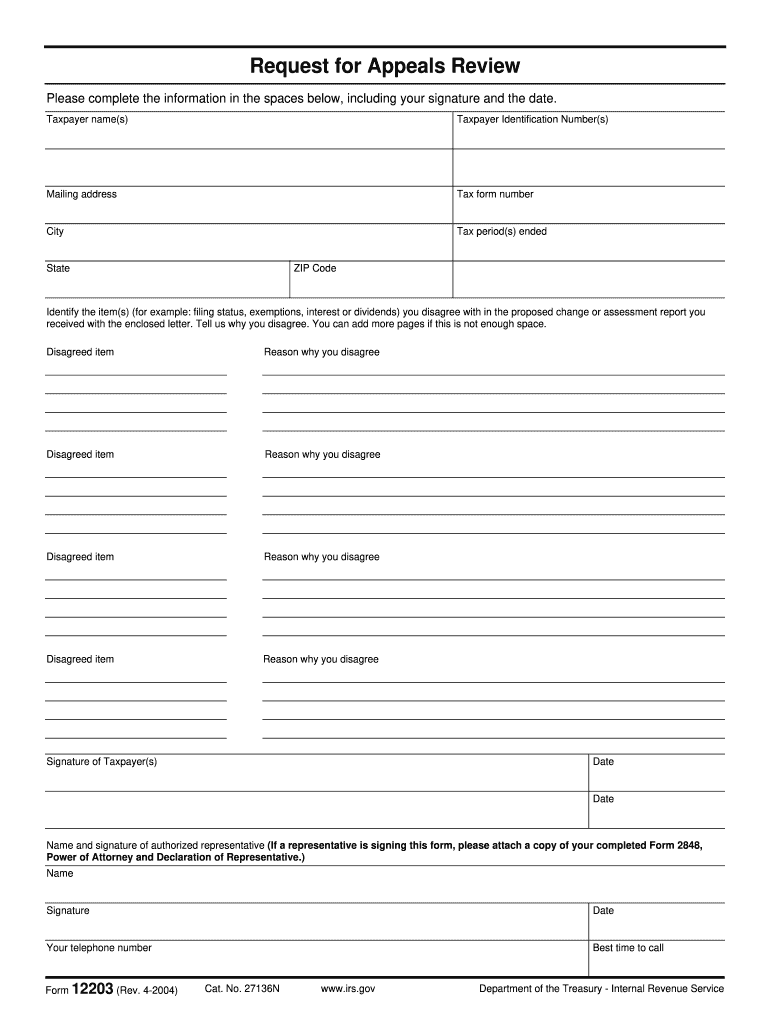

Irs Form 12203 2004

What is the IRS Form 12203?

The IRS Form 12203 is a request for a refund of an overpayment of taxes. This form is specifically used by taxpayers who believe they have paid more tax than they owe. It provides a structured way for individuals and businesses to formally request a refund from the Internal Revenue Service (IRS). The form requires detailed information about the taxpayer, the tax year in question, and the amount believed to be overpaid. Understanding this form is essential for ensuring that taxpayers can reclaim their funds efficiently.

How to use the IRS Form 12203

Using the IRS Form 12203 involves several key steps to ensure accurate submission. First, gather all necessary documentation, including tax returns and any supporting documents that substantiate the claim for a refund. Next, complete the form with precise information, including your name, address, and Social Security number. Be sure to specify the tax year and the amount of overpayment. After filling out the form, review it for accuracy before submitting it to the IRS. This careful process helps to avoid delays in processing your refund.

Steps to complete the IRS Form 12203

Completing the IRS Form 12203 requires careful attention to detail. Follow these steps:

- Gather relevant tax documents, including previous returns and payment records.

- Fill out your personal information accurately, including your full name and address.

- Indicate the tax year for which you are requesting a refund.

- Clearly state the overpayment amount and provide a brief explanation of how the overpayment occurred.

- Review the form for any errors or omissions.

- Sign and date the form before submission.

Legal use of the IRS Form 12203

The legal use of the IRS Form 12203 is governed by IRS regulations. To be considered valid, the form must be filled out accurately and submitted within the designated time frame. Taxpayers are entitled to request a refund if they have overpaid their taxes, but they must provide adequate documentation to support their claim. Compliance with IRS guidelines ensures that the request is processed efficiently and reduces the risk of denial due to technicalities.

Key elements of the IRS Form 12203

Several key elements must be included in the IRS Form 12203 to ensure its validity:

- Taxpayer Information: Full name, address, and Social Security number.

- Tax Year: The specific year for which the refund is requested.

- Overpayment Amount: The exact amount believed to be overpaid.

- Reason for Overpayment: A brief explanation of how the overpayment occurred.

- Signature: The taxpayer's signature and date of submission.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 12203 are crucial to ensure timely processing. Generally, taxpayers should submit the form within three years from the date the original tax return was filed or within two years from the date the tax was paid, whichever is later. Being aware of these deadlines helps taxpayers avoid missing the opportunity to claim a refund.

Quick guide on how to complete irs form 12203 2004

Complete Irs Form 12203 seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without any delays. Handle Irs Form 12203 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Irs Form 12203 with ease

- Obtain Irs Form 12203 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet-ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Irs Form 12203 to ensure exceptional communication throughout the entire form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 12203 2004

Create this form in 5 minutes!

How to create an eSignature for the irs form 12203 2004

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the 2004 review of airSlate SignNow?

The 2004 review of airSlate SignNow highlights its user-friendly platform for eSigning and document management. It emphasizes how businesses can streamline their workflow with an efficient, cost-effective solution. Users appreciate the intuitive interface and the ability to sign documents securely from any device.

-

What pricing options are available for airSlate SignNow in the 2004 review?

According to the 2004 review, airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. These plans typically include various features such as unlimited signatures and templates, making it a robust solution for any budget. The transparent pricing structure allows users to select a plan that fits their specific needs.

-

What features does airSlate SignNow provide as mentioned in the 2004 review?

The 2004 review outlines core features of airSlate SignNow, including electronic signatures, document templates, and team collaboration tools. Users can easily create, send, and track documents, which signNowly improves efficiency. These features make it an ideal choice for businesses looking to simplify their document signing process.

-

How does airSlate SignNow benefit businesses according to the 2004 review?

The 2004 review states that airSlate SignNow empowers businesses to improve their workflow and reduce turnaround time on document approvals. By utilizing this platform, companies can ensure secure and legally binding signatures, which enhances trust with clients. Overall, the benefits translate to increased productivity and cost savings.

-

Can airSlate SignNow integrate with other applications as per the 2004 review?

Yes, the 2004 review confirms that airSlate SignNow offers seamless integrations with popular apps like Google Drive, Dropbox, and CRM software. This compatibility allows businesses to incorporate eSigning into their existing workflows effortlessly. Such integrations ensure a smooth transition and an improved user experience.

-

Is airSlate SignNow secure according to the 2004 review?

The 2004 review emphasizes the high-security standards implemented by airSlate SignNow. Features like SSL encryption and compliance with global regulations ensure that all documents are handled safely. Users can confidently sign documents knowing that their information and transactions are protected.

-

What customer support options are featured in the 2004 review of airSlate SignNow?

The 2004 review highlights that airSlate SignNow provides robust customer support, including 24/7 assistance via chat and email. Additionally, comprehensive online resources, such as tutorials and FAQs, are available to help users navigate the platform effectively. This support structure is crucial for resolving any issues promptly.

Get more for Irs Form 12203

- Assignment of lease from lessor with notice of assignment idaho form

- Idaho notice 497305611 form

- Guaranty or guarantee of payment of rent idaho form

- Letter from landlord to tenant as notice of default on commercial lease idaho form

- Residential or rental lease extension agreement idaho form

- Commercial rental lease application questionnaire idaho form

- Apartment lease rental application questionnaire idaho form

- Residential rental lease application idaho form

Find out other Irs Form 12203

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement