Fha Self Sufficiency Test Worksheet Form

What is the FHA Self Sufficiency Test Worksheet

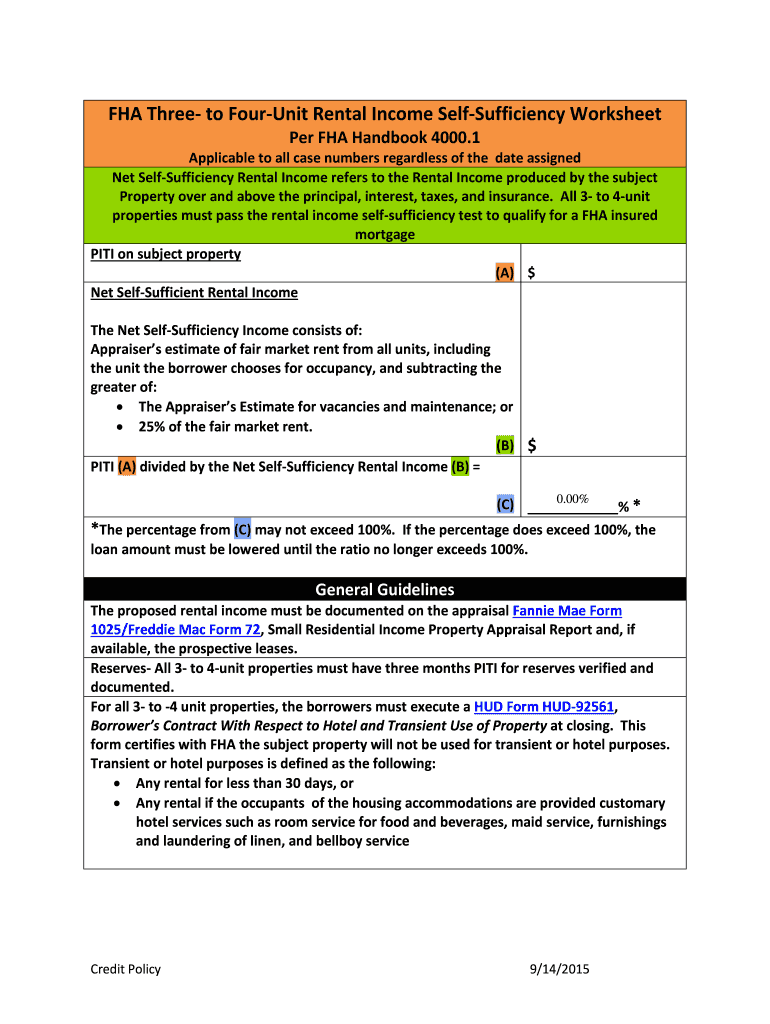

The FHA self sufficiency test worksheet is a crucial document used to evaluate the financial viability of rental properties, specifically those with three to four units. This worksheet helps lenders determine whether the rental income generated from the property is sufficient to cover the mortgage payments and other associated costs. By assessing various income and expense factors, the worksheet ensures that borrowers can maintain the property financially while meeting their mortgage obligations.

How to Use the FHA Self Sufficiency Test Worksheet

Using the FHA self sufficiency test worksheet involves several key steps. First, gather all necessary financial information, including rental income, property expenses, and any other relevant financial data. Next, input this information into the worksheet, ensuring accuracy to reflect the property's financial status. After completing the worksheet, review the results to determine if the rental income sufficiently covers the mortgage and expenses. This evaluation is essential for both borrowers and lenders to understand the property's financial health.

Steps to Complete the FHA Self Sufficiency Test Worksheet

Completing the FHA self sufficiency test worksheet requires a systematic approach:

- Collect all relevant financial documents, including lease agreements, expense reports, and tax returns.

- List all rental income sources, including monthly rents and any additional income from the property.

- Document all property-related expenses, such as maintenance, insurance, and property management fees.

- Calculate the total income and expenses to determine the net income from the property.

- Ensure that the net income meets or exceeds the required threshold as per FHA guidelines.

Legal Use of the FHA Self Sufficiency Test Worksheet

The FHA self sufficiency test worksheet is legally recognized as part of the mortgage application process for properties with three to four units. Compliance with FHA guidelines is essential to ensure that the worksheet is used correctly. This includes adhering to the required calculations and maintaining accurate records of all income and expenses. Proper use of the worksheet not only aids in securing financing but also protects both the borrower and lender by providing a clear financial picture of the property.

Key Elements of the FHA Self Sufficiency Test Worksheet

Several key elements are essential to the FHA self sufficiency test worksheet:

- Rental Income: Total monthly rental income from all units.

- Operating Expenses: Costs associated with property management, maintenance, and utilities.

- Net Income Calculation: The difference between total rental income and operating expenses.

- Debt Coverage Ratio: A critical metric that assesses whether the net income is sufficient to cover mortgage payments.

Examples of Using the FHA Self Sufficiency Test Worksheet

Practical examples illustrate how the FHA self sufficiency test worksheet is applied. For instance, a property owner with three rental units can use the worksheet to assess whether the combined rental income of $3,000 per month sufficiently covers their mortgage payment of $2,000 and operating expenses of $800. By completing the worksheet, the owner can clearly see that their net income of $200 is inadequate, prompting them to consider strategies to increase rental income or reduce expenses.

Quick guide on how to complete fha self sufficiency test worksheet

Complete Fha Self Sufficiency Test Worksheet effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, as you can access the right template and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents efficiently without any hold-ups. Manage Fha Self Sufficiency Test Worksheet on any system using airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

The easiest way to edit and eSign Fha Self Sufficiency Test Worksheet without effort

- Find Fha Self Sufficiency Test Worksheet and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Fha Self Sufficiency Test Worksheet and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fha self sufficiency test worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FHA self sufficiency worksheet?

The FHA self sufficiency worksheet is a crucial tool used to determine if a borrower can manage their mortgage payments and expenses. This worksheet helps assess income compared to expenses, ensuring that individuals can sustain homeownership. Having a clear understanding of this worksheet simplifies the home buying process and enhances financial planning.

-

How can I access the FHA self sufficiency worksheet?

You can easily access the FHA self sufficiency worksheet online through various real estate and banking websites. Additionally, tools like airSlate SignNow provide streamlined processes for filling out and signing these documents electronically. This ensures that you can fill it out quickly and securely.

-

What features does airSlate SignNow offer to help with the FHA self sufficiency worksheet?

airSlate SignNow offers various features like document templates, eSigning capabilities, and secure storage options. These features ensure that you can efficiently complete and manage your FHA self sufficiency worksheet. Our platform is user-friendly, making it easy for anyone to navigate.

-

How much does it cost to use airSlate SignNow for the FHA self sufficiency worksheet?

airSlate SignNow offers competitive pricing plans that cater to different business sizes and needs. Depending on your requirements, you can choose a plan that fits your budget while allowing for efficient use of the FHA self sufficiency worksheet. There is also the option for a free trial to explore the features before committing.

-

What are the benefits of using airSlate SignNow for handling the FHA self sufficiency worksheet?

Using airSlate SignNow to manage your FHA self sufficiency worksheet has several benefits, including increased efficiency and reduced paper clutter. The electronic signing feature speeds up the process, allowing you to complete documents quickly. Additionally, it ensures that your sensitive information remains secure.

-

Can I integrate airSlate SignNow with other applications for the FHA self sufficiency worksheet?

Yes, airSlate SignNow offers integrations with various applications, enhancing your workflow for managing the FHA self sufficiency worksheet. You can connect it with CRM systems, cloud storage, and more for a seamless experience. This flexibility allows you to customize your document management processes based on your needs.

-

Is the FHA self sufficiency worksheet applicable for all types of homes?

The FHA self sufficiency worksheet is specifically designed for FHA loans and is applicable for various types of homes, including single-family residences. This helps potential homebuyers accurately assess their financial situation when applying for an FHA loan. It's essential to ensure that the worksheet is filled out correctly to meet the necessary requirements.

Get more for Fha Self Sufficiency Test Worksheet

Find out other Fha Self Sufficiency Test Worksheet

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF