8300 Form PDF

What is the 8300 Form PDF

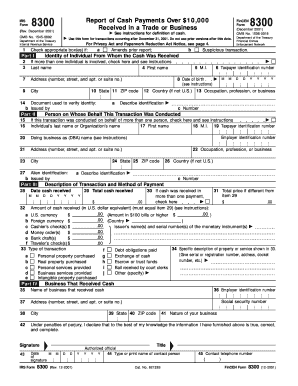

The IRS Form 8300 is a document required by the Internal Revenue Service for reporting cash payments over ten thousand dollars received in a trade or business. This form is crucial for maintaining compliance with federal regulations aimed at preventing money laundering and other financial crimes. The IRS Form 8300 PDF serves as an official record of these transactions, ensuring that businesses accurately report large cash payments. It is essential for businesses that deal in cash transactions, as it helps maintain transparency and accountability.

How to Obtain the 8300 Form PDF

To obtain the IRS Form 8300 PDF, individuals can visit the official IRS website, where the form is available for download at no cost. The form can be easily accessed by searching for "Form 8300" in the IRS forms section. Additionally, businesses may also request a paper copy by contacting the IRS directly, although downloading the PDF is the most efficient method. Once downloaded, the form can be printed and filled out as needed.

Steps to Complete the 8300 Form PDF

Completing the IRS Form 8300 PDF involves several key steps:

- Provide your business's name, address, and Employer Identification Number (EIN).

- Enter the date of the transaction and the total amount of cash received.

- Include the name, address, and taxpayer identification number of the individual or entity making the cash payment.

- Detail the nature of the transaction and any other relevant information.

- Sign and date the form to certify its accuracy.

It is important to ensure that all information is accurate and complete to avoid potential penalties for non-compliance.

Legal Use of the 8300 Form PDF

The IRS Form 8300 PDF is legally mandated for businesses that receive cash payments exceeding ten thousand dollars. Failure to file this form can result in significant penalties, including fines and potential legal action. The form must be filed within fifteen days of the cash transaction, ensuring timely reporting to the IRS. Businesses are also required to keep a copy of the form for their records for at least five years. Understanding the legal implications of this form is essential for compliance and to protect against potential audits.

Filing Deadlines / Important Dates

Filing the IRS Form 8300 PDF must be done within fifteen days of receiving cash payments over ten thousand dollars. This deadline is crucial for compliance with IRS regulations. Additionally, businesses should be aware of the annual reporting requirements, as the IRS may request copies of the form during audits or compliance checks. Keeping track of these deadlines helps ensure that businesses remain compliant and avoid penalties.

Penalties for Non-Compliance

Non-compliance with the filing requirements of the IRS Form 8300 PDF can lead to severe penalties. Businesses that fail to file the form on time, or do not file it at all, may face fines ranging from one hundred to twenty-five thousand dollars, depending on the severity of the violation. Additionally, intentional disregard of the reporting requirements can result in even harsher penalties, including criminal charges. It is essential for businesses to understand these risks and prioritize compliance to avoid financial repercussions.

Quick guide on how to complete 8300 form pdf

Effortlessly Prepare 8300 Form Pdf on Any Device

Digital document administration has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the proper format and securely archive it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage 8300 Form Pdf on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Edit and Electronically Sign 8300 Form Pdf Effortlessly

- Find 8300 Form Pdf and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically designed for that by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign 8300 Form Pdf and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8300 form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 8300 PDF used for?

The IRS Form 8300 PDF is used to report cash payments over $10,000 received in a trade or business. This form is important for complying with federal laws aimed at preventing money laundering and tax evasion. Businesses that handle signNow cash transactions should familiarize themselves with this document.

-

How can I fill out the IRS Form 8300 PDF using airSlate SignNow?

With airSlate SignNow, you can easily fill out the IRS Form 8300 PDF using our intuitive document editor. You can input all necessary information, save it as a PDF, and eSign it for a legally binding submission. Our platform simplifies the document workflow, ensuring compliance and efficiency.

-

Is there a cost to use airSlate SignNow for IRS Form 8300 PDF?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Users can choose a plan that fits their budget, and many features, including eSigning and document management, are included, making it a cost-effective solution for handling the IRS Form 8300 PDF.

-

Can I integrate airSlate SignNow with other tools to manage IRS Form 8300 PDF?

Absolutely! airSlate SignNow seamlessly integrates with various CRM and accounting software, allowing you to manage the IRS Form 8300 PDF along with other business processes. This integration enhances workflow efficiency, ensuring that you can fill out and submit forms without disrupting your operations.

-

What features does airSlate SignNow offer for managing IRS Form 8300 PDF?

airSlate SignNow provides a range of features including electronic signatures, document templates, and collaboration tools, all designed to streamline the process for handling the IRS Form 8300 PDF. These features simplify tracking, editing, and submitting the form, making it easier for businesses to comply with IRS regulations.

-

Is the IRS Form 8300 PDF easy to access through airSlate SignNow?

Yes, accessing the IRS Form 8300 PDF through airSlate SignNow is quick and user-friendly. Users can easily upload the form or start from our templates, making it straightforward to begin. This ease of access ensures that you can quickly address your cash transaction reporting needs.

-

How does airSlate SignNow ensure the security of the IRS Form 8300 PDF?

airSlate SignNow prioritizes security; all documents, including the IRS Form 8300 PDF, are protected with industry-standard encryption. This guarantees that your sensitive business and financial data remain confidential and secure throughout the document signing process.

Get more for 8300 Form Pdf

- Houghton mifflin english grade 5 answer key form

- From nest to bird level f form

- Manulife gp0766e form

- 320 hours field experience requirement school of public health form

- Training and development internship report form

- Affidavit of heirship nebraska form

- Kansas lien release form fill online printable fillable

- Sales tax exemption certificate for health care providers form

Find out other 8300 Form Pdf

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself