How to Amend a New Mexico Tax Return 2023

Understanding the New Mexico PIT-X Form

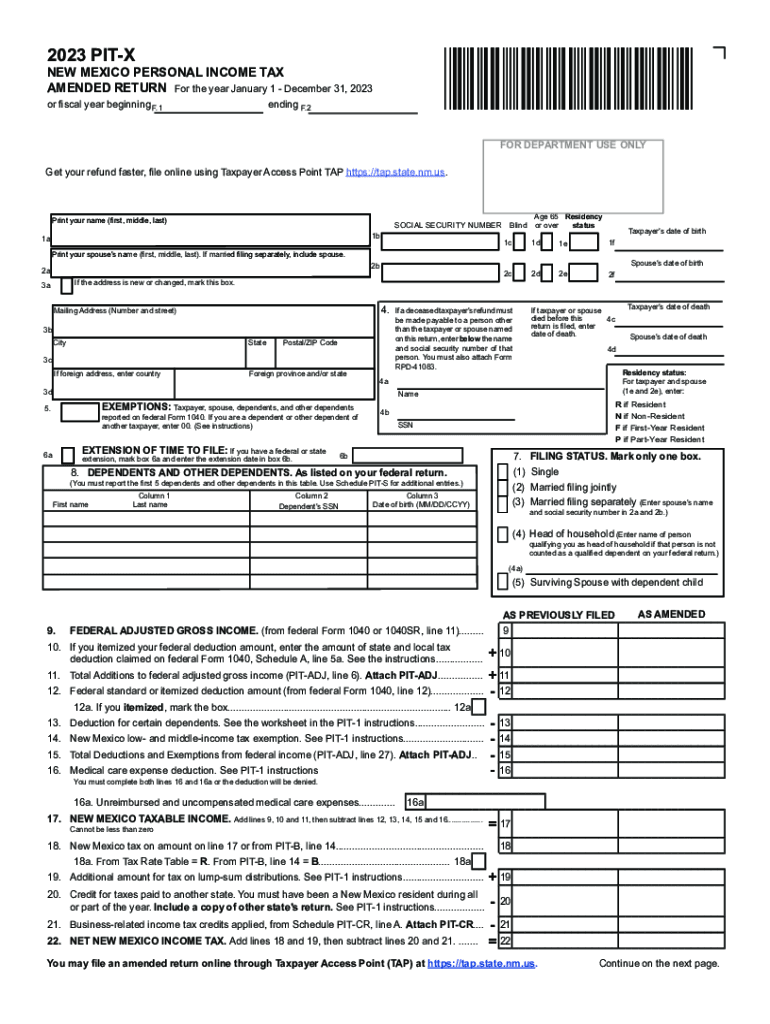

The New Mexico PIT-X form is used for amending a personal income tax return. This form is essential for taxpayers who need to correct errors or provide additional information after submitting their original tax return. The PIT-X allows individuals to ensure their tax filings are accurate and compliant with state regulations. It is particularly relevant for those who have experienced changes in income, deductions, or credits that impact their tax liability.

Steps to Complete the New Mexico PIT-X Form

Completing the PIT-X form involves several key steps:

- Gather relevant documents, including your original tax return and any supporting materials for the changes you need to make.

- Clearly indicate the changes on the PIT-X form, providing detailed explanations for each amendment.

- Calculate any adjustments to your tax liability based on the new information.

- Review the completed form for accuracy before submission.

Required Documents for Amending Your Tax Return

When filing the PIT-X form, it is important to include specific documents to support your amendments. These may include:

- Your original New Mexico personal income tax return.

- Any additional forms or schedules that relate to the changes you are making.

- Documentation that substantiates the adjustments, such as W-2s, 1099s, or receipts for deductions.

Filing Deadlines for the PIT-X Form

Timeliness is crucial when amending your tax return. The PIT-X form must be filed within a specific timeframe, typically within three years from the original due date of the return. It is important to be aware of these deadlines to avoid penalties or complications with your tax status.

Who Issues the PIT-X Form

The New Mexico Taxation and Revenue Department is responsible for issuing the PIT-X form. This department oversees the collection of state taxes and ensures compliance with tax laws. Taxpayers can obtain the form directly from their official website or through designated tax offices across the state.

Penalties for Non-Compliance with Amended Returns

Failing to properly amend your tax return using the PIT-X form can lead to penalties. These may include fines or interest on any unpaid taxes resulting from the errors in your original return. It is advisable to address any discrepancies promptly to mitigate potential penalties and ensure compliance with state tax laws.

Quick guide on how to complete how to amend a new mexico tax return

Effortlessly Prepare How To Amend A New Mexico Tax Return on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage How To Amend A New Mexico Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign How To Amend A New Mexico Tax Return with Ease

- Find How To Amend A New Mexico Tax Return and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form via email, SMS, an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and eSign How To Amend A New Mexico Tax Return and ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to amend a new mexico tax return

Create this form in 5 minutes!

How to create an eSignature for the how to amend a new mexico tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pit x form and how does it work?

The pit x form is a digital document solution that allows users to create, send, and eSign forms seamlessly. With airSlate SignNow, you can easily customize your pit x form to meet your specific needs, ensuring a smooth workflow for document management.

-

How much does the pit x form service cost?

Pricing for the pit x form service varies based on the plan you choose. airSlate SignNow offers flexible pricing options that cater to businesses of all sizes, ensuring you get the best value for your investment in document management.

-

What features are included with the pit x form?

The pit x form includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These features enhance your document workflow, making it easier to manage and sign forms efficiently.

-

What are the benefits of using the pit x form?

Using the pit x form streamlines your document processes, saving time and reducing errors. With airSlate SignNow, you can enhance collaboration and improve productivity by allowing multiple users to access and sign documents from anywhere.

-

Can I integrate the pit x form with other applications?

Yes, the pit x form can be easily integrated with various applications such as CRM systems, cloud storage, and project management tools. This integration capability allows for a more cohesive workflow and enhances overall efficiency.

-

Is the pit x form secure for sensitive documents?

Absolutely! The pit x form is designed with security in mind, featuring encryption and compliance with industry standards. airSlate SignNow ensures that your sensitive documents are protected throughout the signing process.

-

How can I customize my pit x form?

Customizing your pit x form is simple with airSlate SignNow's user-friendly interface. You can add your branding, adjust fields, and tailor the layout to fit your specific requirements, making it a perfect fit for your business.

Get more for How To Amend A New Mexico Tax Return

Find out other How To Amend A New Mexico Tax Return

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT