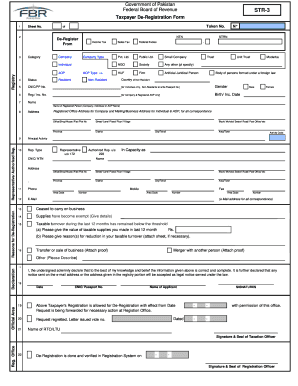

E Fbr Form

What is the E Fbr

The E Fbr is an electronic form used for filing tax-related documents in the United States. It simplifies the process of submitting information to the relevant tax authorities, allowing individuals and businesses to complete their filings efficiently. This form is particularly useful for those who need to report income, claim deductions, or provide other financial information. By using the E Fbr, taxpayers can ensure they meet their obligations while taking advantage of the convenience of digital submissions.

How to use the E Fbr

Using the E Fbr involves several straightforward steps. First, you will need to access the form through a secure online platform. Once you have the form open, carefully fill in the required fields, ensuring that all information is accurate and complete. After filling out the form, review your entries for any errors. Once confirmed, you can submit the E Fbr electronically. This method not only saves time but also provides immediate confirmation of submission.

Steps to complete the E Fbr

Completing the E Fbr can be broken down into a series of clear steps:

- Access the E Fbr through a secure online platform.

- Gather all necessary documents and information required for the form.

- Fill in the form accurately, ensuring all fields are completed.

- Review the information for accuracy and completeness.

- Submit the form electronically and save the confirmation for your records.

Legal use of the E Fbr

The E Fbr is legally recognized as a valid method for submitting tax information, provided it complies with relevant regulations. It is essential to ensure that the information submitted is truthful and accurate, as any discrepancies can lead to penalties or legal issues. The use of secure electronic signatures further enhances the legal standing of the E Fbr, making it a reliable option for taxpayers.

Required Documents

To successfully complete the E Fbr, you will need to gather specific documents. These may include:

- Previous tax returns for reference.

- Income statements, such as W-2s or 1099s.

- Documentation for any deductions you plan to claim.

- Identification information, such as Social Security numbers.

Having these documents ready will streamline the process and help ensure that your E Fbr is filled out correctly.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the E Fbr. Typically, the deadline for individual tax returns falls on April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Businesses may have different deadlines depending on their structure and fiscal year. Staying informed about these dates can help you avoid late fees and penalties.

Quick guide on how to complete e fbr

Complete E Fbr effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage E Fbr on any platform using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The simplest way to edit and eSign E Fbr with ease

- Locate E Fbr and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the information and click on the Done button to preserve your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign E Fbr and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e fbr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is efbr and how does it work with airSlate SignNow?

efbr stands for Electronic Form-Based Reports, a feature of airSlate SignNow that enables users to create, send, and manage structured documents with ease. This functionality helps streamline workflows and ensure seamless operations by utilizing electronic signatures. With efbr, businesses can improve their document management processes and enhance efficiency.

-

What pricing plans are available for efbr in airSlate SignNow?

airSlate SignNow offers several flexible pricing plans that include features like efbr for different business needs. Users can choose a plan that suits their organization’s size and document management requirements. Pricing is competitive, ensuring companies can access the efbr feature at a cost-effective rate without compromising quality.

-

Are there any key features of efbr in airSlate SignNow?

Yes, the efbr feature in airSlate SignNow includes capabilities such as customizable templates, drag-and-drop document creation, and automated workflows. These features empower users to efficiently create and manage electronic forms, enhancing productivity. By leveraging efbr, teams can reduce manual errors and speed up the document approval process.

-

How does efbr improve business efficiency?

efbr makes document processing quicker and more efficient by reducing the time spent on manual input and signature collection. With features like automated notifications and templates, airSlate SignNow enables teams to focus on essential tasks rather than administrative overhead. This leads to faster turnaround times and improved overall productivity.

-

Can I integrate efbr with other software applications?

Absolutely! airSlate SignNow offers extensive integrations with popular software applications, allowing users to utilize efbr seamlessly within their existing tech stack. This flexibility helps businesses maintain their workflows without interruption. Whether it's CRM systems or project management tools, efbr enhances collaboration across platforms.

-

What benefits does efbr provide for customer management?

With efbr in airSlate SignNow, businesses can easily manage customer documents, ensuring they are efficiently processed and securely stored. This leads to a more organized approach to customer interactions and improves satisfaction rates. Utilizing efbr allows for quicker service delivery, thereby enhancing the overall customer experience.

-

How can I start using efbr today?

To start using efbr with airSlate SignNow, simply sign up for a free trial, which gives you immediate access to features and functionalities. Once registered, you can familiarize yourself with the platform and begin creating electronic forms without any setup hassles. This straightforward onboarding process ensures you can quickly harness the power of efbr for your business.

Get more for E Fbr

Find out other E Fbr

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now