CDTFA 106, VehicleVessel Use Tax Clearance Request 2024-2026

Understanding the CDTFA 106, Vehicle Vessel Use Tax Clearance Request

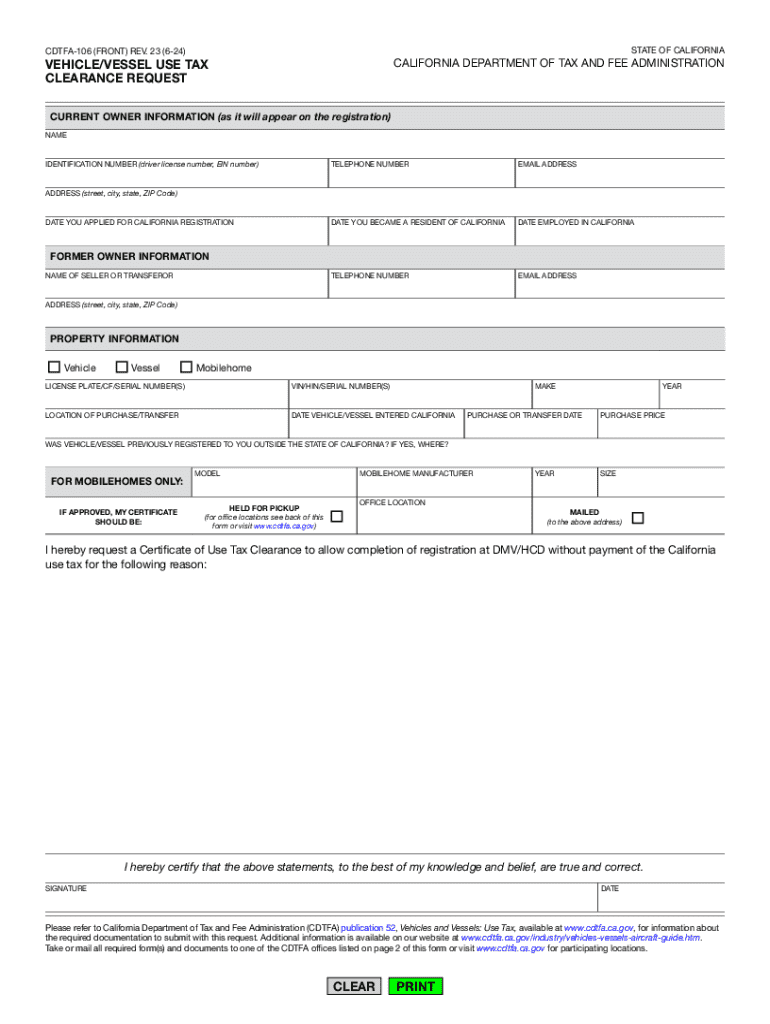

The CDTFA 106 form, also known as the Vehicle Vessel Use Tax Clearance Request, is a crucial document for individuals and businesses in California that seek to register vehicles or vessels. This form is designed to ensure that all applicable use taxes have been paid before a vehicle or vessel can be legally registered. The CDTFA 106 is particularly important for those who have purchased vehicles or vessels from out of state or from private parties, as it verifies compliance with California tax laws.

Steps to Complete the CDTFA 106, Vehicle Vessel Use Tax Clearance Request

Completing the CDTFA 106 form involves several key steps:

- Gather necessary information, including details about the vehicle or vessel, such as the make, model, year, and Vehicle Identification Number (VIN).

- Provide personal information, including your name, address, and contact details.

- Indicate the purchase price of the vehicle or vessel and any applicable taxes paid.

- Sign and date the form to certify that the information provided is accurate.

Once completed, the form can be submitted online or via mail, depending on your preference.

Required Documents for the CDTFA 106 Submission

When submitting the CDTFA 106, certain documents may be required to support your request. These typically include:

- A copy of the bill of sale or purchase agreement for the vehicle or vessel.

- Proof of payment for any use tax already paid, if applicable.

- Identification documents, such as a driver's license or state ID.

Having these documents ready can streamline the submission process and help avoid delays.

Form Submission Methods for the CDTFA 106

The CDTFA 106 form can be submitted through various methods to accommodate different preferences:

- Online: You can complete and submit the form through the CDTFA online services portal.

- Mail: Print the completed form and send it to the appropriate CDTFA address based on your location.

- In-Person: Visit a local CDTFA office to submit the form directly.

Choosing the right submission method can help ensure that your request is processed efficiently.

Legal Use of the CDTFA 106, Vehicle Vessel Use Tax Clearance Request

The CDTFA 106 form serves a legal purpose in California tax law. It is essential for ensuring compliance with state regulations regarding vehicle and vessel registration. By submitting this form, taxpayers affirm that they have met their tax obligations, which helps prevent legal issues related to tax evasion or improper registration. Understanding the legal implications of this form can help individuals and businesses navigate their responsibilities effectively.

Penalties for Non-Compliance with CDTFA Regulations

Failure to comply with the use tax requirements outlined by the CDTFA can result in significant penalties. These may include:

- Fines for late payment of use taxes.

- Interest charges on unpaid taxes.

- Possible legal action for continued non-compliance.

Being aware of these potential consequences underscores the importance of timely and accurate submission of the CDTFA 106 form.

Create this form in 5 minutes or less

Find and fill out the correct cdtfa 106 vehiclevessel use tax clearance request

Create this form in 5 minutes!

How to create an eSignature for the cdtfa 106 vehiclevessel use tax clearance request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is cdtfa ca and how does it relate to airSlate SignNow?

CDTFA CA refers to the California Department of Tax and Fee Administration. airSlate SignNow can help businesses streamline their document signing processes, including those related to tax forms and compliance with CDTFA CA regulations, ensuring that all necessary documents are signed quickly and securely.

-

How much does airSlate SignNow cost for businesses dealing with cdtfa ca?

airSlate SignNow offers various pricing plans that cater to different business needs, including those that require compliance with CDTFA CA. Our plans are designed to be cost-effective, allowing businesses to choose a solution that fits their budget while ensuring they can manage their document signing efficiently.

-

What features does airSlate SignNow offer for managing cdtfa ca documents?

airSlate SignNow provides a range of features that are beneficial for managing CDTFA CA documents, including customizable templates, secure eSigning, and document tracking. These features help businesses ensure compliance and streamline their workflows, making it easier to handle tax-related documents.

-

Can airSlate SignNow integrate with other tools for cdtfa ca compliance?

Yes, airSlate SignNow offers integrations with various tools and platforms that can assist with CDTFA CA compliance. This includes accounting software and document management systems, allowing businesses to create a seamless workflow for handling tax documents and eSignatures.

-

What are the benefits of using airSlate SignNow for cdtfa ca documentation?

Using airSlate SignNow for CDTFA CA documentation provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Businesses can quickly send, sign, and store important documents, ensuring they meet all regulatory requirements without the hassle of traditional methods.

-

Is airSlate SignNow user-friendly for those unfamiliar with cdtfa ca processes?

Absolutely! airSlate SignNow is designed to be user-friendly, even for those who may not be familiar with CDTFA CA processes. Our intuitive interface and helpful resources make it easy for anyone to navigate the document signing process, ensuring a smooth experience.

-

How does airSlate SignNow ensure the security of cdtfa ca documents?

airSlate SignNow prioritizes the security of all documents, including those related to CDTFA CA. We utilize advanced encryption and secure storage solutions to protect sensitive information, ensuring that your documents are safe from unauthorized access.

Get more for CDTFA 106, VehicleVessel Use Tax Clearance Request

- Dll template download form

- Ethekwini municipality application forms 2022 pdf

- Sample application letter for napolcom form

- Boarding form 53658397

- 1 form for certificate for structural design sufficiency to be submitted before issue of planning permission with respect to

- 1377 lawrence avenue east form

- Hfs 2538b form

- Form 511b request for excursion approval by bb deca ontario

Find out other CDTFA 106, VehicleVessel Use Tax Clearance Request

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA