Oxford Fixed Annuity Forms

What is the Oxford Fixed Annuity Forms

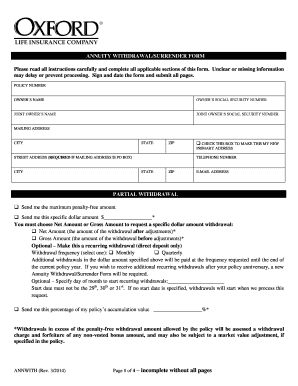

The Oxford fixed annuity forms are essential documents used in the process of applying for and managing fixed annuities offered by Oxford Life Insurance Company. These forms facilitate the collection of necessary information from applicants, ensuring that they meet the eligibility criteria for annuity products. The forms typically include sections for personal information, investment preferences, and beneficiary designations, making them crucial for both the applicant and the insurer.

How to use the Oxford Fixed Annuity Forms

Using the Oxford fixed annuity forms involves several straightforward steps. First, download the appropriate form from the Oxford Life Insurance Company website or request a physical copy from a licensed agent. Next, carefully fill out the required fields, ensuring that all information is accurate and complete. It is important to review the form for any errors before submission. Finally, sign and date the form, and submit it according to the provided instructions, either online or via mail.

Steps to complete the Oxford Fixed Annuity Forms

Completing the Oxford fixed annuity forms requires attention to detail. Follow these steps for a successful submission:

- Gather necessary documents, such as identification and financial statements.

- Fill out personal information, including your name, address, and Social Security number.

- Specify your investment preferences and any additional options offered.

- Designate beneficiaries, ensuring their information is accurate.

- Review the entire form for completeness and accuracy.

- Sign and date the form to validate your application.

- Submit the form through the designated method, either electronically or by mail.

Legal use of the Oxford Fixed Annuity Forms

The legal use of the Oxford fixed annuity forms is governed by various regulations that ensure the protection of both the applicant and the insurer. To be legally binding, the forms must be completed accurately and signed by the applicant. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is essential when submitting forms electronically. This legal framework helps to ensure that electronic signatures are recognized as valid and enforceable.

Key elements of the Oxford Fixed Annuity Forms

Key elements of the Oxford fixed annuity forms include:

- Personal Information: Details such as name, address, and Social Security number.

- Investment Options: Selection of fixed annuity products and terms.

- Beneficiary Designation: Identification of individuals who will receive benefits upon the policyholder's passing.

- Signature Section: A space for the applicant's signature to validate the form.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Oxford fixed annuity forms can be done through various methods, providing flexibility for applicants. Options include:

- Online Submission: Complete the form electronically and submit it through the designated online portal.

- Mail: Print the completed form and send it to the specified address via postal service.

- In-Person: Deliver the form directly to an authorized agent or office location for processing.

Quick guide on how to complete oxford fixed annuity forms

Complete Oxford Fixed Annuity Forms effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, alter, and electronically sign your documents swiftly without delays. Manage Oxford Fixed Annuity Forms on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest way to alter and electronically sign Oxford Fixed Annuity Forms with ease

- Obtain Oxford Fixed Annuity Forms and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which only takes moments and carries the same legal validity as a conventional ink signature.

- Review all information carefully and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Oxford Fixed Annuity Forms and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oxford fixed annuity forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Oxford fixed annuity forms?

Oxford fixed annuity forms are essential documents used to establish fixed annuity contracts with Oxford Life Insurance Company. These forms typically include information about the annuity terms, beneficiary details, and payment options, ensuring that customers understand their investment. Completing these forms accurately is crucial for initiating and managing fixed annuity investments effectively.

-

How can I obtain Oxford fixed annuity forms?

You can easily obtain Oxford fixed annuity forms by visiting the Oxford Life Insurance Company website or contacting their customer service. Alternatively, using airSlate SignNow, you can access and manage these forms digitally, streamlining the process of filling them out and submitting them. This ensures a hassle-free experience for prospective annuity investors.

-

What features do Oxford fixed annuity forms provide?

Oxford fixed annuity forms feature clear sections for personal information, investment details, and choices regarding beneficiaries. They also include language that outlines the terms and conditions of the annuity, facilitating informed decision-making. By utilizing airSlate SignNow, you can enhance the completion process with the ability to eSign and store these forms securely.

-

What benefits do I gain from using Oxford fixed annuity forms?

Using Oxford fixed annuity forms allows for effective management of your annuity investments, providing peace of mind about retirement planning. These forms help define your financial future by detailing how your money will grow over time. Moreover, using airSlate SignNow makes managing these forms straightforward and efficient, with quick access and secure electronic signatures.

-

How does pricing work for Oxford fixed annuity forms?

The pricing for products related to Oxford fixed annuity forms generally depends on the specific annuity plan chosen. Factors influencing costs include the type of annuity, investment duration, and any associated fees. To gain a clearer understanding of the pricing structure, it's advisable to consult with an Oxford representative or use airSlate SignNow to review your options.

-

Are Oxford fixed annuity forms easy to fill out?

Yes, Oxford fixed annuity forms are designed for ease of use, with straightforward sections that guide you through providing necessary information. airSlate SignNow simplifies this process further by allowing you to fill out, review, and eSign these forms electronically. This not only saves time but also reduces the chances of errors during the completion process.

-

Can I integrate Oxford fixed annuity forms with other tools?

Absolutely! Oxford fixed annuity forms can be integrated with various financial management tools when using platforms like airSlate SignNow. This enables you to keep your annuity documents organized with other financial records, ensuring seamless access and efficient management of all your investments in one place.

Get more for Oxford Fixed Annuity Forms

- Maryland dnr form b 108

- Apartment letter leaving form

- Employment verification form 6854315

- Csd loyalty card form

- Constat amiable degat des eaux form

- Sandf group life insurance scheme form

- Code of conduct adults girl scouts diamonds girlscoutsdiamonds form

- Nafta certificate of origin aaa cooper transportation form

Find out other Oxford Fixed Annuity Forms

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online