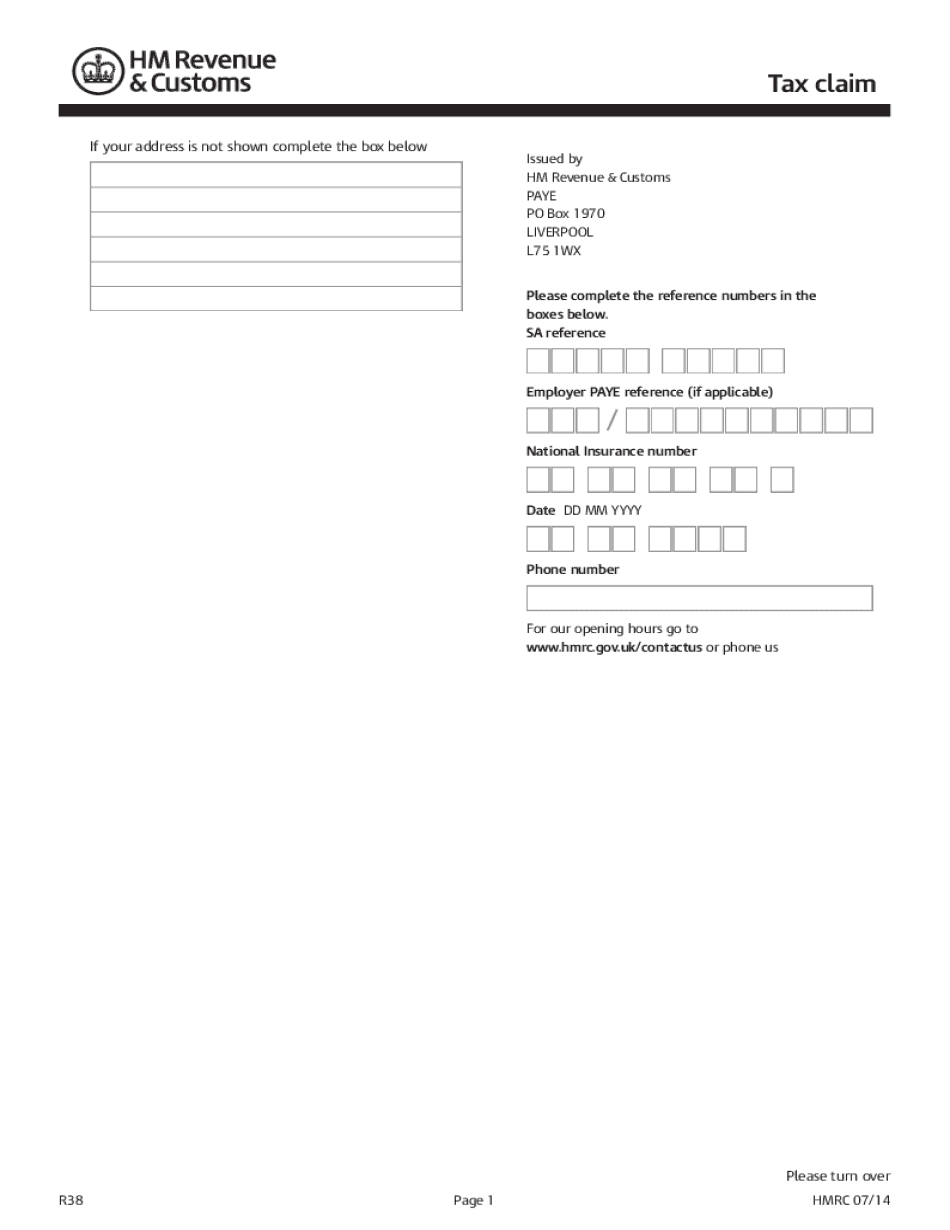

R38 Tax Claim Use Form R38 to Claim a Tax Refund When You Have Overpaid Tax and to Authorise a Representative to Receive the Pay

What is the R38 Tax Claim?

The R38 tax claim form is an essential document used to request a tax refund when an individual has overpaid taxes. This form allows taxpayers to authorize a representative to receive the payment on their behalf, streamlining the process of reclaiming funds. Understanding the purpose of the R38 form is crucial for ensuring that you can effectively manage your tax affairs and recover any excess payments made to the IRS.

How to Use the R38 Tax Claim

To utilize the R38 tax claim form effectively, begin by gathering all necessary documentation, including your tax records and any relevant financial statements. Fill out the form accurately, ensuring that all required fields are completed. If you are designating a representative, include their information as well. Once the form is filled out, it can be submitted electronically or printed and mailed to the appropriate tax authority, depending on your preference and the submission methods available.

Steps to Complete the R38 Tax Claim

Completing the R38 tax claim form involves several key steps:

- Gather necessary documentation, including proof of income and prior tax payments.

- Download the R38 form from an official source.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the amount of tax overpaid and the reason for the claim.

- Provide details of your authorized representative, if applicable.

- Review the form for accuracy before submission.

- Submit the completed form online or via mail.

Required Documents for the R38 Tax Claim

When filing the R38 tax claim, it is important to include specific documents to support your request. These may include:

- Proof of income, such as W-2 forms or 1099 statements.

- Previous tax returns that reflect overpayment.

- Any correspondence from the IRS regarding your tax payments.

- Identification documents to verify your identity.

Filing Deadlines for the R38 Tax Claim

Being aware of filing deadlines is critical when submitting the R38 tax claim form. Typically, claims for tax refunds must be filed within three years from the date the tax return was due or filed. It is advisable to check the IRS guidelines for any specific deadlines that may apply to your situation, ensuring that your claim is submitted in a timely manner to avoid delays in receiving your refund.

Eligibility Criteria for the R38 Tax Claim

To be eligible to file the R38 tax claim form, you must meet certain criteria, including:

- You must have overpaid your taxes in the previous tax year.

- You must be the taxpayer or an authorized representative.

- All required documentation must be provided to support your claim.

Quick guide on how to complete r38 tax claim use form r38 to claim a tax refund when you have overpaid tax and to authorise a representative to receive the

Complete R38 Tax Claim Use Form R38 To Claim A Tax Refund When You Have Overpaid Tax And To Authorise A Representative To Receive The Pay effortlessly on any device

Online document management has become widespread among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely keep it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents promptly without any hold-ups. Handle R38 Tax Claim Use Form R38 To Claim A Tax Refund When You Have Overpaid Tax And To Authorise A Representative To Receive The Pay on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign R38 Tax Claim Use Form R38 To Claim A Tax Refund When You Have Overpaid Tax And To Authorise A Representative To Receive The Pay with ease

- Obtain R38 Tax Claim Use Form R38 To Claim A Tax Refund When You Have Overpaid Tax And To Authorise A Representative To Receive The Pay and click Get Form to initiate.

- Make use of the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Adjust and eSign R38 Tax Claim Use Form R38 To Claim A Tax Refund When You Have Overpaid Tax And To Authorise A Representative To Receive The Pay and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the r38 tax claim use form r38 to claim a tax refund when you have overpaid tax and to authorise a representative to receive the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the r38 form and why would I need to download it?

The r38 form is a crucial document used in various legal and business transactions. You may need to download the r38 form to ensure compliance and facilitate smooth processing of your documents. Using airSlate SignNow makes it convenient to securely download and eSign the form.

-

How do I download the r38 form using airSlate SignNow?

To download the r38 form with airSlate SignNow, simply navigate to the document template section where you can easily access it. Once located, you can download the r38 form in a few clicks. Our user-friendly interface ensures that you can manage this process effortlessly.

-

Is there a cost associated with downloading the r38 form?

Downloading the r38 form through airSlate SignNow is included in our subscription pricing. We offer various plans to suit business needs without extra charges for downloading forms. This makes it a cost-effective solution for your document management.

-

Can I edit the r38 form after downloading it?

Yes, after you download the r38 form from airSlate SignNow, you can edit it using our platform. We provide tools that allow you to fill in necessary details and customize the document as needed. This ensures that your form meets all required specifications before you eSign it.

-

What features does airSlate SignNow offer for handling the r38 form?

airSlate SignNow offers several features for managing the r38 form, including easy downloading, eSigning, and document tracking. You can also collaborate with other users in real-time, ensuring that everyone has the latest version of the r38 form. These features enhance productivity and make document handling streamlined.

-

Are there any integrations available that support downloading the r38 form?

Yes, airSlate SignNow integrates with multiple platforms that can help you download the r38 form seamlessly. Whether you're using cloud storage services or project management tools, our integrations enhance convenience and ensure that documents are accessible when you need them.

-

What are the benefits of using airSlate SignNow to download the r38 form?

Using airSlate SignNow to download the r38 form provides several benefits, including enhanced security, ease of use, and rapid turnaround time. Our platform allows for efficient eSigning and easy document retrieval, which helps improve overall workflow. Plus, accessing the form is simple, making it ideal for busy professionals.

Get more for R38 Tax Claim Use Form R38 To Claim A Tax Refund When You Have Overpaid Tax And To Authorise A Representative To Receive The Pay

- Christmas song fill in the blank pdf form

- Annamalai university books download pdf form

- Mmp short form for annual updates

- George fall off the ladder while he paint the ceiling form

- Application to preserve residencefor naturalizati form

- Update to form i 905 application for authorization to issue

- Form i 539 instructions for application to extendchange nonimmigrant status

- Navmc 11811 administrative remarks redsigned to include electronic signatures per mi ssn field revised toenterfull ssn per mi form

Find out other R38 Tax Claim Use Form R38 To Claim A Tax Refund When You Have Overpaid Tax And To Authorise A Representative To Receive The Pay

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors