignNow for free to eSign my 1040 EZ?

AirSlate SignNow allows new users to sign up for a free trial, enabling you to test the platform's eSigning capabilities for your 1040 EZ form. During the trial, you can explore its features without any commitment. However, continued access for regular use will require a paid subscription.

-

Is airSlate SignNow secure for signing sensitive documents like a 1040 EZ?

Absolutely, airSlate SignNow prioritizes security and ensures that all documents, including your 1040 EZ, are encrypted and securely stored. The platform complies with industry standards to provide a safe environment for eSigning sensitive financial documents. You can trust airSlate SignNow with your confidential information.

-

What benefits does eSigning the 1040 EZ with airSlate SignNow provide?

By eSigning your 1040 EZ with airSlate SignNow, you benefit from enhanced efficiency, as you can complete and send documents faster than traditional methods. Additionally, the convenience of signing from anywhere at any time saves you valuable time during tax season. Plus, all signed documents are automatically stored for easy access.

Get more for printable 1040ez form

- Bcal 1074 form

- Lc 621 state of michigan form

- Dv 001 standard domestic relationship incident report 0604 michigan form

- Blank cna license michigan form

- Oakland community college 1098 form

- Michigan repair facility consumer information sign

- Form 3799 2001

- Employer disclosure questionnaire fill state of michigan form

Find out other michigan 1040ez form

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast