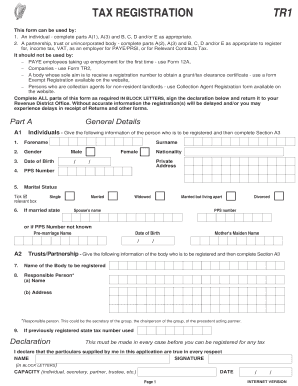

Tax Registration Form TR1 This Form Can Be Used to Register for Tax 2014

What is the Tax Registration Form TR1?

The Tax Registration Form TR1 is a crucial document used by individuals and businesses in the United States to officially register for tax purposes. This form is essential for establishing a taxpayer's identity with the Internal Revenue Service (IRS) and state tax authorities. By completing the TR1, taxpayers can ensure they are compliant with federal and state tax regulations, allowing them to file taxes accurately and on time.

How to Obtain the Tax Registration Form TR1

To obtain the Tax Registration Form TR1, individuals can visit the IRS website or the website of their respective state tax authority. The form is typically available for download in PDF format, making it easy to print and fill out. Additionally, some state tax offices may provide physical copies of the form upon request. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Steps to Complete the Tax Registration Form TR1

Completing the Tax Registration Form TR1 involves several key steps:

- Provide personal information, including your name, address, and Social Security number or Employer Identification Number (EIN).

- Indicate the type of entity you are registering, such as an individual, partnership, or corporation.

- Specify the reason for registration, whether for income tax, sales tax, or other tax obligations.

- Review the form for accuracy and completeness before submission.

Once completed, the form can be submitted according to the guidelines provided by the IRS or your state tax authority.

Key Elements of the Tax Registration Form TR1

The Tax Registration Form TR1 includes several key elements that are essential for proper registration:

- Taxpayer Identification: This section requires your name and identification number.

- Entity Type: Indicate whether you are registering as an individual, corporation, or other entity.

- Tax Type: Specify which taxes you are registering for, such as income tax or sales tax.

- Signature: The form must be signed to validate the information provided.

Each of these elements plays a vital role in ensuring that the registration process is completed correctly.

Legal Use of the Tax Registration Form TR1

The Tax Registration Form TR1 serves a legal purpose by formally registering individuals and businesses with tax authorities. This registration is necessary for compliance with federal and state tax laws. Failure to complete this form can lead to penalties and issues with tax filings. It is important to understand that the information provided on the TR1 is used to establish your tax obligations and to ensure that you are recognized as a legitimate taxpayer.

Form Submission Methods

The Tax Registration Form TR1 can be submitted through various methods, depending on the requirements of the IRS or state tax authority:

- Online Submission: Many states offer an online portal for submitting the form electronically.

- Mail Submission: The completed form can be mailed to the appropriate tax authority address.

- In-Person Submission: Taxpayers may also have the option to submit the form in person at designated tax offices.

Choosing the correct submission method is important to ensure timely processing of your registration.

Quick guide on how to complete tax registration form tr1 this form can be used to register for tax

Complete Tax Registration Form TR1 This Form Can Be Used To Register For Tax effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the right template and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly and without delays. Handle Tax Registration Form TR1 This Form Can Be Used To Register For Tax on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Tax Registration Form TR1 This Form Can Be Used To Register For Tax with ease

- Locate Tax Registration Form TR1 This Form Can Be Used To Register For Tax and click Get Form to commence.

- Utilize the tools available to complete your document.

- Emphasize pertinent parts of the documents or obscure sensitive information using specific tools provided by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Tax Registration Form TR1 This Form Can Be Used To Register For Tax and maintain excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax registration form tr1 this form can be used to register for tax

Create this form in 5 minutes!

How to create an eSignature for the tax registration form tr1 this form can be used to register for tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax Registration Form TR1 and how can it be used?

The Tax Registration Form TR1 is a crucial document that can be used to register for tax purposes. This form is essential for businesses and individuals who need to comply with tax regulations. By utilizing the Tax Registration Form TR1, you ensure that your tax registration process is streamlined and efficient.

-

How does airSlate SignNow facilitate the completion of the Tax Registration Form TR1?

airSlate SignNow provides an easy-to-use platform that allows users to fill out and eSign the Tax Registration Form TR1 seamlessly. With our intuitive interface, you can complete the form quickly and securely, ensuring that all necessary information is accurately captured. This simplifies the registration process and saves you valuable time.

-

Is there a cost associated with using airSlate SignNow for the Tax Registration Form TR1?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution ensures that you can manage your documents, including the Tax Registration Form TR1, without breaking the bank. We provide transparent pricing with no hidden fees, making it easy to choose the right plan for your requirements.

-

What features does airSlate SignNow offer for managing the Tax Registration Form TR1?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the Tax Registration Form TR1. These features enhance your document management experience, allowing you to monitor the status of your forms and ensure timely submissions. Our platform is designed to simplify the entire process.

-

Can I integrate airSlate SignNow with other software for the Tax Registration Form TR1?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the Tax Registration Form TR1 alongside your existing tools. Whether you use CRM systems, cloud storage, or accounting software, our platform can seamlessly connect to enhance your workflow and efficiency.

-

What are the benefits of using airSlate SignNow for the Tax Registration Form TR1?

Using airSlate SignNow for the Tax Registration Form TR1 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and submit your forms electronically, minimizing the risk of errors and delays. This ensures that your tax registration is handled promptly and accurately.

-

Is airSlate SignNow secure for handling the Tax Registration Form TR1?

Yes, airSlate SignNow prioritizes security and compliance when handling the Tax Registration Form TR1. Our platform employs advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are safe and secure while using our services.

Get more for Tax Registration Form TR1 This Form Can Be Used To Register For Tax

- Board of immigration appeals department of justice form

- 7quot57amp form

- Agent acknowledgement form

- Print form 4473

- Hud termite inspection reporting and requirements npma form

- Fillable online paduaresearch cab unipd oncologia e form

- Fillable online form e 200 fax email print pdffiller

- Oha 45 13a long oregon birth record order form

Find out other Tax Registration Form TR1 This Form Can Be Used To Register For Tax

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free