Michigan Homestead Property Tax Credit Claim MI Form

Understanding the Michigan Homestead Property Tax Credit Claim

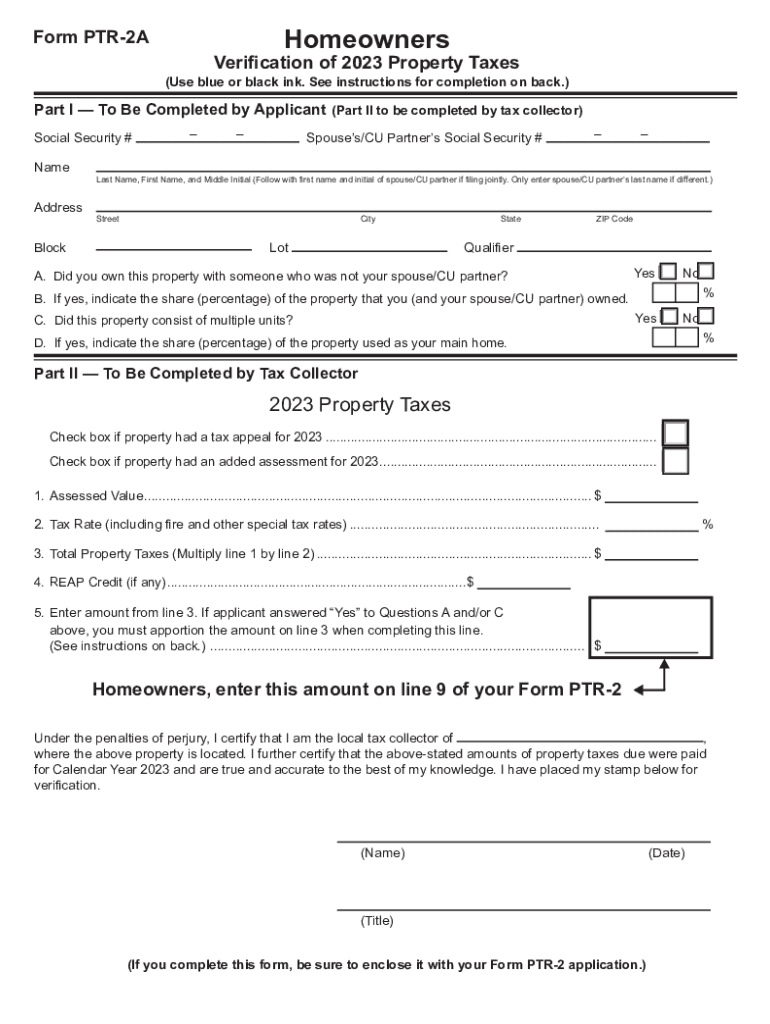

The Michigan Homestead Property Tax Credit Claim, often referred to as the PTR 2A form, is designed to provide financial relief to homeowners by reducing their property tax burden. This credit is available to eligible residents who meet specific criteria, including income limits and residency requirements. Understanding the purpose and function of this form is crucial for homeowners seeking to benefit from potential tax savings.

Steps to Complete the Michigan Homestead Property Tax Credit Claim

Completing the PTR 2A form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of income and property ownership. Next, fill out the form by providing personal information, details about your property, and financial data. It is important to double-check all entries for correctness before submission. Finally, submit the completed form to the appropriate local tax authority by the specified deadline to ensure consideration for the credit.

Eligibility Criteria for the Michigan Homestead Property Tax Credit Claim

To qualify for the Michigan Homestead Property Tax Credit, applicants must meet certain eligibility criteria. Generally, this includes being a homeowner or a renter who pays property taxes indirectly. Additionally, applicants must have a total household income below a specified threshold, which is adjusted annually. Age, disability status, and the type of property owned or rented can also influence eligibility. Understanding these criteria is essential for determining if you can benefit from the tax credit.

Required Documents for the Michigan Homestead Property Tax Credit Claim

When preparing to submit the PTR 2A form, it is important to have all required documents at hand. Commonly required documents include proof of income, such as W-2 forms or tax returns, and documentation of property ownership, like a property deed or rental agreement. Additionally, any supporting documents that verify age or disability status may be necessary. Having these documents ready will streamline the application process and help ensure a successful claim.

Form Submission Methods for the Michigan Homestead Property Tax Credit Claim

The PTR 2A form can be submitted through various methods to accommodate different preferences. Homeowners may choose to submit the form online through the state’s tax portal, which offers a convenient and efficient option. Alternatively, the form can be mailed directly to the local tax authority or submitted in person at designated offices. Each submission method has its own guidelines and deadlines, so it is important to follow the instructions carefully to ensure timely processing.

Important Filing Deadlines for the Michigan Homestead Property Tax Credit Claim

Filing deadlines for the Michigan Homestead Property Tax Credit Claim are crucial for ensuring eligibility. Generally, the form must be submitted by a specific date each year, which aligns with the state’s tax filing schedule. Missing the deadline may result in the loss of potential tax credits for that year. It is advisable to mark the deadline on your calendar and prepare your application well in advance to avoid any last-minute issues.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan homestead property tax credit claim mi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a ptr 2a form?

The ptr 2a form is a document used for specific tax reporting purposes. It is essential for businesses to accurately complete this form to ensure compliance with tax regulations. Understanding the ptr 2a form can help streamline your tax filing process.

-

How can airSlate SignNow help with the ptr 2a form?

airSlate SignNow provides an easy-to-use platform for sending and eSigning the ptr 2a form. With our solution, you can quickly prepare, send, and receive signed documents, ensuring that your ptr 2a form is processed efficiently. This saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the ptr 2a form?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while allowing you to manage your ptr 2a form efficiently. Check our website for detailed pricing information.

-

Are there any features specifically designed for the ptr 2a form?

Yes, airSlate SignNow includes features that enhance the handling of the ptr 2a form. These features include customizable templates, automated workflows, and secure storage options. This ensures that your ptr 2a form is not only easy to manage but also secure.

-

What are the benefits of using airSlate SignNow for the ptr 2a form?

Using airSlate SignNow for the ptr 2a form offers numerous benefits, including increased efficiency and reduced turnaround time. Our platform allows for real-time tracking of document status, ensuring you never miss a deadline. Additionally, the ease of use enhances collaboration among team members.

-

Can I integrate airSlate SignNow with other tools for managing the ptr 2a form?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and applications. This means you can connect your existing systems to streamline the process of managing the ptr 2a form, enhancing productivity and ensuring a smooth workflow.

-

Is airSlate SignNow secure for handling sensitive ptr 2a form data?

Yes, airSlate SignNow prioritizes security and compliance. We implement advanced encryption and security protocols to protect your ptr 2a form data. You can trust that your sensitive information is safe while using our platform.

Get more for Michigan Homestead Property Tax Credit Claim MI

Find out other Michigan Homestead Property Tax Credit Claim MI

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document