Form 12203 a Request for Appeal Internal Revenue Service 2020

What is the Form 12203 A Request For Appeal Internal Revenue Service

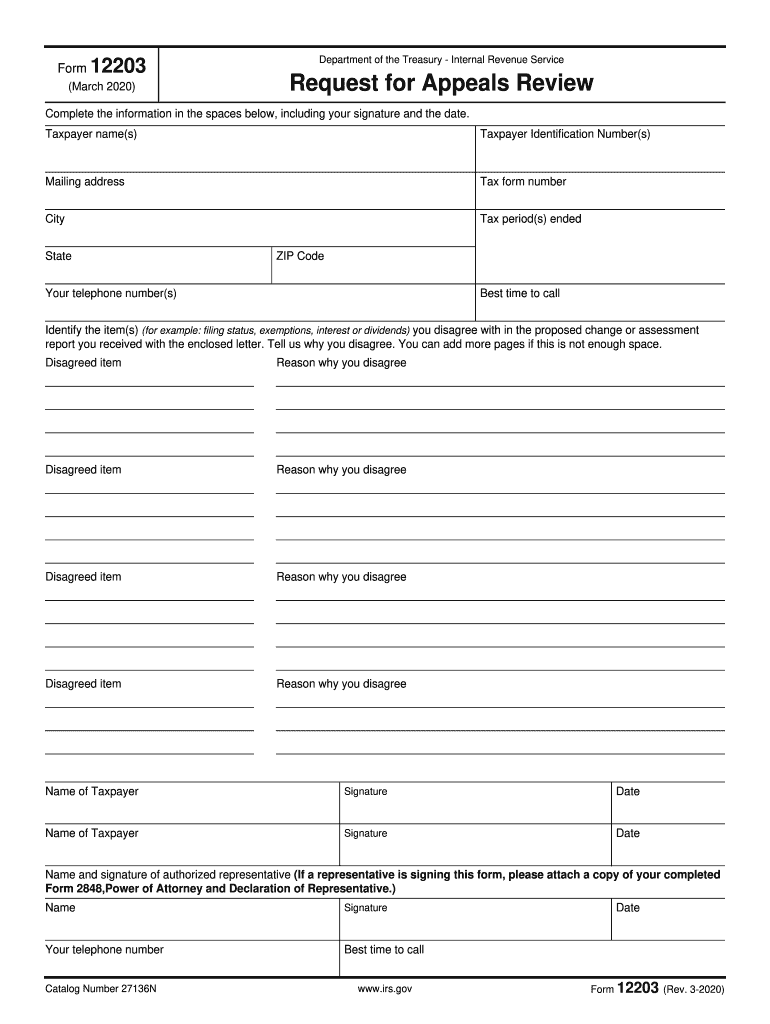

The Form 12203, also known as the Request for Appeal, is a document used by taxpayers in the United States to formally request an appeal of an IRS decision regarding their tax matters. This form is essential for individuals or entities who disagree with the IRS's findings, such as audit results or tax assessments. By submitting this form, taxpayers initiate the appeals process, allowing them to present their case for reconsideration.

Steps to complete the Form 12203 A Request For Appeal Internal Revenue Service

Completing Form 12203 involves several key steps to ensure accuracy and compliance with IRS requirements. First, gather all relevant documentation, including previous correspondence with the IRS and any supporting evidence related to your case. Next, fill out the form with accurate information, including your personal details and specifics about the IRS decision you are appealing. It is crucial to clearly articulate the reasons for your appeal in the designated section. After completing the form, review it thoroughly for any errors before submitting it to the appropriate IRS office.

How to use the Form 12203 A Request For Appeal Internal Revenue Service

Using Form 12203 effectively requires understanding its purpose and the appeals process. Once the form is completed, it should be submitted to the IRS office that issued the original decision. Taxpayers can use this form to appeal various IRS actions, such as penalties, audits, or tax adjustments. It is important to follow the specific instructions on the form regarding submission methods and deadlines to ensure that the appeal is considered valid.

Filing Deadlines / Important Dates

Filing deadlines for Form 12203 are crucial to the appeals process. Generally, taxpayers must submit their appeal within thirty days of receiving the IRS's decision. Missing this deadline can result in the loss of the right to appeal. It is advisable to keep track of all important dates related to your case and ensure timely submission of the form to avoid complications.

Legal use of the Form 12203 A Request For Appeal Internal Revenue Service

The legal use of Form 12203 is governed by IRS regulations and guidelines. To be considered valid, the form must be completed accurately and submitted within the specified time frame. The IRS recognizes this form as a legitimate means for taxpayers to contest decisions, provided that all necessary information is included and the appeal is based on valid grounds. Compliance with these legal standards is essential for a successful appeal.

Key elements of the Form 12203 A Request For Appeal Internal Revenue Service

Key elements of Form 12203 include the taxpayer's identification information, details of the IRS decision being appealed, and a clear statement of the reasons for the appeal. Additionally, the form requires the taxpayer's signature and date to validate the request. Ensuring that all these elements are accurately completed is vital for the form's acceptance by the IRS.

Quick guide on how to complete form 12203 a request for appeal internal revenue service

Effortlessly prepare Form 12203 A Request For Appeal Internal Revenue Service on any device

Online document management has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 12203 A Request For Appeal Internal Revenue Service on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to edit and electronically sign Form 12203 A Request For Appeal Internal Revenue Service with ease

- Obtain Form 12203 A Request For Appeal Internal Revenue Service and click Get Form to begin.

- Make use of the tools available to fill out your document.

- Emphasize key sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements with just a few clicks from any device you choose. Edit and electronically sign Form 12203 A Request For Appeal Internal Revenue Service and ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 12203 a request for appeal internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 12203 a request for appeal internal revenue service

How to create an electronic signature for your Form 12203 A Request For Appeal Internal Revenue Service online

How to create an eSignature for the Form 12203 A Request For Appeal Internal Revenue Service in Chrome

How to generate an eSignature for signing the Form 12203 A Request For Appeal Internal Revenue Service in Gmail

How to create an eSignature for the Form 12203 A Request For Appeal Internal Revenue Service from your smart phone

How to make an eSignature for the Form 12203 A Request For Appeal Internal Revenue Service on iOS devices

How to generate an eSignature for the Form 12203 A Request For Appeal Internal Revenue Service on Android

People also ask

-

What is an appeals appeal request and how can airSlate SignNow help?

An appeals appeal request is a formal process to contest a decision or seek reconsideration. With airSlate SignNow, you can efficiently create, send, and manage these requests in a secure digital environment, ensuring that your appeals are handled swiftly and effectively.

-

How does airSlate SignNow simplify the appeals appeal request process?

AirSlate SignNow simplifies the appeals appeal request process by allowing users to create templates, automate workflows, and sign documents electronically. This streamlines the entire process, making it faster and easier for both requesters and decision-makers.

-

Is pricing for airSlate SignNow competitive for handling appeals appeal requests?

Yes, airSlate SignNow offers cost-effective pricing plans that are ideal for businesses of all sizes managing appeals appeal requests. Our solutions provide excellent value, combining advanced features with affordability to cater to your appeals management needs.

-

What features are essential for managing appeals appeal requests effectively?

Key features for managing appeals appeal requests include electronic signatures, document templates, status tracking, and secure storage. AirSlate SignNow includes all these features, enhancing the efficiency and reliability of your appeal management process.

-

Can airSlate SignNow integrate with other tools for appeals appeal requests?

Absolutely! AirSlate SignNow seamlessly integrates with various applications, allowing you to manage your appeals appeal requests alongside your existing tools. This integration capability streamlines your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for appeals appeal requests?

Using airSlate SignNow for appeals appeal requests offers numerous benefits, including time savings, improved accuracy, and enhanced collaboration. The user-friendly platform ensures that all parties can participate seamlessly in the appeals process.

-

How secure is airSlate SignNow for handling sensitive appeals appeal requests?

AirSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards to protect your data. You can trust our platform to handle your sensitive appeals appeal requests with the highest level of security.

Get more for Form 12203 A Request For Appeal Internal Revenue Service

- Qa surveillance control gsagov form

- Nrl faqs dmv cagov form

- Frequently asked question mark twains signatureuc form

- Ghgrp reported datagreenhouse gas reporting program form

- Necromancy iphone form

- Sources sought request for information rfi

- Gsa 3542 customer supply center orderus agency for form

- Request for retirement estimate gsagov form

Find out other Form 12203 A Request For Appeal Internal Revenue Service

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now