If You Designate an Amount that is Too Low, it Could Result in You 2023-2026

Understanding the W-4 Form

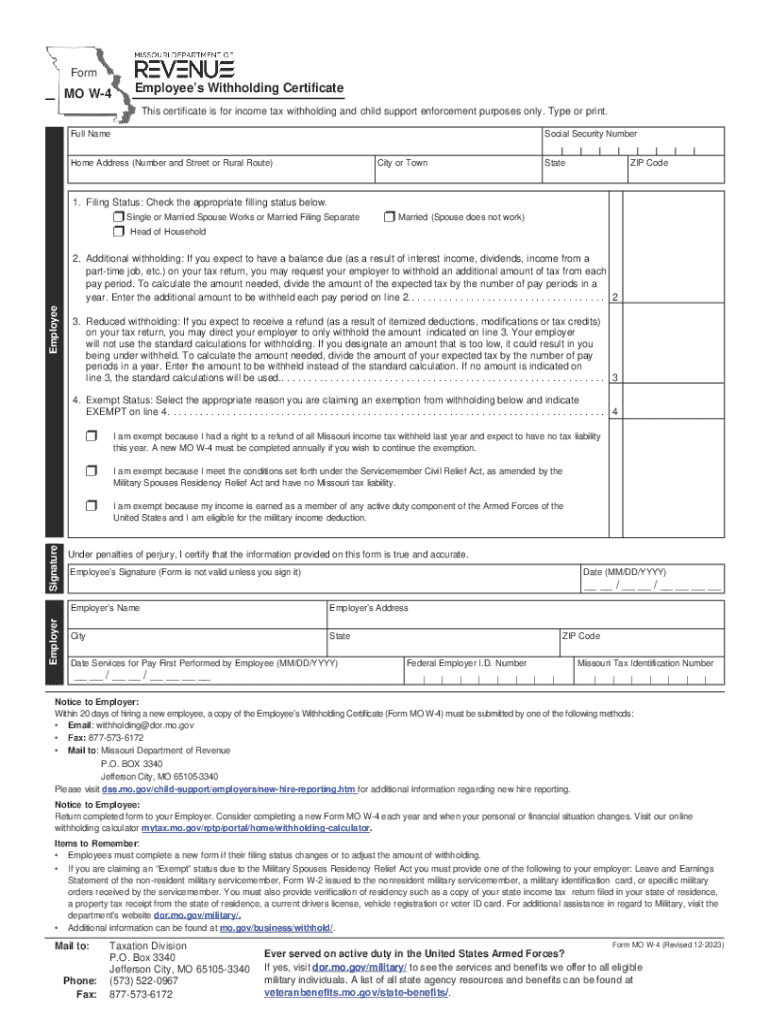

The W-4 form, officially known as the Employee's Withholding Certificate, is a crucial document for employees in the United States. It informs employers how much federal income tax to withhold from an employee's paycheck. Completing this form accurately is essential to ensure that the right amount of tax is withheld, which can affect your tax refund or the amount owed when filing your tax return.

Steps to Fill Out the W-4 Form

Filling out the W-4 form involves several key steps:

- Personal Information: Start by providing your name, address, Social Security number, and filing status. This information helps your employer determine your tax situation.

- Multiple Jobs or Spouse Works: If you have more than one job or if your spouse works, indicate this in the appropriate section. This ensures accurate withholding across all income sources.

- Claiming Dependents: If you have qualifying dependents, you can claim them to reduce your withholding amount. This section allows you to calculate the tax credits you may be eligible for.

- Other Adjustments: You can specify any additional amount you want withheld from each paycheck or claim any other adjustments, such as deductions.

- Signature and Date: Finally, sign and date the form to validate it. Your employer cannot process the form without your signature.

IRS Guidelines for the W-4 Form

The Internal Revenue Service (IRS) provides specific guidelines for completing the W-4 form. It is advisable to refer to the latest IRS instructions to ensure compliance with current tax laws. The IRS updates the W-4 form periodically, so checking for the most recent version is important. The guidelines also include information on how to calculate your withholding accurately based on your financial situation.

Common Mistakes to Avoid on the W-4 Form

When filling out the W-4 form, it is essential to avoid common mistakes that could lead to incorrect withholding:

- Incorrect Personal Information: Ensure that your name and Social Security number are accurate to avoid issues with your employer or the IRS.

- Not Updating the Form: If your financial situation changes, such as a new job or changes in dependents, update your W-4 form promptly.

- Ignoring Additional Withholding: If you anticipate owing taxes at the end of the year, consider requesting additional withholding to avoid a tax bill.

Form Submission Methods

After completing the W-4 form, you can submit it to your employer through various methods. Typically, you can hand it in person, send it via email, or submit it through your employer's online payroll system, if available. It is important to keep a copy of the completed form for your records.

Create this form in 5 minutes or less

Find and fill out the correct if you designate an amount that is too low it could result in you

Create this form in 5 minutes!

How to create an eSignature for the if you designate an amount that is too low it could result in you

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of a W-4 form?

The W-4 form is used by employees to inform their employer about their tax situation. This helps employers withhold the correct amount of federal income tax from employees' paychecks. Understanding how to fill out a W-4 form accurately can ensure you are not over or under-withheld.

-

How can airSlate SignNow help me fill out a W-4 form?

airSlate SignNow provides an intuitive platform that simplifies the process of filling out a W-4 form. With our eSignature capabilities, you can easily complete and send your W-4 form securely. Learning how to fill out a W-4 form with our tool ensures a smooth and efficient experience.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking of document status. These features make it easier to manage important documents like the W-4 form. Knowing how to fill out a W-4 form using our platform enhances your document management efficiency.

-

Is there a cost associated with using airSlate SignNow for W-4 forms?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective while providing robust features for document management. Understanding how to fill out a W-4 form with our service can save you time and money.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and more. This integration allows you to streamline your workflow, especially when learning how to fill out a W-4 form and managing related documents.

-

What are the benefits of using airSlate SignNow for W-4 forms?

Using airSlate SignNow for W-4 forms offers numerous benefits, including enhanced security, ease of use, and faster processing times. Our platform ensures that your documents are handled securely while simplifying the process of how to fill out a W-4 form. This can lead to improved accuracy and compliance.

-

How do I get started with airSlate SignNow?

Getting started with airSlate SignNow is easy! Simply sign up for an account, and you can begin creating and managing your documents, including W-4 forms. Our user-friendly interface will guide you through how to fill out a W-4 form in no time.

Get more for If You Designate An Amount That Is Too Low, It Could Result In You

Find out other If You Designate An Amount That Is Too Low, It Could Result In You

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT