T226 Form

What is the T226 Form

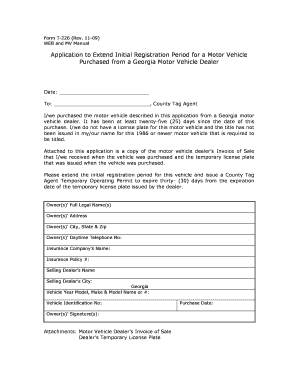

The T226 form, also known as the GA form T226, is a document used primarily for tax purposes in the United States. It is essential for individuals and businesses to accurately report specific financial information to the Internal Revenue Service (IRS). This form helps in the calculation of various tax liabilities and ensures compliance with federal regulations. Understanding the purpose and requirements of the T226 form is crucial for effective tax planning and reporting.

How to Use the T226 Form

Using the T226 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form with the required information, ensuring that all entries are clear and accurate. After completing the form, review it for any errors or omissions. Finally, submit the form to the appropriate tax authority, either electronically or by mail, depending on your preference and the guidelines provided by the IRS.

Steps to Complete the T226 Form

Completing the T226 form requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant financial documents.

- Begin filling out the form with your personal information, including your name, address, and Social Security number.

- Report your income accurately, including wages, dividends, and any other sources of revenue.

- Document any deductions or credits you are eligible for, as these can significantly impact your tax liability.

- Review the completed form for accuracy, ensuring all figures are correct and all sections are filled out.

- Submit the form according to IRS guidelines, either electronically or via mail.

Legal Use of the T226 Form

The T226 form is legally binding when filled out and submitted according to IRS regulations. To ensure its legal standing, it is important to comply with all requirements set forth by the IRS. This includes providing accurate information, signing the form where required, and maintaining records of submission. Utilizing a reliable electronic signature service can further enhance the legal validity of the form, as it provides a secure method of signing and storing documents.

Required Documents

Before filling out the T226 form, it is important to gather all necessary documents to support your entries. Required documents may include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses.

- Bank statements for income verification.

- Previous tax returns for reference.

Filing Deadlines / Important Dates

Filing deadlines for the T226 form are crucial for compliance with IRS regulations. Typically, the form must be submitted by April 15 of each year for individual taxpayers. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, as these can vary based on tax law adjustments or specific situations, such as natural disasters.

Quick guide on how to complete t226 form

Complete T226 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without delays. Manage T226 Form on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and electronically sign T226 Form with ease

- Obtain T226 Form and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign T226 Form and maintain excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t226 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t226 form and how is it used?

The t226 form is a legal document that allows businesses to streamline their signing process. By utilizing airSlate SignNow, you can easily create, send, and eSign the t226 form, ensuring efficiency and compliance in your operations.

-

How does airSlate SignNow simplify the t226 form signing process?

airSlate SignNow provides a user-friendly interface that allows you to create and manage the t226 form effortlessly. With features like document templates and eSignatures, you can save time and reduce errors while ensuring a smooth signing experience.

-

Are there any costs associated with using the t226 form on airSlate SignNow?

Using the t226 form on airSlate SignNow comes with flexible pricing plans that cater to various business needs. Whether you are a small business or a large enterprise, pricing is designed to be cost-effective, allowing you to access all the necessary features for your documents.

-

Can I integrate airSlate SignNow with other applications for managing the t226 form?

Yes, airSlate SignNow offers seamless integrations with popular applications to enhance your workflow. By incorporating the t226 form into your existing tools, you can further streamline processes and improve document management efficiency.

-

What security features does airSlate SignNow offer for the t226 form?

AirSlate SignNow prioritizes security for all documents, including the t226 form. With robust encryption, two-factor authentication, and secure storage, you can trust that your data remains safe throughout the signing process.

-

How can airSlate SignNow improve the turnaround time for the t226 form?

By utilizing airSlate SignNow’s eSigning capabilities, the turnaround time for the t226 form is signNowly reduced. Businesses can send documents for signing in seconds and receive completed forms back quickly, ensuring prompt processing.

-

Is it easy to customize the t226 form using airSlate SignNow?

Absolutely! airSlate SignNow provides tools that allow you to easily customize the t226 form according to your business needs. You can add fields, adjust the layout, and personalize each document to better reflect your brand.

Get more for T226 Form

Find out other T226 Form

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online