L8 Form

What is the L8 Form?

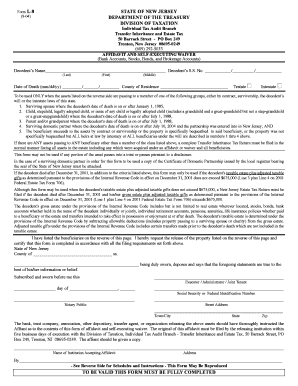

The L8 form, also known as the NJ L8, is a tax form used in the state of New Jersey. It is primarily utilized by businesses to report specific financial information to the state tax authorities. This form plays a critical role in ensuring compliance with state tax regulations and is essential for accurate tax reporting.

How to Use the L8 Form

Using the L8 form involves several key steps. First, ensure you have all necessary financial records and documentation at hand. This includes income statements, expense reports, and any relevant tax documents. Next, fill out the form accurately, providing all required information. It is crucial to review the completed form for any errors before submission to avoid complications with the state tax authorities.

Steps to Complete the L8 Form

Completing the L8 form requires careful attention to detail. Follow these steps:

- Gather all necessary financial documents.

- Access the L8 form from the New Jersey Division of Taxation website or through authorized providers.

- Fill in your business information, including name, address, and tax identification number.

- Report your income and expenses as required by the form.

- Double-check all entries for accuracy.

- Submit the form by the designated deadline, either online or via mail.

Legal Use of the L8 Form

The L8 form holds legal significance in New Jersey as it is used to report taxable income and expenses. Proper completion and submission of the form are essential to comply with state tax laws. Failure to submit the L8 form can result in penalties, including fines or additional tax liabilities. Therefore, understanding the legal implications of this form is crucial for businesses operating in New Jersey.

Filing Deadlines / Important Dates

Timely filing of the L8 form is essential to avoid penalties. The deadline for submission typically aligns with the state's tax filing schedule. Businesses should be aware of specific dates, such as the end of the tax year and any extensions that may apply. Keeping a calendar of important dates can help ensure compliance and timely submission.

Required Documents

To complete the L8 form, certain documents are necessary. These may include:

- Income statements

- Expense reports

- Previous tax returns

- Any relevant financial statements

Having these documents ready will facilitate a smoother completion process and ensure accuracy in reporting.

Quick guide on how to complete l8 form

Complete L8 Form seamlessly on any device

Online document management has gained traction with businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and electronically sign your documents swiftly and without interruptions. Manage L8 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign L8 Form effortlessly

- Access L8 Form and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for sending your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate reprinting document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign L8 Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the l8 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the l8 form nj and how can airSlate SignNow help?

The l8 form nj is a specific document required in New Jersey for electronic signatures. airSlate SignNow simplifies the process of filling out and eSigning the l8 form nj with its user-friendly interface and reliable eSignature features.

-

How much does airSlate SignNow cost for handling l8 form nj?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can efficiently manage the l8 form nj without breaking the bank, making it a cost-effective solution for eSigning documents.

-

What features does airSlate SignNow provide for managing l8 form nj?

airSlate SignNow includes features such as customizable templates, workflow automation, and secure cloud storage. These features ensure that you can effortlessly handle the l8 form nj and other important documents while saving time.

-

Are there any benefits in using airSlate SignNow for the l8 form nj?

Using airSlate SignNow for the l8 form nj brings numerous benefits, including enhanced security and compliance. You'll enjoy a streamlined signing process that increases productivity and speeds up document turnaround times.

-

Can I integrate airSlate SignNow with other applications for l8 form nj?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing for better workflow and document management. This capability helps streamline your processing of the l8 form nj alongside your existing tools.

-

Is my data secure when using airSlate SignNow for the l8 form nj?

Absolutely! airSlate SignNow prioritizes your security by employing top-tier encryption and compliance measures. This ensures that all information, including the l8 form nj, is securely stored and transmitted.

-

What industries benefit from using airSlate SignNow for l8 form nj?

Various industries, including healthcare, real estate, and finance, can benefit from using airSlate SignNow for the l8 form nj. Its flexible features cater to diverse business needs, enabling efficient document management in any sector.

Get more for L8 Form

Find out other L8 Form

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document