Ca 540 2023

What is the CA 540?

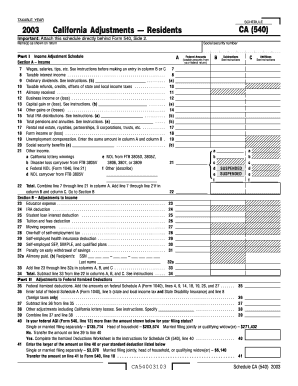

The CA 540 is the California Resident Income Tax Return form used by individuals to report their income, calculate their tax liability, and claim any applicable credits or deductions. This form is essential for California residents who earn income during the tax year and need to comply with state tax laws. The CA 540 is designed for use by single filers, married couples filing jointly, and heads of household, ensuring that a wide range of taxpayers can accurately report their financial information.

How to Obtain the CA 540

To obtain the CA 540, taxpayers can visit the California Franchise Tax Board (FTB) website, where the form is available for download in PDF format. Additionally, physical copies of the form can be requested through the mail by contacting the FTB directly. Taxpayers may also find the CA 540 at local libraries, post offices, or tax preparation offices during the tax season. It is important to ensure that the correct version of the form is used for the applicable tax year.

Steps to Complete the CA 540

Completing the CA 540 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income on the appropriate lines of the form.

- Calculate adjustments to income, deductions, and credits as applicable.

- Determine your total tax liability and any payments made during the year.

- Sign and date the form before submitting it to the FTB.

Filing Deadlines / Important Dates

Taxpayers must be aware of the important deadlines associated with the CA 540 to avoid penalties. Typically, the deadline for filing the CA 540 is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an extension, which allows additional time to file but does not extend the deadline for payment of taxes owed.

Required Documents

To complete the CA 540 accurately, several documents are required, including:

- W-2 forms from employers reporting wages and salary.

- 1099 forms for any freelance or contract work.

- Records of any other income, such as rental income or investment earnings.

- Documentation for deductions and credits, such as mortgage interest statements or educational expenses.

Penalties for Non-Compliance

Failure to file the CA 540 on time or accurately can result in penalties imposed by the California Franchise Tax Board. These penalties may include late filing fees, interest on unpaid taxes, and potential legal action for severe non-compliance. It is crucial for taxpayers to file their returns accurately and on time to avoid these consequences.

Quick guide on how to complete ca 540

Effortlessly Prepare Ca 540 on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to easily access the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without any delays. Manage Ca 540 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Alter and eSign Ca 540 with Ease

- Find Ca 540 and select Get Form to begin.

- Utilize the tools we offer to submit your document.

- Highlight pertinent sections of your documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Edit and eSign Ca 540 and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca 540

Create this form in 5 minutes!

How to create an eSignature for the ca 540

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2014 schedule ca 540?

The 2014 schedule ca 540 is a tax form used by California residents to report their income and calculate their state tax liability. It is essential for ensuring compliance with California tax laws and can help you maximize your deductions. Understanding this form is crucial for accurate tax filing.

-

How can airSlate SignNow help with the 2014 schedule ca 540?

airSlate SignNow provides a seamless way to eSign and send your 2014 schedule ca 540 and other tax documents securely. With its user-friendly interface, you can easily manage your documents and ensure they are signed and submitted on time. This can save you time and reduce the stress associated with tax season.

-

What features does airSlate SignNow offer for tax documents like the 2014 schedule ca 540?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are perfect for handling the 2014 schedule ca 540. These features streamline the signing process and ensure that all parties can access and sign documents easily. This enhances efficiency and accuracy in your tax filing.

-

Is airSlate SignNow cost-effective for managing the 2014 schedule ca 540?

Yes, airSlate SignNow is a cost-effective solution for managing your 2014 schedule ca 540 and other documents. With various pricing plans available, you can choose one that fits your budget while still accessing powerful features. This makes it an ideal choice for both individuals and businesses looking to simplify their document management.

-

Can I integrate airSlate SignNow with other software for my 2014 schedule ca 540?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your 2014 schedule ca 540. This integration allows for a smoother workflow, enabling you to import data directly and reduce manual entry errors. It enhances your overall efficiency during tax season.

-

What are the benefits of using airSlate SignNow for the 2014 schedule ca 540?

Using airSlate SignNow for your 2014 schedule ca 540 offers numerous benefits, including increased efficiency, enhanced security, and ease of use. You can quickly send, sign, and store your documents in one place, reducing the risk of lost paperwork. This ensures that your tax filing process is smooth and stress-free.

-

How secure is airSlate SignNow for handling the 2014 schedule ca 540?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your 2014 schedule ca 540 and other sensitive documents. This ensures that your information remains confidential and secure throughout the signing process. You can trust airSlate SignNow to keep your data safe.

Get more for Ca 540

Find out other Ca 540

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later